Get the free VC)

Show details

VC)20rtlflcon T 8ina44RqutredS. We certify under penalties of perjury that we reviewed this report, including all attachments, and to the best of our knowledge and belief, they are true, correct and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vc

Edit your vc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

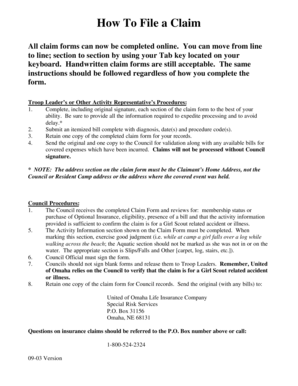

How to edit vc online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit vc. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vc

How to fill out vc

01

To fill out a VC (Venture Capital) application, follow these steps:

02

Gather all the necessary information and documents, such as your business plan, financial statements, and market research.

03

Research and identify potential VCs that align with your industry and business goals.

04

Prepare a well-written executive summary that highlights your business idea, market potential, and unique selling proposition.

05

Complete the VC application form, providing accurate and detailed information about your company, team, financials, and growth projections.

06

Include any supporting documents requested by the VC, such as investor presentations, product demos, or customer testimonials.

07

Review the completed application thoroughly to ensure all information is correct and organized.

08

Submit the application through the designated channel specified by the VC, which may be an online portal or email.

09

Follow up with the VC to confirm receipt of your application and inquire about the next steps in the evaluation process.

10

Be prepared for due diligence, meetings, and potential negotiations with the VC before a final decision is made.

11

If your application is successful, carefully review the terms and conditions of the VC's investment offer before accepting.

Who needs vc?

01

VC funding is typically sought by entrepreneurs and startups who require external capital to finance their business growth and development.

02

Specifically, the following entities may be in need of VC funding:

03

- Early-stage startups with innovative ideas and high growth potential.

04

- Existing businesses looking to expand their operations, enter new markets, or launch new products.

05

- Entrepreneurs who lack sufficient personal savings or traditional financing options to fund their ventures.

06

- Companies operating in industries with high capital requirements, such as technology, biotechnology, and clean energy.

07

- Individuals or teams with limited business experience or networks, who can benefit from the expertise and connections of VC investors.

08

- Businesses aiming to scale rapidly and achieve a significant market share within a short timeframe.

09

Ultimately, anyone with a compelling business concept, a solid plan for growth, and the capacity to attract and leverage VC investment can benefit from VC funding opportunities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get vc?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the vc in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit vc online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your vc and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out the vc form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign vc and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is vc?

VC typically refers to a 'voluntary disclosure' form or process used in various regulatory or compliance contexts, often related to tax filings or financial reporting.

Who is required to file vc?

Individuals or entities that have an obligation to disclose certain financial information, discrepancies, or compliance statuses under specific regulations or agreements are generally required to file VC.

How to fill out vc?

To fill out VC, one must complete the designated form by providing accurate and relevant financial data, signatures, and any other required documentation as per the issuing authority's guidelines.

What is the purpose of vc?

The purpose of VC is to encourage compliance by allowing individuals or entities to voluntarily disclose issues, thereby reducing penalties or legal consequences associated with noncompliance.

What information must be reported on vc?

Information that must be reported on VC typically includes financial details, discrepancies, the nature of the violation, and any corrective actions that have been taken.

Fill out your vc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.