What is Monthly Budget Workbook?

A Monthly Budget Workbook is a tool that helps individuals track their income and expenses on a monthly basis. It allows users to set financial goals, monitor their spending, and make necessary adjustments to stay within their budget.

What are the types of Monthly Budget Workbook?

There are several types of Monthly Budget Workbooks available, including:

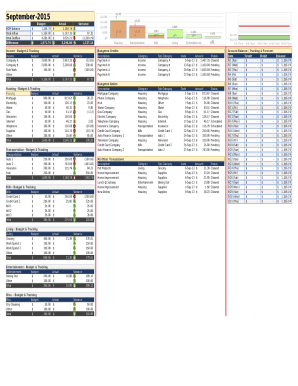

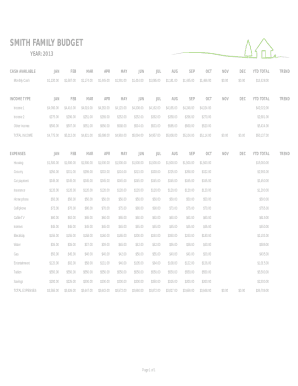

Spreadsheet-based budget templates

Online budgeting tools and apps

Printable budget worksheets

How to complete Monthly Budget Workbook

Completing a Monthly Budget Workbook is easy with the following steps:

01

Gather all your financial information, including income sources and expenses

02

Use the budget template of your choice to input your financial data

03

Regularly update your budget with actual income and spending figures to stay on track

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Monthly Budget Workbook

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the 70 20 10 rule money?

The biggest chunk, 70%, goes towards living expenses while 20% goes towards repaying any debt, or to savings if all your debt is covered. The remaining 10% is your 'fun bucket', money set aside for the things you want after your essentials, debt and savings goals are taken care of.

What is the 50 20 30 budget rule?

By Melissa Green | Citizens Bank Staff One of the most common percentage-based budgets is the 50/30/20 rule. The idea is to divide your income into three categories, spending 50% on needs, 30% on wants, and 20% on savings.

How do I create a budget plan in Excel?

How to Create a Budget Spreadsheet in Excel Identify Your Financial Goals. Determine Your Budget Period. Calculate Your Total Income. Begin Creating Your Excel Budget. Enter All Cash, Debit and Check Transactions Into the Budget Spreadsheet. Enter All Credit Transactions. Calculate Total Expenses From All Sources.

How do I make a monthly budget spreadsheet?

How to create a budget spreadsheet Choose a spreadsheet program or template. Create categories for income and expense items. Set your budget period (weekly, monthly, etc.). Enter your numbers and use simple formulas to streamline calculations. Consider visual aids and other features.

Does Excel have a monthly budget template?

DIY with the Personal budget template This Excel template can help you track your monthly budget by income and expenses. Input your costs and income, and any difference is calculated automatically so you can avoid shortfalls or make plans for any projected surpluses.

How do I create a simple monthly budget in Excel?

How to create a budget in Excel using templates Navigate to the "File" tab. The "File" tab is on the top ribbon in Excel. Search for budgets. Select a suitable template. Fill the template. Create budget headers. Enter the expenses, costs, and income. Calculate the balance. Create visualizations.