Get the free refinance mortgage calculator form

Show details

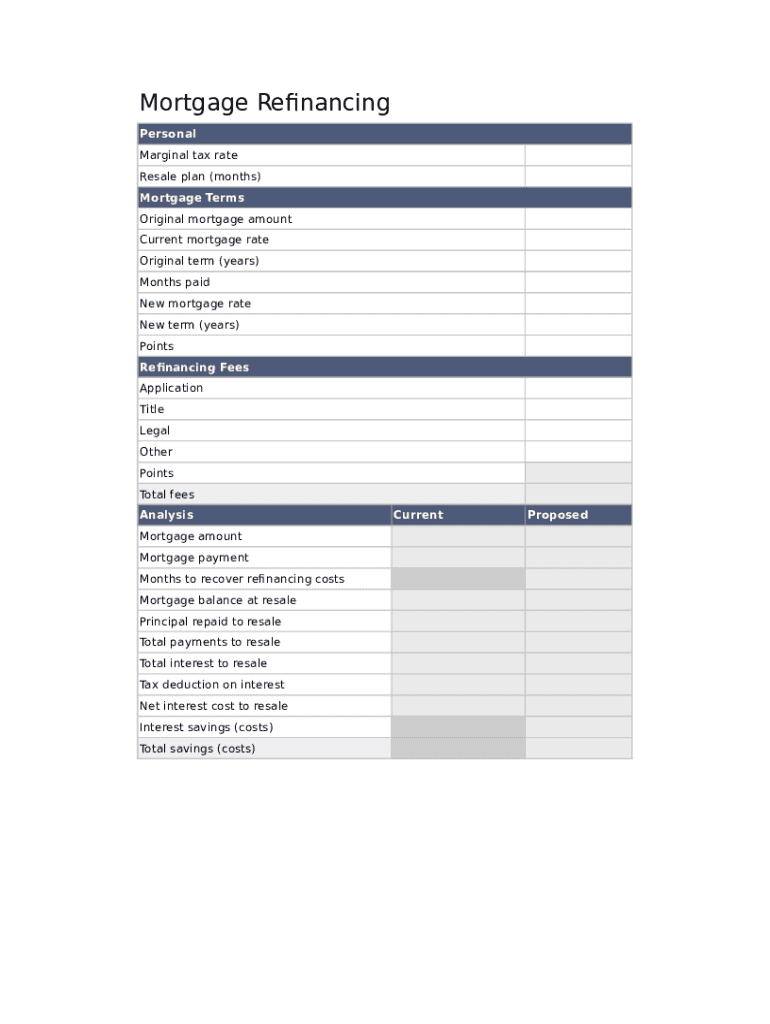

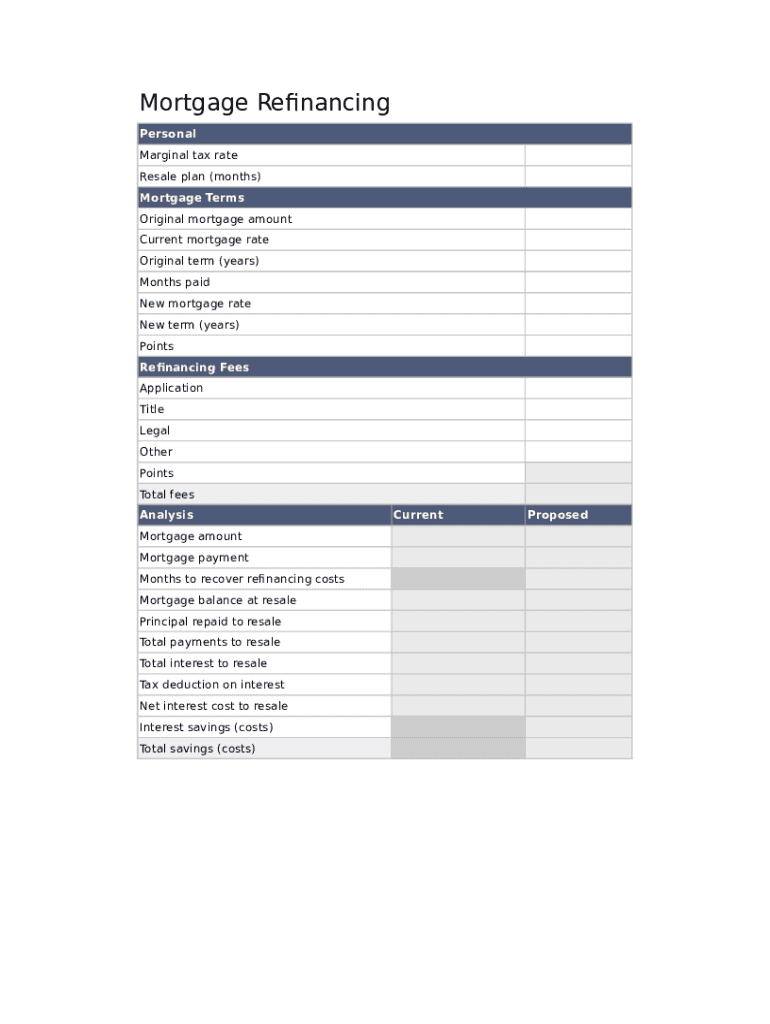

Mortgage Refinancing

Personal

Marginal tax rate

Resale plan (months)

Mortgage Terms

Original mortgage amount

Current mortgage rate

Original term (years)

Months paid

New mortgage rate

New term (years)

Points

Refinancing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your refinance mortgage calculator form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your refinance mortgage calculator form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit refinance mortgage calculator online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit refinance mortgage calculator. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

How to fill out refinance mortgage calculator form

How to fill out refinance mortgage calculator:

01

Start by accessing a reliable refinance mortgage calculator online.

