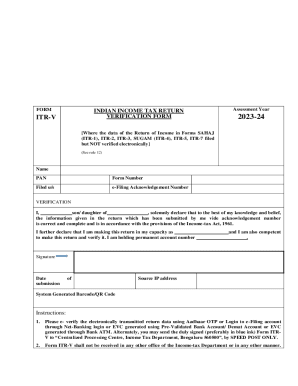

India ITR-V 2020 free printable template

Show details

482THE GAZETTE OF INDIA : EXTRAORDINARY PART II SEC. 3(i) I minute Please enter total of column (7) in 9c of Part BTI VERIFICATION I, son/ daughter of, solemnly declare that to the best of my knowledge

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tax verification document

Edit your tax verification document form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax verification document form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax verification document online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax verification document. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

India ITR-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tax verification document

How to fill out India ITR-V

01

Download the ITR-V form from the official income tax department website.

02

Fill in your personal details such as name, address, PAN, and assessment year.

03

Ensure that all income details are filled accurately, including salaries, business income, and other sources.

04

Verify tax paid and any refunds claimed if applicable.

05

Sign the declaration at the bottom of the form.

06

Convert the signed form into a PDF format.

07

Send the signed ITR-V in a physical format to the designated income tax department address within 120 days of e-filing.

Who needs India ITR-V?

01

Individuals who have e-filed their income tax returns in India but have not submitted their returns in a physical format.

02

Taxpayers who need to verify their electronically filed returns to complete the filing process.

03

Residents of India who earn a total income exceeding the exempt limit and need to report their tax liabilities.

Fill

form

: Try Risk Free

People Also Ask about

What is the password for income tax Acknowledgement PDF?

Password for Opening ITR Acknowledgment Form: The password is unique for every taxpayer. The password is a combination of the taxpayer's PAN number and Date of Birth (DoB). It is obtained by entering the PAN number in the lower case and the birth date in the 'DDMMYYYY' format without any space between the two.

How do I open my income tax acknowledge?

Step 1: Go to the e-Filing portal homepage. Step 2: Click Income Tax Return (ITR) Status. Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue. Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

How can I get my ITR Acknowledgement number?

You can check your acknowledgement number from your ITR-V received on your registered email after e-Filing your return.

How can I download ITR without login?

Step 1: A taxpayer has to visit the e-filing portal of the income tax department. The feature 'e-Verify Return' can be accessed on the home page of the portal under 'Our Services'. Step 2: Enter your PAN, select the relevant Assessment Year, enter Acknowledgment Number of the ITR filed and Mobile Number and Continue.

How can download my ITR Acknowledgement online?

Step 1: Go to the e-Filing portal homepage. Step 2: Click Income Tax Return (ITR) Status. Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue. Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

How do I get an e-filing Acknowledgement?

How to get the acknowledgement number or download ITR-V of Income-tax Return filed? Step 1: Sign in to the Income-tax Department website. Step 2 : Click on View Filed returns under e-File tab. Step 3: You will get the acknowledgement number under the relevant AY and also the option to download an ITR-V copy (receipt).

How can I know my ITR Acknowledgement?

You can check your acknowledgement number from your ITR-V received on your registered email after e-Filing your return.

How can I check my ITR Acknowledgement online?

Step 1: Go to the e-Filing portal homepage. Step 2: Click Income Tax Return (ITR) Status. Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue. Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

How do I download an e-filing Acknowledgement?

Below is a step by step process to download ITR acknowledgement: log in to the Income-tax portal. Click here : Click on View Filed returns under the e-file tab : e-File >> Income Tax Returns >> View Filed Returns. Click on Download Receipt : Your acknowledgement will be downloaded : That's it. You are done.

How to generate acknowledgement for ITR?

Step 1: Go to the e-Filing portal homepage. Step 2: Click Income Tax Return (ITR) Status. Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue. Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

Is there Acknowledgement of filing the return of income?

ITR – V is the acknowledgement of filing the return of income.

How can I get my ITR Acknowledgement online?

Step 1: Go to the e-Filing portal homepage. Step 2: Click Income Tax Return (ITR) Status. Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue. Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax verification document from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your tax verification document into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit tax verification document online?

With pdfFiller, the editing process is straightforward. Open your tax verification document in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my tax verification document in Gmail?

Create your eSignature using pdfFiller and then eSign your tax verification document immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is India ITR-V?

India ITR-V is an Income Tax Return Verification form that taxpayers in India need to submit after e-filing their income tax returns. It serves as an acknowledgment of the submitted income tax return.

Who is required to file India ITR-V?

All taxpayers who file their income tax returns online are required to submit ITR-V. This includes individuals, Hindu Undivided Families (HUFs), and entities whose total income exceeds the exemption limit.

How to fill out India ITR-V?

To fill out ITR-V, taxpayers need to download the form from the Income Tax Department's website, print it out, sign it, and send it to the Centralized Processing Centre (CPC) of the Income Tax Department within 120 days of e-filing.

What is the purpose of India ITR-V?

The purpose of ITR-V is to verify the authenticity of e-filed income tax returns and to serve as an acknowledgment that the taxpayer has submitted their return for the assessment year.

What information must be reported on India ITR-V?

ITR-V must include the taxpayer's name, PAN, acknowledgment number, e-filing date, and a signed declaration confirming the accuracy of the information provided in the income tax return.

Fill out your tax verification document online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Verification Document is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.