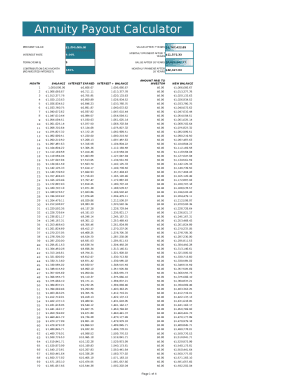

What is Annuity Payout Calculator?

An annuity payout calculator is a tool that helps individuals estimate the future payments they will receive from an annuity based on certain inputs such as the initial investment amount, interest rate, and length of the annuity term. It provides users with a clear understanding of how much they can expect to receive at regular intervals over a specified period.

What are the types of Annuity Payout Calculator?

There are two main types of annuity payout calculators: fixed and variable. Fixed annuity payout calculators provide a guaranteed payment amount over a set period, while variable annuity payout calculators offer payments that fluctuate based on the performance of underlying investments.

How to complete Annuity Payout Calculator

To complete an annuity payout calculator, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.