What is Cash Budget Template?

A Cash Budget Template is a financial tool that helps individuals or businesses forecast their cash inflows and outflows over a specific period. It allows users to plan ahead, monitor their funds, and make informed decisions regarding their financial management.

What are the types of Cash Budget Templates?

There are several types of Cash Budget Templates that cater to different financial needs and situations. Some common types include:

Monthly Cash Budget Template

Annual Cash Budget Template

Project-based Cash Budget Template

How to complete Cash Budget Template

Completing a Cash Budget Template is a straightforward process that involves the following steps:

01

Start by listing all your expected sources of income for the period.

02

Next, outline all planned expenses and allocate funds accordingly.

03

Take into account any unexpected or variable expenses that may arise.

04

Compare your projected cash flow with your actual income and expenditure regularly to make necessary adjustments.

05

Utilize online tools like pdfFiller to easily create, edit, and share your Cash Budget Template for efficient financial planning.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Cash Budget Template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

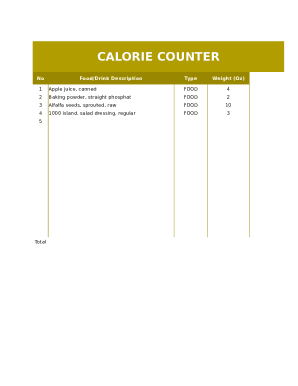

What are the main components for preparing a cash budget?

Estimated Sales and Expenses Expected cash receipts. Cash sales. Collections of accounts receivable. Other income.

What is the format of a cash budget?

The cash budget starts with the cash at the beginning of the period. Next, add all the cash inflows or income. Now, subtract the cash outflows or expenses from that figure. If the resulting balance is positive or excess, then you have enough cash.

What are the 3 parts of a cash budget?

The cash budget includes the beginning balance, detail on payments and receipts, and an ending balance.

What are the elements of a budget?

The three main elements, or parts, of a personal budget are income, expenditures, and savings. Each of the three elements plays a part in ensuring that a household operates and uses their income responsibly.

What are the four elements in cash budget?

The cash budget represents a detailed plan of future cash flows and is composed of four elements: cash receipts, cash disbursements, net change in cash for the period, and new financing needed.

What are 4 uses of cash budget?

What are the functions of a cash budget? The main functions of the cash budget are the following: forecasting of cash requirement, cash position, controlling cash expenditure, expansion schemes and sound dividend policy.

Related templates