AK Form 6385 2020 free printable template

Show details

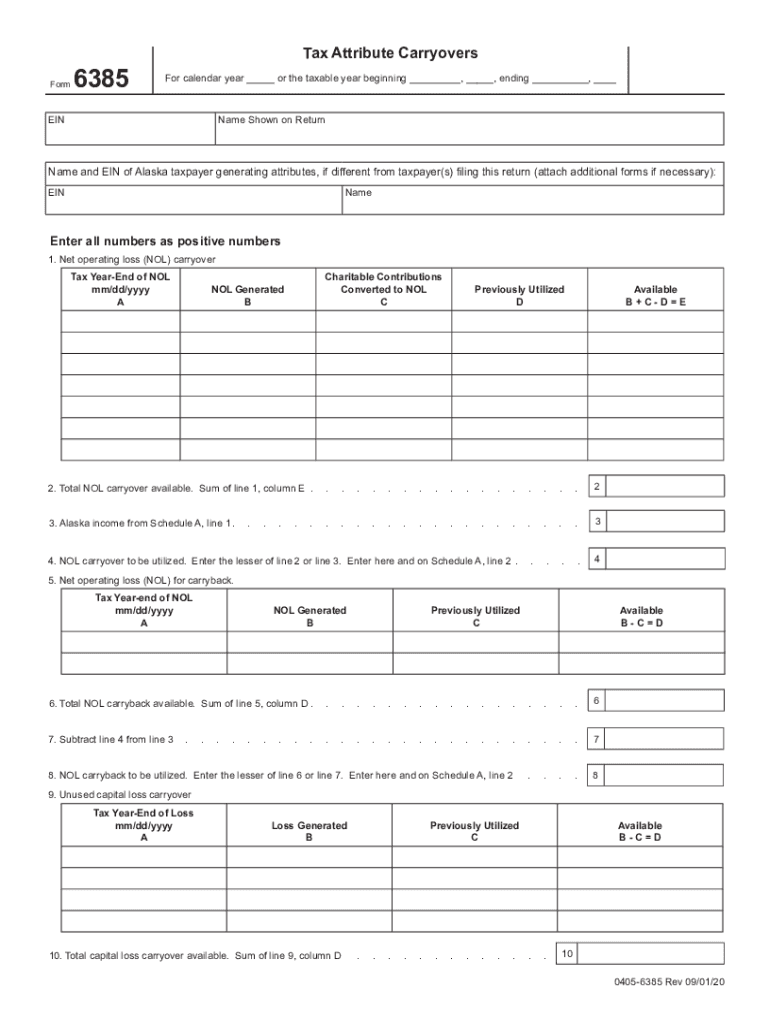

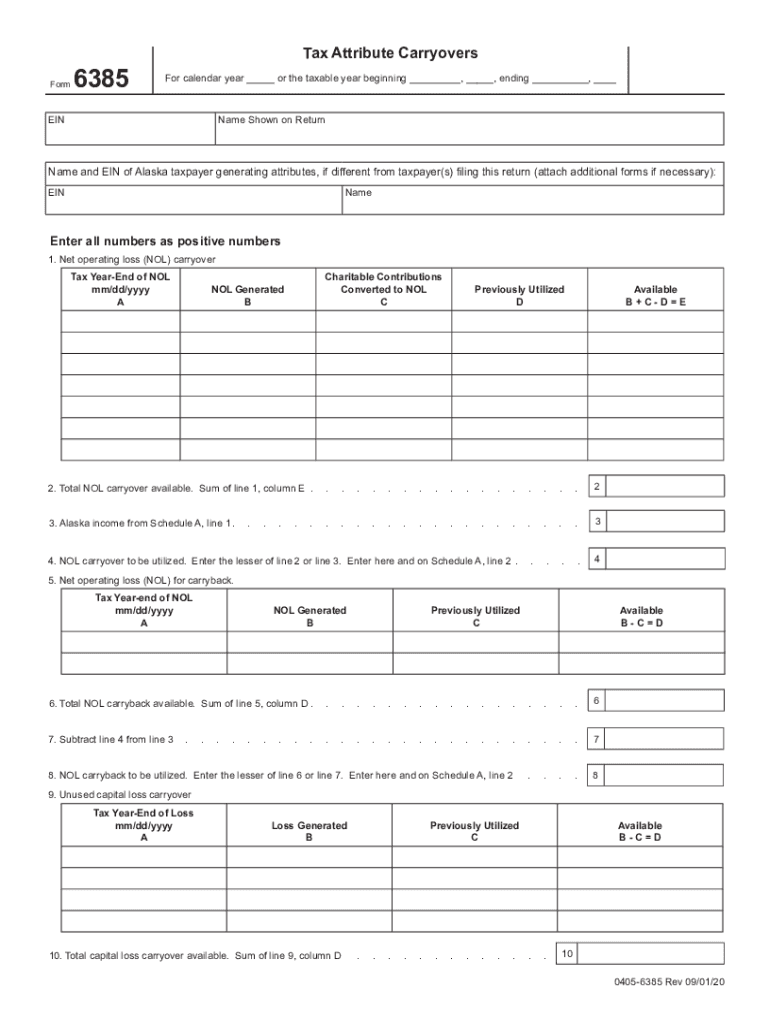

Form6385Tax Attribute Carryovers For calendar year or the taxable year beginning, ending, Innate Shown on Returnable and EIN of Alaska taxpayer generating attributes, if different from taxpayer(s)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ak carryovers - tax

Edit your ak carryovers - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ak carryovers - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ak carryovers - tax online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ak carryovers - tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AK Form 6385 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ak carryovers - tax

How to fill out AK Form 6385

01

Obtain a copy of AK Form 6385 from the appropriate military resources.

02

Fill in the service member's personal information, including name, rank, and unit.

03

Specify the type of request you are making with clear and concise language.

04

Provide a detailed description of the purpose of the request and any relevant circumstances.

05

Attach any necessary supporting documents that reinforce your request.

06

Review the form for accuracy and completeness.

07

Submit the completed form to the appropriate authority for processing.

Who needs AK Form 6385?

01

Active duty military personnel seeking a specific action or event approval.

02

Reservists or National Guard members requiring permission for actions related to their service.

03

Commanding officers making formal requests on behalf of their subordinates.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ak carryovers - tax without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including ak carryovers - tax, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get ak carryovers - tax?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific ak carryovers - tax and other forms. Find the template you need and change it using powerful tools.

How do I make edits in ak carryovers - tax without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing ak carryovers - tax and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is AK Form 6385?

AK Form 6385 is a document used within the Alaska Department of Health to report specific data regarding healthcare and social services.

Who is required to file AK Form 6385?

Organizations and individuals receiving state funding or providing certain health and social services in Alaska are required to file AK Form 6385.

How to fill out AK Form 6385?

To fill out AK Form 6385, you must provide accurate information regarding the services rendered, the beneficiaries served, and any financial data as required by the form's instructions.

What is the purpose of AK Form 6385?

The purpose of AK Form 6385 is to gather essential data for program evaluation, funding justification, and ensuring compliance with state regulations regarding health and social services.

What information must be reported on AK Form 6385?

Information required on AK Form 6385 includes service types provided, number of clients served, funding amounts, outcomes of services, and demographics of the client population.

Fill out your ak carryovers - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ak Carryovers - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.