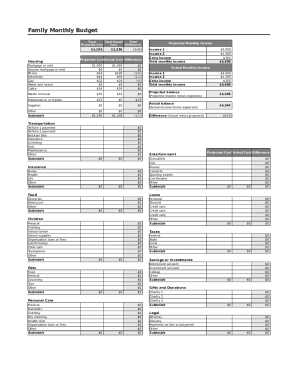

What is Family Monthly Budget Planner?

A Family Monthly Budget Planner is a tool that helps you keep track of your income and expenses for the month. It allows you to plan and manage your finances to ensure that you are staying within your budget and saving for future goals.

What are the types of Family Monthly Budget Planner?

There are various types of Family Monthly Budget Planners available, including physical planners, Excel spreadsheets, and online budgeting tools. Each type has its advantages and features to suit different needs and preferences.

How to complete Family Monthly Budget Planner

Completing a Family Monthly Budget Planner is essential for effective financial management. Here are some steps to help you complete it successfully:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.