Canada TD1 E 2012 free printable template

Show details

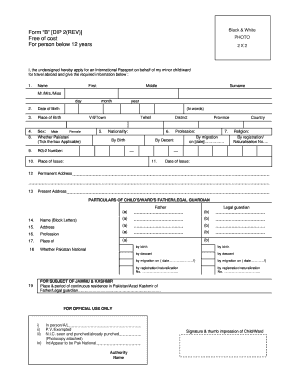

Restore Help 2012 PERSONAL TAX CREDITS RETURN TD1 Your employer or payer will use this form to determine the amount of your tax deductions. Read the back before completing this form. Complete this form based on the best estimate of your circumstances. Last name Address including postal code First name and initial s Date of birth YYYY/MM/DD Employee number For non-residents only Country of permanent residence Social insurance number 1. Restore Help 2012 PERSONAL TAX CREDITS RETURN TD1 Your...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada TD1 E

Edit your Canada TD1 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada TD1 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada TD1 E online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada TD1 E. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada TD1 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada TD1 E

How to fill out Canada TD1 E

01

Obtain a copy of the Canada TD1 E form from the Canada Revenue Agency (CRA) website or your employer.

02

Fill in your personal information, including your last name, first name, and address.

03

Provide your social insurance number (SIN).

04

Indicate your total expected income for the year.

05

Claim the applicable deductions and credits by checking the appropriate boxes.

06

Calculate your total and enter it in the designated section.

07

Sign and date the form to validate your submission.

08

Submit the completed form to your employer or the designated tax office.

Who needs Canada TD1 E?

01

Individuals who are starting a new job in Canada.

02

New employees who want to determine their tax deductions.

03

Workers who wish to claim personal tax credits.

04

Employees receiving pensions or other income sources in Canada.

Fill

form

: Try Risk Free

People Also Ask about

How do I write a TD1 form?

0:02 12:25 HOW TO: Fill-in a Canadian TD1 Form *2022* - YouTube YouTube Start of suggested clip End of suggested clip Itself is two pages. Long it is divided up into steps at the beginning of the first. Page you needMoreItself is two pages. Long it is divided up into steps at the beginning of the first. Page you need to put in your name first and last your date of birth. Your address including postal code.

What does it mean by first name and initial?

Initials are the capital letters which begin each word of a name. For example, if your full name is Michael Dennis Stocks, your initials will be M. D. S.

What if I fill out my TD1 incorrectly?

If you think a TD1 contains incorrect information, call 1-855-284-5942. If the individual does not complete these forms, you are still responsible for deducting taxes, allowing the basic personal amount only.

What is a TD1 form in Canada?

The TD1 Personal Tax Credit Return is a form used to determine the amount of tax to be deducted from an individual's employment income or other income, such as pension. In addition to the federal TD1 form, there are also provincial ones specific to each province.

What is a T4?

No matter what you call it, the T4 is a tax document that summarizes how much you've earned over the past year. Your T4 slip will also show any required deductions, such as employment insurance premiums or income tax, made by your employer.

What is first name and initials on tax form Canada?

What does first name and initials mean on a form? On the 1040x form where it says "first name and initial" do they mean initial as in the first letter of your middle name or first name? Yes, you put your first name and the initial of your middle name.

What is a TD1 form Trinidad?

If you are an employee of a business, the Tax Declaration 1 Form (commonly referred to as the TD1 form) is used to calculate the amount of tax that is withheld by your employer. You must complete and submit a TD1 form to your employer when you begin your employment.

What is Ontario Personal Tax Credits Return?

In Ontario, for the 2022 tax year the basic personal tax credit amount is $11,141. For the 2023 tax year this amount is $11,865.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Canada TD1 E from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your Canada TD1 E into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit Canada TD1 E in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing Canada TD1 E and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for signing my Canada TD1 E in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your Canada TD1 E right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is Canada TD1 E?

Canada TD1 E is a personal tax credit return form used by employees to indicate their eligibility for tax credits and deductions in accordance with Canadian tax laws.

Who is required to file Canada TD1 E?

Individuals who are starting a new job or who wish to update their tax credits with their employer must file the Canada TD1 E form.

How to fill out Canada TD1 E?

To fill out Canada TD1 E, individuals must provide their personal information, including their name, address, and social insurance number, and select the applicable tax credits based on their circumstances.

What is the purpose of Canada TD1 E?

The purpose of Canada TD1 E is to determine the amount of tax to be withheld from an employee's paycheque, ensuring that the right amount of taxes is deducted according to their personal circumstances.

What information must be reported on Canada TD1 E?

The information that must be reported on Canada TD1 E includes personal identification details, total income, and specific claims for credits such as the basic personal amount or dependent amounts.

Fill out your Canada TD1 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada td1 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.