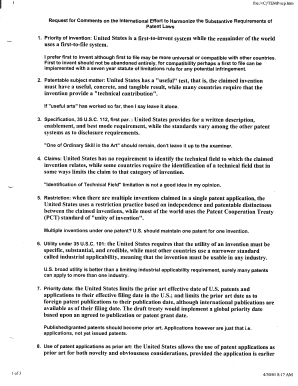

Get the Property Tax Appeal Packet. LightPDF - Edit, Convert PDF Files Online for Free

Show details

2919 Commerce St Suite 272

Dallas, TX 75226PROPER

PROPER TTY T

TAX

AX

APPEAL P

PA

ACRE

CNET

TPROPERTYPRESENTED PREPARED ON:2018

1111 SAMPLE ST, DALLAS Tax ID: 00000236789000000Bryan They

bryanutley@somemail.com

12009

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax appeal packet

Edit your property tax appeal packet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax appeal packet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property tax appeal packet online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit property tax appeal packet. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax appeal packet

How to fill out property tax appeal packet

01

Start by gathering all the necessary documents for your property tax appeal. This may include documents such as property tax assessment notices, recent property appraisals, and any relevant supporting documentation.

02

Carefully review your property tax assessment notice to understand the specific reasons for your appeal and the deadline to submit your appeal packet.

03

Prepare a written statement explaining why you believe your property tax assessment is incorrect. Be clear and concise, and provide any supporting evidence or documentation that proves your case.

04

Complete the necessary appeal forms provided by your local tax assessor's office or the relevant tax appeal board. Ensure that you provide accurate and detailed information in all the required sections.

05

Attach all the required documents to your appeal packet. This may include copies of recent property appraisals, photographs of the property, or any other evidence that supports your claim.

06

Make copies of your entire appeal packet for your records before submitting it. This will serve as a backup in case any documents get lost or misplaced.

07

Submit your completed appeal packet to the appropriate authority within the specified deadline. You may need to pay a filing fee, so be prepared to include payment if required.

08

Follow up with the tax assessor's office or the tax appeal board to ensure that your appeal packet has been received and is being processed. Keep track of any correspondences related to your appeal.

09

Attend any scheduled hearings or meetings related to your property tax appeal. Be prepared to present your case and provide any additional evidence or information requested by the authorities.

10

Stay informed about the progress of your property tax appeal and the final decision. If your appeal is successful, you may receive a lower property tax assessment and a refund for any overpaid taxes.

Who needs property tax appeal packet?

01

Property owners who believe that their property tax assessment is inaccurate or unfairly high.

02

Property owners who have gathered sufficient evidence to support their claim for a lower property tax assessment.

03

Property owners who are willing to invest time and effort in preparing and submitting a property tax appeal packet.

04

Property owners who are aware of the appeal process and the necessary steps to challenge their property tax assessment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send property tax appeal packet to be eSigned by others?

When you're ready to share your property tax appeal packet, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for the property tax appeal packet in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your property tax appeal packet in minutes.

Can I edit property tax appeal packet on an Android device?

You can make any changes to PDF files, like property tax appeal packet, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is property tax appeal packet?

A property tax appeal packet is a collection of documents and forms submitted to challenge the assessed value of a property, aiming to reduce the property tax owed.

Who is required to file property tax appeal packet?

Property owners or their authorized representatives are required to file a property tax appeal packet if they believe their property has been unfairly assessed.

How to fill out property tax appeal packet?

To fill out a property tax appeal packet, gather the necessary documentation, complete the forms accurately, provide supporting evidence, and ensure all required information is included.

What is the purpose of property tax appeal packet?

The purpose of the property tax appeal packet is to formally contest the assessed value of a property and to seek a reassessment that could potentially lower the property taxes.

What information must be reported on property tax appeal packet?

The information that must be reported includes property details, the current assessment value, the grounds for the appeal, and any supporting evidence such as property comparisons or appraisal reports.

Fill out your property tax appeal packet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Appeal Packet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.