What is Financial Freedom Template?

Financial Freedom Template is a structured document that helps individuals track their financial goals, income, expenses, and investments. It acts as a roadmap towards achieving financial independence and stability.

What are the types of Financial Freedom Template?

There are several types of Financial Freedom Templates available, including: Monthly Budget Template, Savings Goal Tracker Template, Investment Portfolio Template, Debt Repayment Plan Template, and Financial Goal Setting Template.

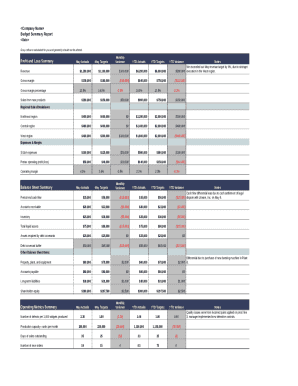

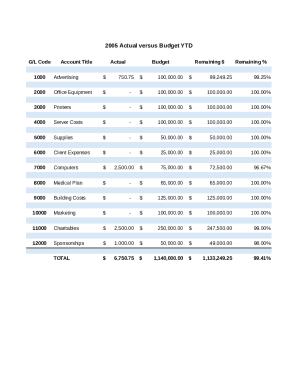

Monthly Budget Template

Savings Goal Tracker Template

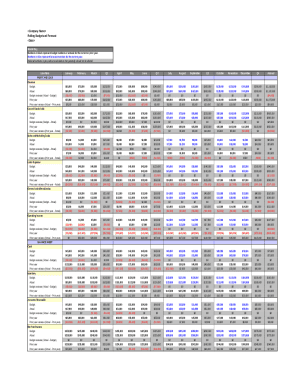

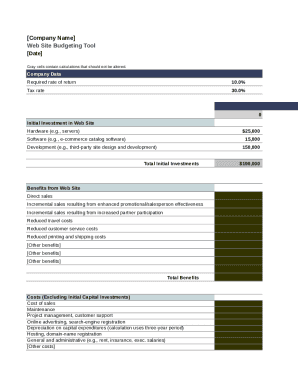

Investment Portfolio Template

Debt Repayment Plan Template

Financial Goal Setting Template

How to complete Financial Freedom Template

To successfully complete a Financial Freedom Template, follow these steps:

01

Start by setting clear financial goals and priorities

02

Gather all necessary financial information and documents

03

Fill in the template with accurate details and figures

04

Regularly update and review your progress towards financial freedom

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Financial Freedom Template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is my path to financial freedom?

In The Path to Financial Freedom, Ridwan will teach you how to create a budget, save for emergencies, spend on what you value today, and invest to ensure you are set up for the future. Investing is a mentality that can be learned by reinventing how we see savings.

What are the 6 pillars of financial planning?

The Financial Planning Process Financial planning consists of six fundamental components – Financial Management, Tax Planning, Asset Management, Risk Management, Retirement Planning and Estate Planning.

What are the 4 pillars of financial freedom?

Regardless of income or wealth, number of investments, or amount of credit card debt, everyone's financial state fits into a common, fundamental framework, that we call the Four Pillars of Personal Finance. Everyone has four basic components in their financial structure: assets, debts, income, and expenses.

What is the golden rule for financial freedom?

This strategy is called “Paying Yourself First” and is considered one of the golden rules of personal finance. We have simply moved Step 4 to Step 2. And are treating “Savings and Investments” as you would any other mandatory expense, no different from rent or your phone bill.

How much money do you need for financial freedom?

Having trotted out those disclaimers, the math result is that financial independence happens when your assets are equal to your expenses divided by 4%. In other words, Assets = Expenses / 0.04 = Expenses * 25. Once your assets are 25x your expenses then you're financially independent and able to retire at any time.

What are the 7 levels of financial freedom?

Sabatier's 7 levels of financial freedom Level 1: Clarity. Level 2: Self-sufficiency. Level 3: Breathing room. Level 4: Stability. Level 5: Flexibility. Level 6: Financial independence. Level 7: Abundant wealth.

Related templates