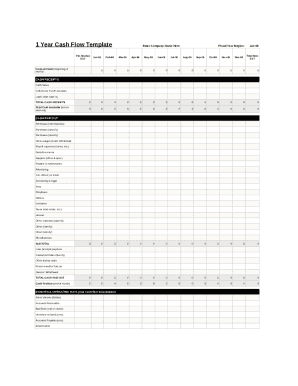

What is 1 Year Cash Flow Template?

A 1 Year Cash Flow Template is a financial document that outlines the expected cash inflows and outflows for a business or individual over a one-year period. This template is essential for budgeting, forecasting, and managing cash flow to ensure financial stability and growth.

What are the types of 1 Year Cash Flow Template?

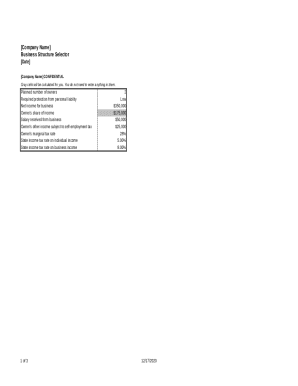

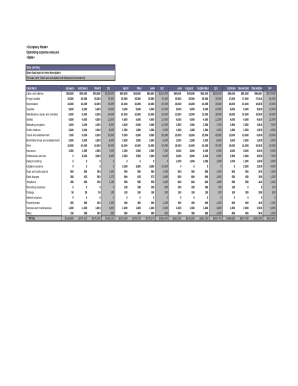

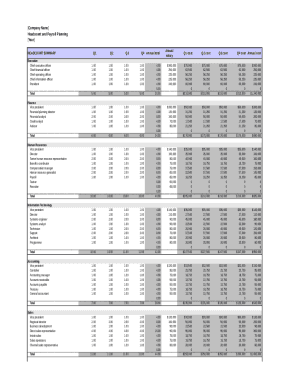

There are several types of 1 Year Cash Flow Templates, each tailored to different business models and needs. Some common types include:

How to complete 1 Year Cash Flow Template

Completing a 1 Year Cash Flow Template is crucial for effective financial planning. Follow these steps to ensure accuracy and comprehensiveness:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.