Get the free Doc 880-1

Show details

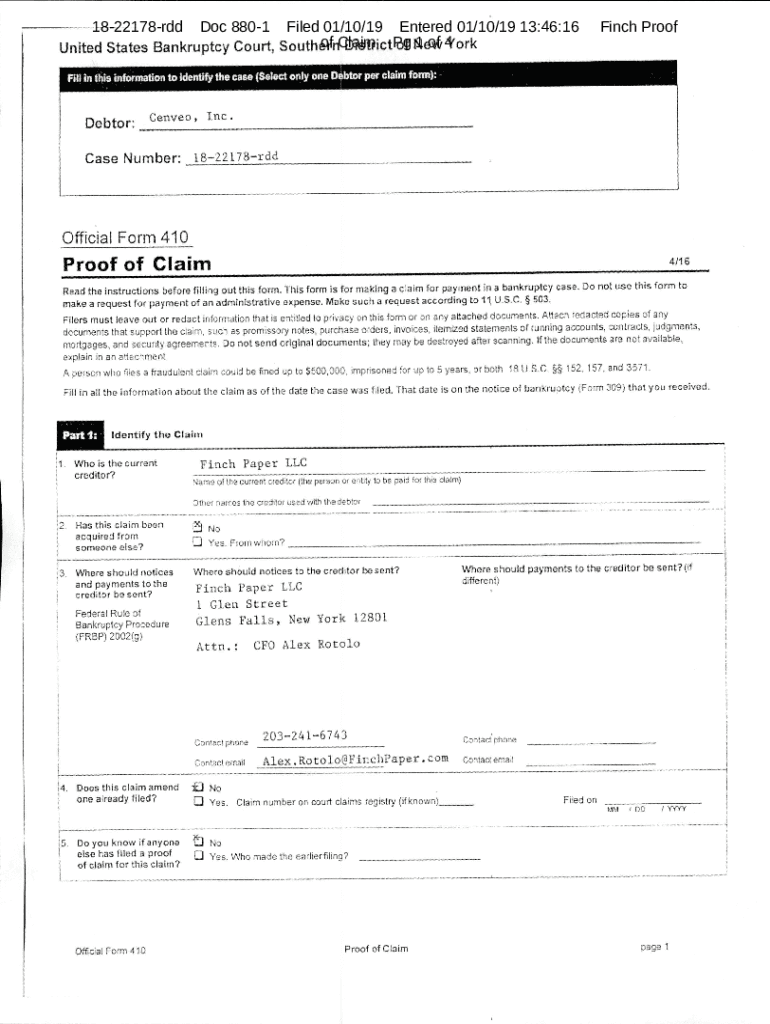

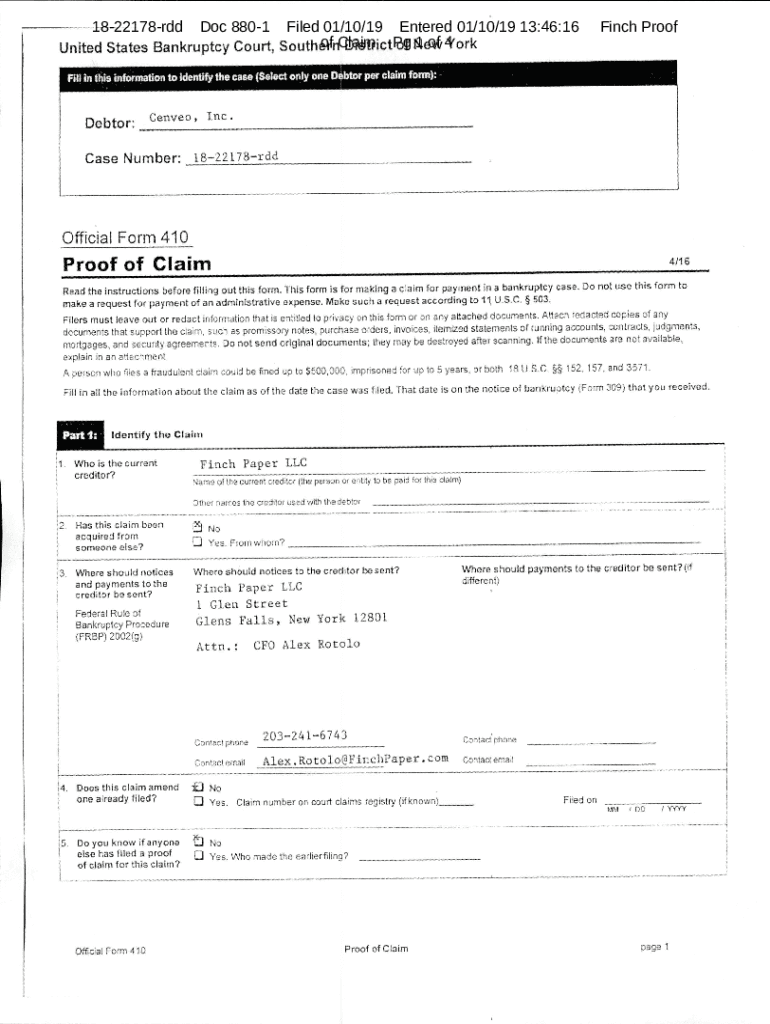

1822178rddDoc 8801Filed 01/10/19 Entered 01/10/19 13:46:16

of Claim

1 of 4York

United States Bankruptcy Court, Southern

District

of New Finch Poorly in this information to Identity the case(Select

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign doc 880-1

Edit your doc 880-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your doc 880-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit doc 880-1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit doc 880-1. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out doc 880-1

How to fill out doc 880-1

01

To fill out doc 880-1, follow these steps:

1. Start by opening the document in a word editing program such as Microsoft Word.

2. Read through the entire document to familiarize yourself with its contents and requirements.

3. Begin by filling out the necessary personal information sections, including your name, contact information, and any other requested details.

4. Proceed to the main sections of the document, which may include sections for identifying the purpose of the document, providing any relevant background information, and addressing specific questions or concerns.

5. Carefully review each section before providing your response, ensuring that all information is accurate and complete.

6. Use clear and concise language to convey your thoughts and ideas, addressing any required topics or questions thoroughly.

7. Double-check all entered information for any errors or omissions, making any necessary revisions.

8. Save the completed document to your computer or a desired storage location.

9. If required, print out a hard copy of the document for submission or further processing.

10. Keep a copy of the filled-out document for your records, ensuring its safekeeping and accessibility as needed.

Who needs doc 880-1?

01

Doc 880-1 may be needed by various individuals or organizations. Some examples of who may need this document include:

1. Employees or applicants for employment who are required to provide certain information or complete certain forms as part of their onboarding or ongoing employment processes.

