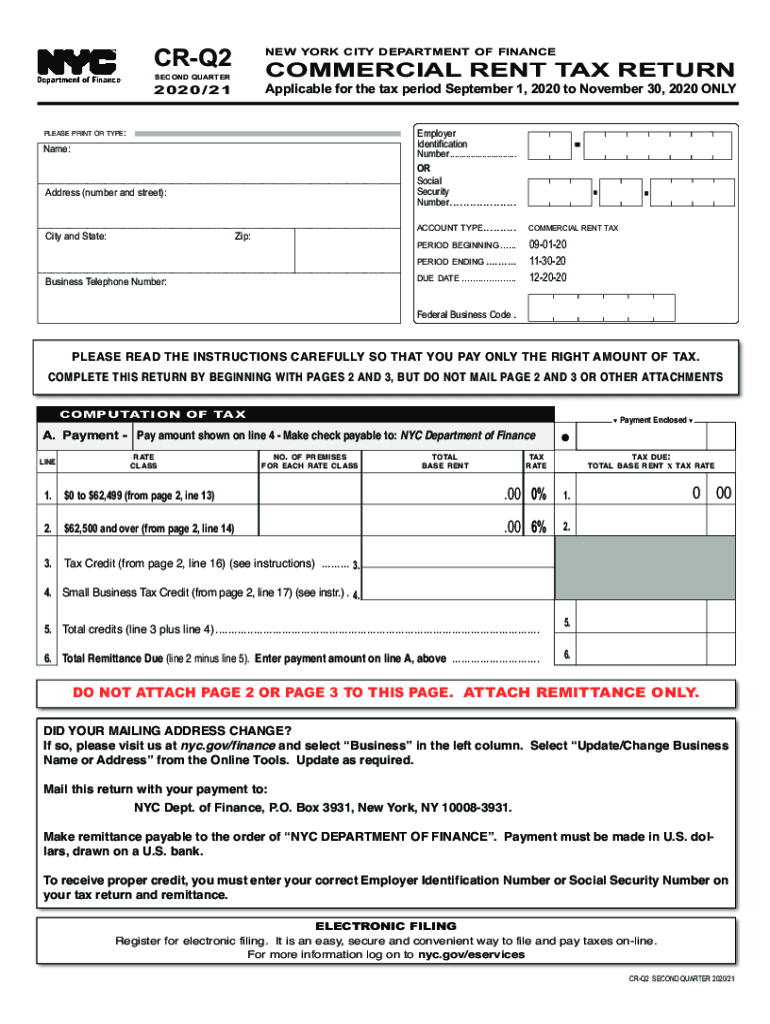

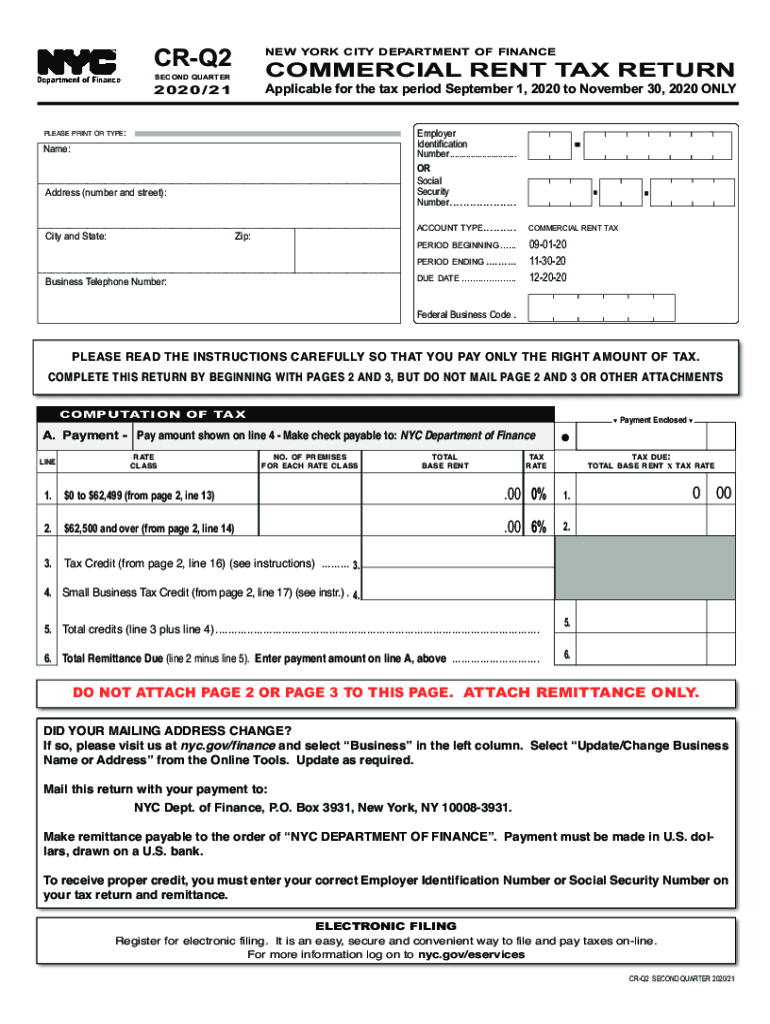

NY DoF CR-Q2 2020 free printable template

Get, Create, Make and Sign NY DoF CR-Q2

Editing NY DoF CR-Q2 online

Uncompromising security for your PDF editing and eSignature needs

NY DoF CR-Q2 Form Versions

How to fill out NY DoF CR-Q2

How to fill out NY DoF CR-Q2

Who needs NY DoF CR-Q2?

Instructions and Help about NY DoF CR-Q2

All right subtext one on the CSET number three we need to recognize the form first off so perform an equals b n plus RT, so we're going to say from the beginning that an is 22 and b is 14, so we're going to apply the euclidean algorithm again Mr. manager of a again if you notice a technique is being done here refer to the previous you clean algorithm question with two large numbers by the CD of two larger numbers goes at once a remainder of 6 it comes out front goes in once with remainder of 2 goes in 3 times remainder of 0 that confirms that the CD is in fact to which is pretty obvious between 14 and 22, but we still need to be able to show it now I'm going to take these and rewrite them instead of being sawed off which an equals B n plus R I'm going to put it in the form a minus V 10 equals R and instead of writing all four statements I'm going to write just the first three, and it's going to become apparent why in a second so 22 minus 14 times 1 is 8 I'm going to leave some space here all right I'm chopping each one of these for the remainders right so solving this last one for the remainder it's 8 minus 6 times 1 is 2 I'm not going to bother to read mine that last one and back up you know we knew that a know that an is 22 and B is 14 so when we see this 22 number I can just write that an is 22 so a minus and 14 is just me, so it's a minus B times 1 is 8 and a minus B is 8 well look here at 14 remember we have these two values an is 22 and B is 14, so that's B minus, and we have a definition for a definition for an is written up there's a minus PT and that drops word I've done in