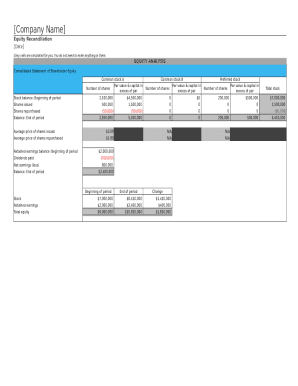

Shareholder Equity Report Template

What is Shareholder Equity Report Template?

The Shareholder Equity Report Template is a document that outlines the financial position of a company by detailing the shareholders' equity at a specific point in time. It reflects the difference between a company's assets and liabilities, giving stakeholders an overview of the company's net worth.

What are the types of Shareholder Equity Report Template?

There are several types of Shareholder Equity Report Templates, including: 1. Basic Shareholder Equity Report Template 2. Comprehensive Shareholder Equity Report Template 3. Visual Shareholder Equity Report Template 4. Interactive Shareholder Equity Report Template

How to complete Shareholder Equity Report Template

To complete a Shareholder Equity Report Template, follow these steps: 1. Gather financial data including assets, liabilities, and equity details. 2. Input the data into the designated sections of the template. 3. Review the report for accuracy and completeness. 4. Save or share the completed Shareholder Equity Report.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.