02

Input your current loan details, such as the loan amount, interest rate, and remaining term.

03

Enter the new loan details, including the desired loan amount, interest rate, and term.

04

Include any additional fees or closing costs when prompted.

05

Review the results provided by the calculator, including the new monthly payment, interest savings, and potential closing costs.

Who needs a refinance mortgage calculator:

01

Individuals who currently have a mortgage and are considering refinancing to potentially lower their interest rate, monthly payment, or term.

02

Homeowners who want to compare different loan scenarios to determine the most advantageous option for their financial goals.

03

Financial professionals, such as mortgage brokers or loan officers, who assist clients in evaluating the benefits of refinancing.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is refinance mortgage calculator?

A refinance mortgage calculator is a tool that allows borrowers to calculate and evaluate the potential savings and costs associated with refinancing their existing mortgage. It takes into account various factors such as the current loan balance, interest rate, and term, as well as the proposed new interest rate and term. By inputting this information, borrowers can determine if refinancing their mortgage would be beneficial, such as lowering their monthly payment, reducing the overall interest paid, or shortening the loan term. This calculator helps borrowers make informed decisions about whether or not to refinance their mortgage.

Who is required to file refinance mortgage calculator?

The refinance mortgage calculator is typically used by homeowners who are considering refinancing their existing mortgage. It helps them estimate potential savings and costs associated with refinancing, including monthly payment savings, interest savings, and break-even period. However, it is not required for anyone to file the refinance mortgage calculator; it is simply a tool for personal evaluation and decision-making.

How to fill out refinance mortgage calculator?

To fill out a refinance mortgage calculator, follow these steps:

1. Enter the current mortgage information: Start by entering the remaining balance of your current mortgage loan. This is the amount you still owe on your current mortgage.

2. Input the current interest rate: Enter the interest rate on your current mortgage. This can typically be found on your mortgage statement or by contacting your lender.

3. Provide the loan term: Enter the remaining loan term for your current mortgage. For example, if you have 20 years left on your current mortgage, enter that term.

4. Enter your home value: Input the current value of your home. This can be an estimate based on market conditions or a professional appraisal if available.

5. Input the new interest rate: Enter the interest rate you expect to receive on your refinance loan. You can use current market rates as a guide or consult with a mortgage lender.

6. Provide the new loan term: Enter the term, or the number of years, for your refinanced mortgage. Common terms are 15 or 30 years, but this can vary depending on your specific needs.

7. Input the closing costs: Include any fees or costs associated with refinancing your mortgage. These can include appraisal fees, origination fees, and title fees. You can get estimates from your lender or use an average percentage of the loan amount.

8. Consider any cash-out amount: If you plan to take cash out of your home's equity during the refinance, enter that amount in this section.

9. Adjust for mortgage insurance: If your original mortgage required mortgage insurance but your new loan will not, adjust the calculator accordingly.

10. Submit the details and review the results: Once you have filled out all the necessary information, submit the data and review the results provided by the calculator. This will show you estimated monthly payments, total interest paid, and other relevant details.

Keep in mind that a refinance mortgage calculator provides estimates and should be used as a guide. For accurate results, consult with a mortgage professional or lender who can provide personalized information based on your specific situation.

What is the purpose of refinance mortgage calculator?

The purpose of a refinance mortgage calculator is to help individuals estimate the potential savings or costs associated with refinancing their existing mortgage. It allows users to input relevant details such as current loan balance, interest rate, and remaining term, along with the proposed new loan terms, such as interest rate, term, and closing costs. The calculator then provides an analysis of the savings in terms of lower monthly payments, interest savings over the life of the loan, and the breakeven point when the cost of refinancing is recouped. This helps borrowers decide whether refinancing is a financially beneficial option for them.

What information must be reported on refinance mortgage calculator?

When using a refinance mortgage calculator, you typically need to provide the following information:

1. Loan Amount: The current outstanding balance on your existing mortgage that you want to refinance.

2. Interest Rate: The interest rate on your existing mortgage. If you're not sure, you can check your loan documents or contact your lender.

3. Loan Term: The remaining term of your existing mortgage, i.e., the number of years left until the loan is fully paid off.

4. New Interest Rate: The estimated interest rate you expect to receive on the new mortgage you plan to refinance into.

5. Loan Term: The number of years you intend to have for repayment of the new mortgage. This may differ from your existing loan term.

6. Closing Costs: The total costs associated with refinancing, including lender fees, appraisal fees, title insurance, etc. This can typically be found in the loan estimate provided by the lender.

7. Other Costs: Any other costs or fees related to the refinance, such as prepayment penalties, property taxes, and insurance.

By entering this information into a refinance mortgage calculator, it can estimate the new monthly payment, potential savings, and other relevant financial details based on your specific situation.

What is the penalty for the late filing of refinance mortgage calculator?

The penalty for late filing of a refinance mortgage calculator would depend on the specific terms and conditions set by the lender or mortgage provider. Generally, there can be late fees or penalties associated with late filing, which could be a fixed amount or a percentage of the outstanding loan balance. It is recommended to review the terms and conditions of the mortgage agreement or consult with the lender to determine the exact penalty for late filing.

How can I manage my refinance mortgage calculator directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your refinance mortgage calculator and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I complete refinance mortgage calculator on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your refinance mortgage calculator, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I complete refinance mortgage calculator on an Android device?

Use the pdfFiller Android app to finish your refinance mortgage calculator and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your refinance mortgage calculator form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.