here, and it's a minus B times 1, so we clean that up a little — the plus the B and you get 2 B minus F so 2 B minus an equals 6 now that's our definition for 6 which we're gonna place down there — want to be always the quantity, and then we also have our eighth value which is not from our last statement but problem two statements ago, so opening is going to the preceding statement and two statements ago to get your inputs to get your substituted values the substitute value for 8 is just a minus B and this equals 2 so finishing this up a minus a negative a so 2 a negative B minus another to B so minus 3b 2a minus 3b is 2 now one thing I did know from the beginning is that this is of the form ax plus B y equals the CD of a comma B this is known as a dire Fanzine equation the time of an equation big name for a pretty simple idea coefficient ax plus coefficient y equals number alright where instead of integer solutions or a lattice points if you will well look at this original form underwrite it right below this ax plus B y equals the CD of a comma B right, and we already knew that the equation was 22 X plus 14 y equals 2 okay, so you can look into either one of these equations I'm pretty clearly what you're seeing is that an excuse me X has to equal two and Y has to equal negative three right, and we go ahead and note that since we recognize the form of the structure...

People Also Ask about

What is the basic tax formula?

How is Ghana tax calculated?

How much tax will I pay on my income in Canada?

How do u calculate tax?

What is the formula to calculate tax?

How do you calculate tax in Canada?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NY DoF CR-Q2 online?

Can I sign the NY DoF CR-Q2 electronically in Chrome?

How do I edit NY DoF CR-Q2 on an Android device?

What is NY DoF CR-Q2?

Who is required to file NY DoF CR-Q2?

How to fill out NY DoF CR-Q2?

What is the purpose of NY DoF CR-Q2?

What information must be reported on NY DoF CR-Q2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.