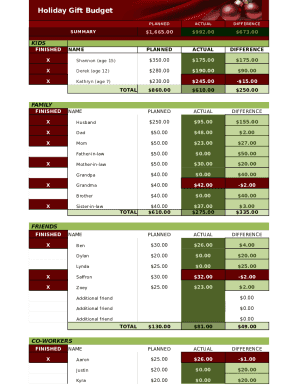

What is Holiday Budget Workbook?

The Holiday Budget Workbook is a handy tool designed to help you plan and track your expenses during the holiday season. It allows you to set a budget, track your spending, and stay on top of your finances to ensure a stress-free holiday season.

What are the types of Holiday Budget Workbook?

There are various types of Holiday Budget Workbooks available to cater to different needs. Some common types include:

Basic Holiday Budget Workbook

Detailed Holiday Budget Workbook

Family Holiday Budget Workbook

Digital Holiday Budget Workbook

How to complete Holiday Budget Workbook

Completing a Holiday Budget Workbook is simple and straightforward. Just follow these steps:

01

Set a budget for each category (gifts, decorations, food, etc.)

02

Track your spending and update the workbook regularly

03

Review your progress and make adjustments as needed

By utilizing pdfFiller, you can easily create, edit, and share your Holiday Budget Workbook online. With unlimited fillable templates and powerful editing tools, pdfFiller is your go-to PDF editor for all your document needs.

Video Tutorial How to Fill Out Holiday Budget Workbook

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you make a holiday budget and stick to it?

How to Make a Holiday Budget and Stick to It in 7 Easy Steps Start Planning Your Holiday Budget Early. Ready to strategize your holiday shopping? Take Inventory. Adjust Your Expectations. List and Categorize Holiday Spending. Set Holiday Spending Limits. Shop Smarter. Track Your Spending. Holiday Budgeting in a Nutshell.

What is a reasonable budget for Christmas?

In fact, a good rule of thumb is to spend no more than 10% of your monthly income on Christmas gifts. This means that if you make $10,000 per month, you can budget up to $1,000 on Christmas gifts.

How much does the average person spend on Christmas UK?

ing to YouGov's annual Christmas spending tracker, the biggest expense for Britons this year will typically be on presents and gifts (a median figure of £300), followed by food and drink (£100) and socialising (£100).

How do I make a holiday budget?

How to keep your holiday spending on budget Value your relationships. Price check with your phone. Be proactive. Buy last year's electronics. Know the truth about Black Friday and Cyber Monday. Stay on top of your spending. Consider making gifts. Save up for expensive presents.

How do you budget for Christmas?

In fact, a good rule of thumb is to spend no more than 10% of your monthly income on Christmas gifts. This means that if you make $10,000 per month, you can budget up to $1,000 on Christmas gifts. Whatever amount you budget for, you will need to split up the amount between all of your intended gift recipients.

How to do Christmas on a extreme budget?

These are the best ways to do Christmas on a budget: Make a Christmas budget. Prioritise your Christmas purchases. Agree not to buy Christmas presents this year. Beware of Christmas 'deals' Use price trackers to decide when to buy gifts. Spend less on your Christmas dinner. Don't buy new wrapping paper.