Canada T5001 2020 free printable template

Show details

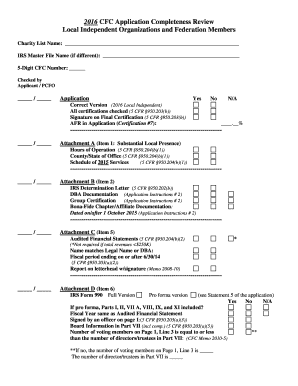

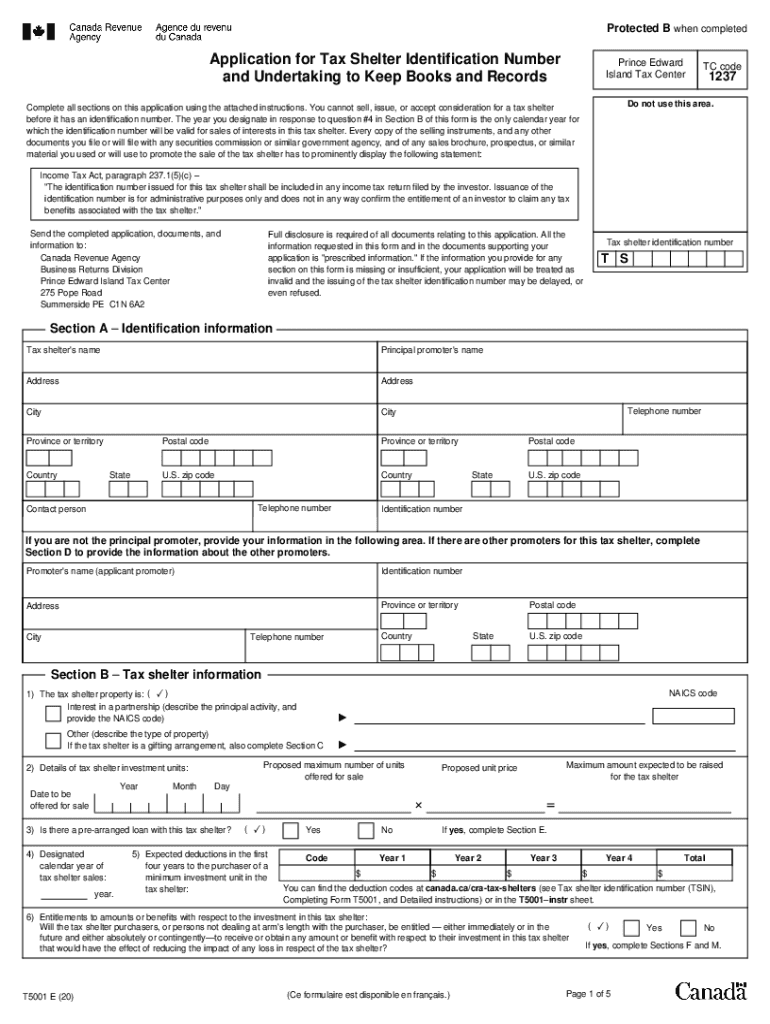

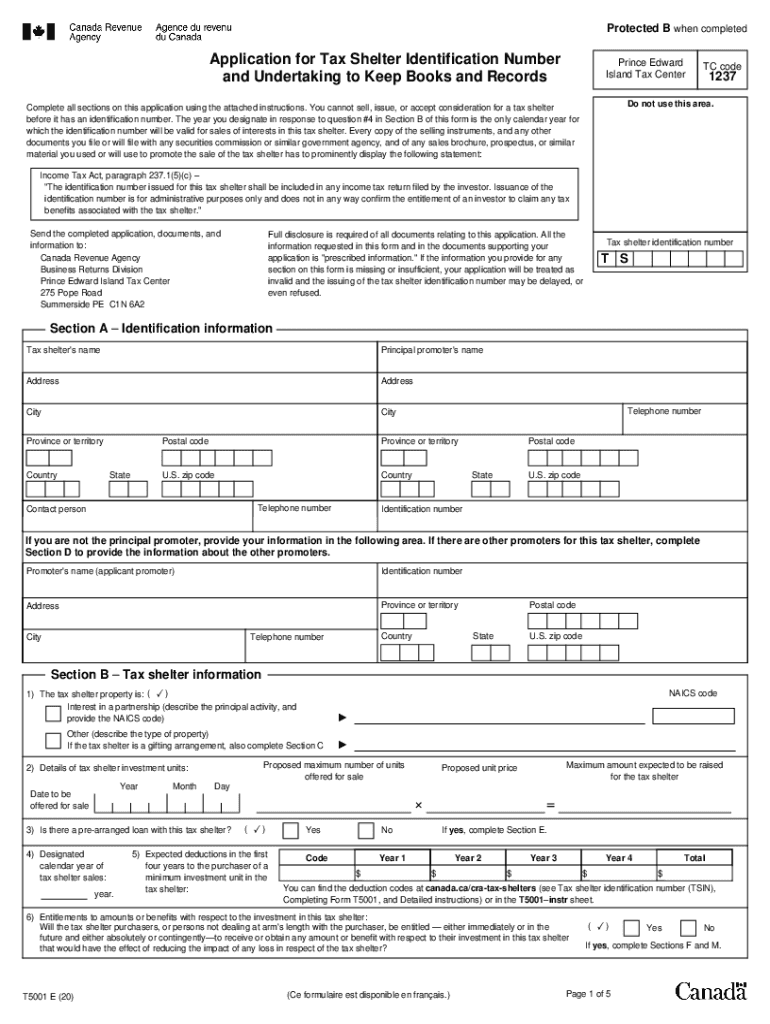

Protected B when completedApplication for Tax Shelter Identification Number

and Undertaking to Keep Books and Records Prince Edward

Island Tax Center TC code1237Do not use this area. Complete all

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign t5001 tax identification number form

Edit your cra t5001 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form t5001 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit t5001 application tax identification online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit t5001 tax form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T5001 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out cra form t5001

How to fill out Canada T5001

01

Obtain the Canada T5001 form from the Canada Revenue Agency (CRA) website or through your tax software.

