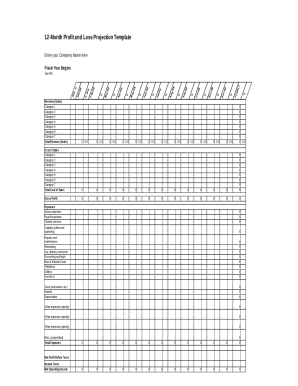

What is 12-month Profit And Loss Projection Template?

The 12-month Profit And Loss Projection Template is a financial document that predicts a company's revenue and expenses over the next year. It helps businesses plan for the future by outlining expected income and costs.

What are the types of 12-month Profit And Loss Projection Template?

There are several types of 12-month Profit And Loss Projection Templates available, including:

Traditional Profit And Loss Projection Template

Forecasted Profit And Loss Projection Template

Detailed Profit And Loss Projection Template

How to complete 12-month Profit And Loss Projection Template

Completing a 12-month Profit And Loss Projection Template is essential for financial planning. Here are steps to help you fill out the template:

01

Gather all financial data for the upcoming year

02

Input projected revenue and sales figures

03

List all anticipated expenses and costs

04

Calculate the net profit or loss for each month

05

Review and adjust the projections as needed

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 12-month Profit And Loss Projection Template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is twelve month profit and loss projection?

Download this template to track your revenue and expenses so you can forecast your profits and losses for the next 12 months. You will examine revenue, cost of sales, gross and net profit, operating expenses, industry averages and taxes.

How do you create a year to date profit and loss?

Let's have a look at the basic tips to build a profit and loss statement: Choose a time frame. List your business revenue for the time period, breaking the totals down by month. Calculate your expenses. Determine your gross profit by subtracting your direct costs from your revenue. Figure out if you're making money.

What is a 12-month projection?

Unlike a budget or calendar year forecast, a rolling 12-month forecast adds one month to the forecast period each time a month is closed so that you are continuously forecasting for 12 months. This enables continuous planning of future performance based on actual performance.

How do you prepare a profit and loss account for the year ended?

How to write a profit and loss statement Step 1: Calculate revenue. Step 2: Calculate cost of goods sold. Step 3: Subtract cost of goods sold from revenue to determine gross profit. Step 4: Calculate operating expenses. Step 5: Subtract operating expenses from gross profit to obtain operating profit.

How do you create a profit and loss projection?

How to write a profit and loss statement Step 1: Calculate revenue. Step 2: Calculate cost of goods sold. Step 3: Subtract cost of goods sold from revenue to determine gross profit. Step 4: Calculate operating expenses. Step 5: Subtract operating expenses from gross profit to obtain operating profit.

How do you create a profit and loss forecast?

How to write a profit and loss forecast Start by thinking about your VAT. Plan your sales figures. Make sure to include a running total. Add in any planned Purchases. Don't forget your Direct Expenses. Use this information to formulate your Gross Profit. List your Fixed Costs. Calculate your Net Profit.