CA Schedule 1067A 2019 free printable template

Show details

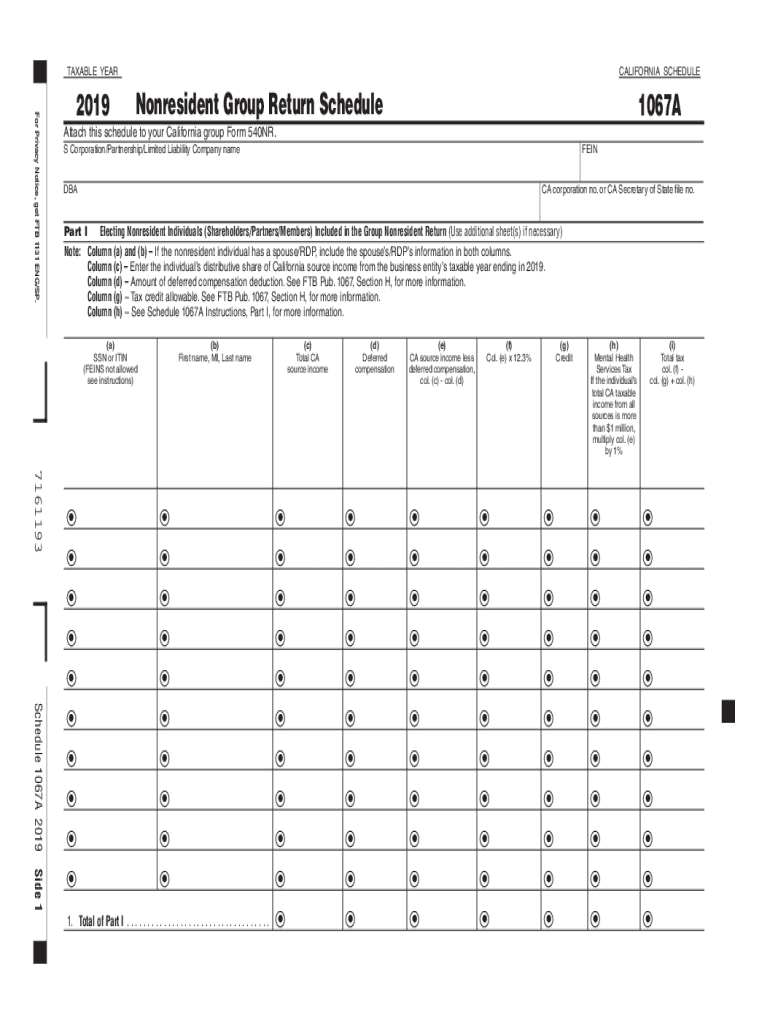

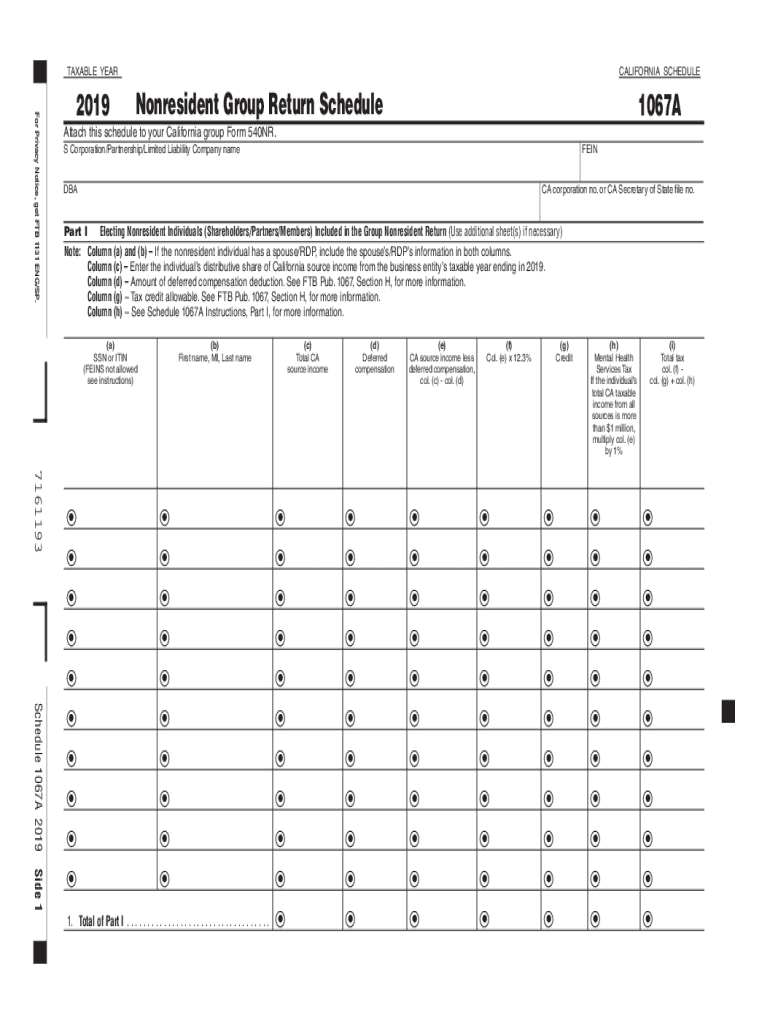

TAXABLE Year Privacy Notice, get FT 1131 ENG/SP.2019CALIFORNIA SCHEDULENonresident Group Return Schedule1067AAttach this schedule to your California group Form 540NR. S Corporation/Partnership/Limited

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Schedule 1067A

Edit your CA Schedule 1067A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Schedule 1067A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA Schedule 1067A online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA Schedule 1067A. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Schedule 1067A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA Schedule 1067A

How to fill out CA Schedule 1067A

01

Gather all necessary financial documents and information related to your California income tax.

02

Download or obtain a copy of CA Schedule 1067A from the California Franchise Tax Board website.

03

Fill in your name, address, and Social Security number (or taxpayer identification number) at the top of the form.

04

Report your total income by entering the amounts from your federal tax return, including wages, dividends, interest, and business income.

05

Deduct any applicable adjustments to income as specified in the instructions for Schedule 1067A.

06

Calculate your California adjusted gross income by subtracting adjustments from your total income.

07

Complete the sections for credits and other tax calculations as required.

08

Review all entries for accuracy and completeness before submitting the form.

09

Sign and date the form, and keep a copy for your records.

Who needs CA Schedule 1067A?

01

California taxpayers who earn income from California sources.

02

Individuals who are required to file a California income tax return but do not meet the requirements for the short form.

03

Taxpayers claiming specific deductions or credits that necessitate additional reporting on CA Schedule 1067A.

Fill

form

: Try Risk Free

People Also Ask about

What is form 109 FTB CA?

Generally, Form 109 is due on or before the 15th day of the 5th month following the close of the taxable year. An employees' trust defined in IRC Section 401(a) an IRA, or a Coverdell ESA must file Form 109 by the 15th day of the 4th month after the end of the taxable year.

What is an FTB 540 form?

A Purpose. Use Form 540-ES, Estimated Tax for Individuals, and the 2021 CA Estimated Tax Worksheet, to determine if you owe estimated tax for 2021 and to figure the required amounts. Estimated tax is the tax you expect to owe in 2021 after subtracting the credits you plan to take and tax you expect to have withheld.

