What is Monthly Budget Sheet?

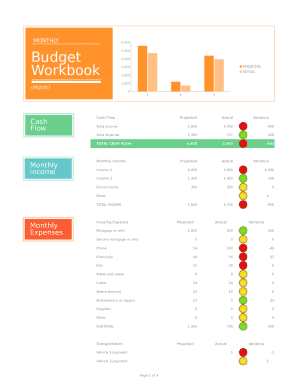

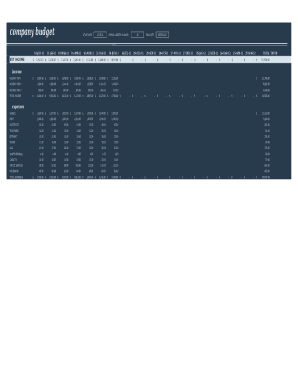

A Monthly Budget Sheet is a tool that helps individuals track and manage their finances for a specific month. It includes categories for income, expenses, savings, and other financial aspects to provide a comprehensive overview of one's financial situation.

What are the types of Monthly Budget Sheet?

There are several types of Monthly Budget Sheets, including: 1. Basic Monthly Budget Sheet - Includes essential categories such as income, expenses, and savings. 2. Detailed Monthly Budget Sheet - Offers more specific categories for detailed tracking of finances. 3. Interactive Monthly Budget Sheet - Allows users to input data and calculate totals easily. 4. Visual Monthly Budget Sheet - Uses charts and graphs to visualize financial data for better understanding.

How to complete Monthly Budget Sheet

Completing a Monthly Budget Sheet is crucial for effective financial management. Here are steps to follow: 1. Gather all financial documents such as pay stubs, bills, and bank statements. 2. List all sources of income and categorize expenses. 3. Calculate total income and expenses to determine the monthly budget. 4. Adjust budget categories as needed to meet financial goals. 5. Review and analyze the budget sheet regularly to track progress and make adjustments.

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. It is the only PDF editor users need to get their documents done.