What is Start Up Budget Template?

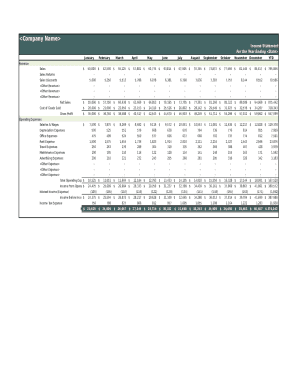

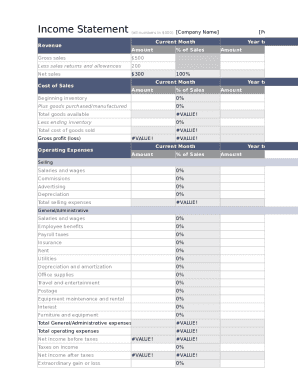

A Start Up Budget Template is a pre-designed format or layout that helps entrepreneurs and business owners plan and track their financial expenses and revenue when starting a new business. It provides a framework for organizing financial data and projecting future financial outcomes.

What are the types of Start Up Budget Template?

There are several types of Start Up Budget Templates available, each designed to suit different business needs and preferences. Some common types include:

How to complete Start Up Budget Template

Completing a Start Up Budget Template is essential for efficient financial management of your business. Here are some key steps to help you complete a Start Up Budget Template:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.