02

Fill in your personal information including your name, address, and social insurance number (SIN).

03

Enter the information regarding the amount received for services provided.

04

Complete the relevant sections based on whether you are reporting income or a loss.

05

Double-check all the information for accuracy.

06

Sign and date the form before submitting it to the CRA.

Who needs Canada T5001?

01

Anyone who has received income from a trust or a partnership needs to fill out the Canada T5001.

02

Individuals receiving payments that need to be reported on a tax return, such as certain types of income from investments.

Fill

cra form t 5001 identification

: Try Risk Free

People Also Ask about form t 5001

Why i cannot access my Service Canada account?

Help. If your MSCA is locked due to the security code, please contact our Registration and Authentication Help Desk at 1-866-279-5238.

Is my CRA login the same as My Service Canada account?

Did you know that the Canada Revenue Agency's My Account and Employment and Social Development Canada's (ESDC) My Service Canada Account are now linked? With one user ID and password, you can securely access your information from both accounts without having to revalidate your identity!

Is CRA login and GCKey the same?

Can I use my GCKey to access my Canada Revenue Agency's (CRA) online services? No. To access the CRA's login services, you must either use one of the Sign-In Partners or register for a CRA User ID and password.

What is the difference between Service Canada and CRA?

These are different services from each of two Federal government agencies. CRA provides tax information. Service Canada deals with EI CPP OAS and other services.

What is My Service Canada account used for?

My Service Canada Account ( MSCA ) is a secure online portal. It allows you to apply, view and update your information for Employment Insurance ( EI ), Canada Pension Plan ( CPP ), Canada Pension Plan disability and Old Age Security ( OAS ).

Can I use my CRA login for Service Canada?

If you are registered for CRA's My Account you can securely access ESDC's My Service Canada Account without having to login or revalidate your identity. The link will take you directly to your My Service Canada Account within a single secure session, without having to sign in or register with MSCA.

Is CRA having technical difficulties today?

We are currently experiencing technical difficulties with our phones services.

Why can't I log into my CRA account?

If your CRA user ID and password have been revoked Some taxpayers may have received a notification that their CRA user ID and password have been revoked. Visit CRA user ID and password have been revoked for more information. Sign in or register for My Account, My Business Account or Represent a Client with the CRA.

Is CRA still offline?

There is currently no indication that CRA systems have been compromised, or that there has been unauthorized access to taxpayer information because of this vulnerability. Most of our digital services have been restored as of Monday, December 13, 2021.

Is the CRA account the same as Service Canada?

Did you know that the Canada Revenue Agency's My Account and Employment and Social Development Canada's (ESDC) My Service Canada Account are now linked? With one user ID and password, you can securely access your information from both accounts without having to revalidate your identity!

How do I access My Service Canada Account?

My Service Canada Account ( MSCA ) is a secure online portal.If you already have an access code or a provincial digital ID, choose an option to access MSCA : Sign in with GCKey. Sign in with your bank. Sign in with your province.

How do I access my CRA account without access code?

Did you know? If you are ready to file your income tax and benefit return but have misplaced your NETFILE access code, you can visit the Canada Revenue Agency's (CRA) Web site, enter your information, and receive your access code instantly!

Is Service Canada and CRA account the same?

Did you know that the Canada Revenue Agency's My Account and Employment and Social Development Canada's (ESDC) My Service Canada Account are now linked? With one user ID and password, you can securely access your information from both accounts without having to revalidate your identity!

Can I access CRA through Service Canada?

If you are registered for CRA's My Account you can securely access ESDC's My Service Canada Account without having to login or revalidate your identity. The link will take you directly to your My Service Canada Account within a single secure session, without having to sign in or register with MSCA.

Is a GCKey the same as my CRA login?

Can I use my GCKey to access my Canada Revenue Agency's (CRA) online services? No. To access the CRA's login services, you must either use one of the Sign-In Partners or register for a CRA User ID and password.

Why can't I access my Service Canada account?

Help. If your MSCA is locked due to the security code, please contact our Registration and Authentication Help Desk at 1-866-279-5238.

Can I access CRA from MSCA?

Submit them with your income tax return to the Canada Revenue Agency (CRA). If you decide to receive your tax slips online, they will be available in MSCA on February 1. You will not be notified when they are available and will not receive your tax slip by mail. Accessing your tax information slips online is secure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get t 5001 tax?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific cra form t 5001 tax and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an eSignature for the t 5001 tax shelter identification in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your t 5001 tax shelter right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit cra t5001 app tax on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share Canada T5001 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is Canada T5001?

The T5001 is a tax form used in Canada to report payments made to individuals or entities for services rendered in the construction industry.

Who is required to file Canada T5001?

Individuals or businesses that make payments for construction services amounting to $600 or more in a calendar year must file the T5001.

How to fill out Canada T5001?

To fill out the T5001, you need to provide the payer's name, the payee's name, the amounts paid, and any applicable tax withheld, using the designated fields on the form.

What is the purpose of Canada T5001?

The purpose of the T5001 is to ensure accurate reporting of payments made in the construction sector, aiding in tax compliance and information reporting.

What information must be reported on Canada T5001?

The T5001 requires reporting of the payer's details, payee's details, total payment amounts, and any amount withheld for taxes during the reporting period.

Fill out your Canada T5001 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t5001 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.