2. Government agencies or departments that require specific information or documentation from individuals or businesses.

3. Educational institutions or admissions offices requesting additional information or supplementary materials for applications.

4. Insurance companies or providers requesting certain details or declarations from policyholders or applicants.

5. Licensing authorities or regulatory bodies requesting specific information or documentation to fulfill legal or professional requirements.

6. Contractors or vendors submitting bids, proposals, or other types of documentation to clients or customers.

7. Any individual or organization participating in a legal or administrative process that necessitates the completion of doc 880-1.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit doc 880-1 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your doc 880-1 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I sign the doc 880-1 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I complete doc 880-1 on an Android device?

Use the pdfFiller Android app to finish your doc 880-1 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is doc 880-1?

Doc 880-1 is a required tax form used by certain taxpayers to report specific financial information to the IRS.

Who is required to file doc 880-1?

Taxpayers who meet certain income thresholds or specific criteria outlined by the IRS are required to file doc 880-1.

How to fill out doc 880-1?

To fill out doc 880-1, you must provide accurate financial information, including income details, deductions, and other relevant data as specified on the form.

What is the purpose of doc 880-1?

The purpose of doc 880-1 is to ensure that taxpayers report their financial information correctly and comply with federal tax obligations.

What information must be reported on doc 880-1?

On doc 880-1, taxpayers must report their income, deductions, credits, and any other necessary financial information as required by the IRS.

Fill out your doc 880-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Doc 880-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.