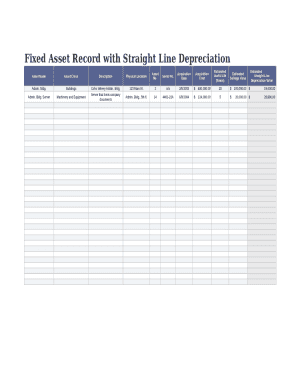

Straight Line Depreciation Calculator

What is Straight Line Depreciation Calculator?

A Straight Line Depreciation Calculator is a tool used to determine the depreciation expense of an asset using the straight-line method. This method evenly spreads the cost of an asset over its useful life, making it a simple and widely used depreciation calculation.

What are the types of Straight Line Depreciation Calculator?

There are two main types of Straight Line Depreciation Calculators:

Basic Straight Line Depreciation Calculator

Advanced Straight Line Depreciation Calculator

How to complete Straight Line Depreciation Calculator

Completing a Straight Line Depreciation Calculator is a straightforward process. Here are the steps to follow:

01

Enter the initial cost of the asset

02

Determine the salvage value of the asset

03

Input the estimated useful life of the asset

04

Calculate the annual depreciation expense using the formula: (Initial Cost - Salvage Value) / Useful Life

05

Repeat the calculation for each year of the asset's useful life to determine the depreciation expense for each year

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Straight Line Depreciation Calculator

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is an example of depreciation value?

The total amount depreciated each year, which is represented as a percentage, is called the depreciation rate. For example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000. This means the rate would be 15% per year.

How do you calculate straight line depreciation?

How Do You Calculate Straight Line Depreciation? To calculate depreciation using a straight line basis, simply divide net price (purchase price less the salvage price) by the number of useful years of life the asset has.

What is the easy formula for depreciation?

The formula to calculate annual depreciation using the straight-line method is (cost – salvage value) / useful life.

What is depreciation value formula?

Table of contents. Straight Line Depreciation Method = (Cost of an Asset – Residual Value)/Useful life of an Asset. Unit of Product Method =(Cost of an Asset – Salvage Value)/ Useful life in the form of Units Produced.

What is depreciation value?

Definition: The monetary value of an asset decreases over time due to use, wear and tear or obsolescence. This decrease is measured as depreciation. Description: Depreciation, i.e. a decrease in an asset's value, may be caused by a number of other factors as well such as unfavorable market conditions, etc.

What is straight line depreciation example?

Example of Straight Line Depreciation Purchase cost of $60,000 – estimated salvage value of $10,000 = Depreciable asset cost of $50,000. 1 / 5-year useful life = 20% depreciation rate per year. 20% depreciation rate x $50,000 depreciable asset cost = $10,000 annual depreciation.