Canada TD1 E 2021 free printable template

Show details

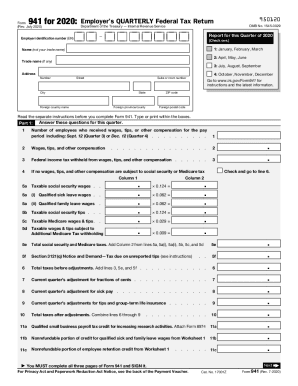

Protected B when completed2021 Personal Tax Credits ReturnTD1Read page 2 before filling out this form. Your employer or payer will use this form to determine the amount of your tax deductions.

Fill

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada TD1 E

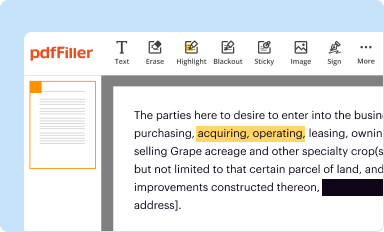

Edit your Canada TD1 E form online

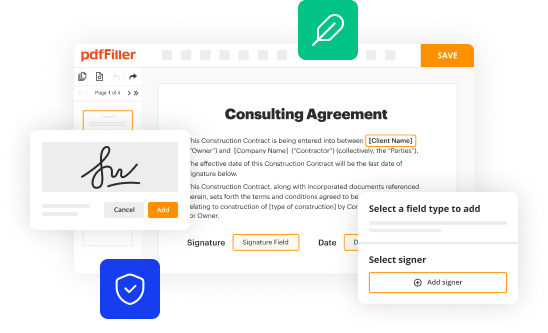

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada TD1 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada TD1 E online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Canada TD1 E. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada TD1 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada TD1 E

How to fill out Canada TD1 E

01

Obtain a copy of the TD1 E form from the Canada Revenue Agency website or your employer.

02

Fill in your name and address at the top of the form.

03

Provide your social insurance number (SIN).

04

Indicate your marital status by checking the appropriate box.

05

Complete the section for income information, detailing your expected income for the year.

06

If applicable, fill out the additional deductions section for any non-refundable tax credits you will claim.

07

Sign and date the form to confirm that the information provided is accurate and complete.

08

Submit the completed TD1 E form to your employer.

Who needs Canada TD1 E?

01

Individuals who are employed in Canada and are subject to income tax withholding.

02

New employees starting a job in Canada who need to establish their tax exemption or deductions.

03

Employees who wish to claim specific deductions or credits on their income tax withholdings.

Fill

form

: Try Risk Free

People Also Ask about

What is the TD1 amount for 2022?

Personal Tax Credits Return (TD1 Federal) Description20222021TD1 Federal Basic exemption14398*13808 Jan 1, 2022

How do I fill out a TD1 form 2022 in Ontario?

0:22 9:17 HOW TO: Fill-in an Ontario TD1 Form *2022* - YouTube YouTube Start of suggested clip End of suggested clip The first part of the form is name address birth date and social insurance number so that part'sMoreThe first part of the form is name address birth date and social insurance number so that part's fairly straightforward. The purpose of this form of course is to fill in by an employee.

Is a TD1 form required?

You don't have to complete a new TD1 every year unless there's a change to your eligibility for federal, provincial or territorial personal tax credit amounts. If you do not complete a TD1, then your employer or payer will deduct taxes based on you claiming only the basic personal amount.

Should I complete TD1 form?

Individuals do not have to complete a new TD1 every year unless there is a change to their federal, provincial or territorial personal tax credit amounts. If a change happens, they must complete a new form no later than seven days after the change.

What is a TD1?

What is a TD1? TD1, Personal Tax Credits Return, is a form used to determine the amount of tax to be deducted from an individual's employment income or other income, such as pension income. There are federal and provincial/territorial TD1 forms.

What is the purpose of a TD1?

The TD1 Personal Tax Credit Return is a form used to determine the amount of tax to be deducted from an individual's employment income or other income, such as pension. In addition to the federal TD1 form, there are also provincial ones specific to each province.

Who uses TD1 form?

Individuals paid by commissions and who claim expenses can elect to use Form TD1X, Statement of Commission Income and Expenses for Payroll Tax Deductions, to take into consideration the expenses in the calculation of their income tax. Individuals in Québec should use the federal TD1X and the provincial Form TP-1015.

Who needs to fill out TD1?

All new employees must fill out two TD1 forms upon starting a new job. It is usually included in onboarding documents. A new hire must complete both the federal TD1 and the provincial TD1 if more than the basic personal amount is claimed.

What is the federal TD1 amount for 2022?

Personal Tax Credits Return (TD1 Federal) Description20222019TD1 Federal Basic exemption14398*12069 Jan 1, 2022

How much do you need to fill in TD1 form?

When filling out the TD1, employees can choose to claim the basic personal amount of tax credits or opt to have more tax deducted at source from their pay. The basic personal amount in 2022 is $14,398.

Do I need to complete a TD1 every year?

You don't have to complete a new TD1 every year unless there's a change to your eligibility for federal, provincial or territorial personal tax credit amounts. If you do not complete a TD1, then your employer or payer will deduct taxes based on you claiming only the basic personal amount.

Where can I find my TD1?

The federal and provincial/territorial TD1 Personal Tax Credits Return forms can be found on the CRA website.

What happens if I don't fill out a TD1?

Employees who do not fill out new forms may be penalized $25 for each day the form is late. The minimum penalty is $100, and increases by $25 per day to the maximum of $2,500. Employees do not have to fill out new TD1 forms every year if their personal tax credit amounts have not changed.

What is the basic personal amount for TD1?

TD1 Form and Source Deductions When filling out the TD1, employees can choose to claim the basic personal amount of tax credits or opt to have more tax deducted at source from their pay. The basic personal amount in 2022 is $14,398.

Should I complete TD1?

You must sign and date the TD1 form and give it to your employer. If you work for the same employer from year to year, you do not have to complete a TD1 form every year, unless there is a change to your federal, provincial, or territorial personal tax credit amounts.

What should I put on my TD1?

Information about tax credits, and the circumstances in which they can be claimed, are contained in the TD1 form itself. You simply need to enter the applicable tax credits on each line of the document, leaving those entitlements which do not apply blank (you'll also need to specify your name and address).

What is a TD1 tax form?

The TD1 Personal Tax Credits Return is used to calculate the amount of income tax that will be deducted or withheld from your employment or pension income.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the Canada TD1 E in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your Canada TD1 E right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the Canada TD1 E form on my smartphone?

Use the pdfFiller mobile app to fill out and sign Canada TD1 E on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete Canada TD1 E on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your Canada TD1 E. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is Canada TD1 E?

Canada TD1 E is a form used to determine the amount of federal and provincial or territorial tax deductions from an individual's employment income. It is specifically designed for employees in Quebec.

Who is required to file Canada TD1 E?

Individuals who work in Quebec and are subject to tax deductions from their employment income are required to file Canada TD1 E.

How to fill out Canada TD1 E?

To fill out Canada TD1 E, individuals must provide personal information such as their name, address, and social insurance number, along with any applicable deductions or credits they wish to claim.

What is the purpose of Canada TD1 E?

The purpose of Canada TD1 E is to collect information to accurately calculate the amount of tax to withhold from an employee's paycheck, ensuring that the correct tax deductions are made throughout the year.

What information must be reported on Canada TD1 E?

The information that must be reported on Canada TD1 E includes personal identification details, the amounts for any tax credits, and relevant deductions that may affect the tax calculation.

Fill out your Canada TD1 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada td1 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.