What is CA FTB form 100?

Form 100, California Corporation Franchise or Income Tax Return.

Who must file form 540?

If you have a tax liability for 2022 or owe any of the following taxes for 2022, you must file Form 540. Tax on a lump-sum distribution. Tax on a qualified retirement plan including an Individual Retirement Arrangement (IRA) or an Archer Medical Savings Account (MSA).

Do I file 540 or 540ez?

Form 540 is used by California residents to file their state income tax every April. This form should be completed after filing your federal taxes, such as Form 1040, Form 1040A, or Form 1040EZ, because information from your federal taxes will be used to help fill out Form 540.

What is CA 540 tax penalty?

If your tax return shows a balance due of $540 or less, the penalty is either: $135. 100% of the amount due.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in CA Schedule 1067A?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your CA Schedule 1067A to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit CA Schedule 1067A on an iOS device?

Create, edit, and share CA Schedule 1067A from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How can I fill out CA Schedule 1067A on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your CA Schedule 1067A. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is CA Schedule 1067A?

CA Schedule 1067A is a California tax form used by certain partnerships to report income from the sale of unrealized appreciation or depreciation on assets.

Who is required to file CA Schedule 1067A?

Partnerships that have any income from the sale of unrealized appreciation or depreciation on assets are required to file CA Schedule 1067A.

How to fill out CA Schedule 1067A?

To fill out CA Schedule 1067A, partnerships must provide detailed information regarding the income from asset sales, including the type of assets, acquisition details, and sale proceeds.

What is the purpose of CA Schedule 1067A?

The purpose of CA Schedule 1067A is to ensure that the state of California accurately captures and assesses tax on income derived from the sale of assets within partnerships.

What information must be reported on CA Schedule 1067A?

CA Schedule 1067A must report information such as the types of assets sold, the amount of unrealized gain or loss, sale date, and details of the partnership's overall income from these transactions.

Fill out your CA Schedule 1067A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Schedule 1067a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.