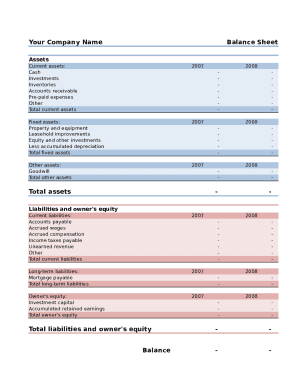

What is a Balance Sheet Template?

A Balance Sheet Template is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It shows the company's assets, liabilities, and shareholders' equity.

What are the types of Balance Sheet Template?

There are several types of Balance Sheet Templates, including:

Classified Balance Sheet Template

Comparative Balance Sheet Template

Common-Size Balance Sheet Template

How to complete a Balance Sheet Template

Completing a Balance Sheet Template can be done by following these steps:

01

List all assets and categorize them into current and non-current assets.

02

Similarly, list all liabilities and categorize them into current and non-current liabilities.

03

Calculate shareholders' equity by subtracting total liabilities from total assets.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Balance Sheet Template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are 7 the main balance sheet features include?

They will include the following: Cash. Accounts receivable. Common stock. Retained earnings. Inventory. Fixed assets. Accounts payable. Debt.

How do I make my own balance sheet?

How to make a balance sheet in 8 steps Step 1: Pick the balance sheet date. Step 2: List all of your assets. Step 3: Add up all of your assets. Step 4: Determine current liabilities. Step 5: Calculate long-term liabilities. Step 6: Add up liabilities. Step 7: Calculate owner's equity.

Does Word have a balance sheet template?

On this Page: You can download a free sample balance sheet template in MS Word format! Perfect for businesses, organizations, and individuals. This easy-to-use template provides a clear and professional format for presenting your financial information.

How do I make a balance sheet UK?

Follow these steps on how to prepare a balance sheet: Decide on the reporting period and timeframe. Identify the assets. Identify the liabilities. Identify shareholders' equity. Check if the total liabilities and equity balance with assets.

Does Excel have a balance sheet template?

A balance sheet template in excel is a document that allows you to input your financial data and automatically generate a formatted balance sheet. This can be a useful tool if you want to create a balance sheet for your business or personal finances.

How many sections does a balance sheet have?

As an overview of the company's financial position, the balance sheet consists of three major sections: (1) the assets, which are probable future economic benefits owned or controlled by the entity. (2) the liabilities, which are probable future sacrifices of economic benefits. and (3) the owners' equity, calculated as