CA CALSTRS ES 1161 2010 free printable template

Show details

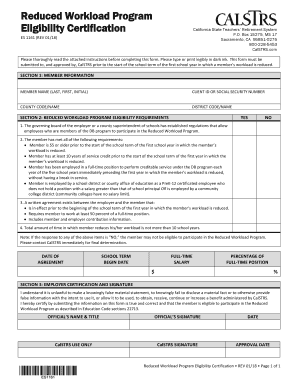

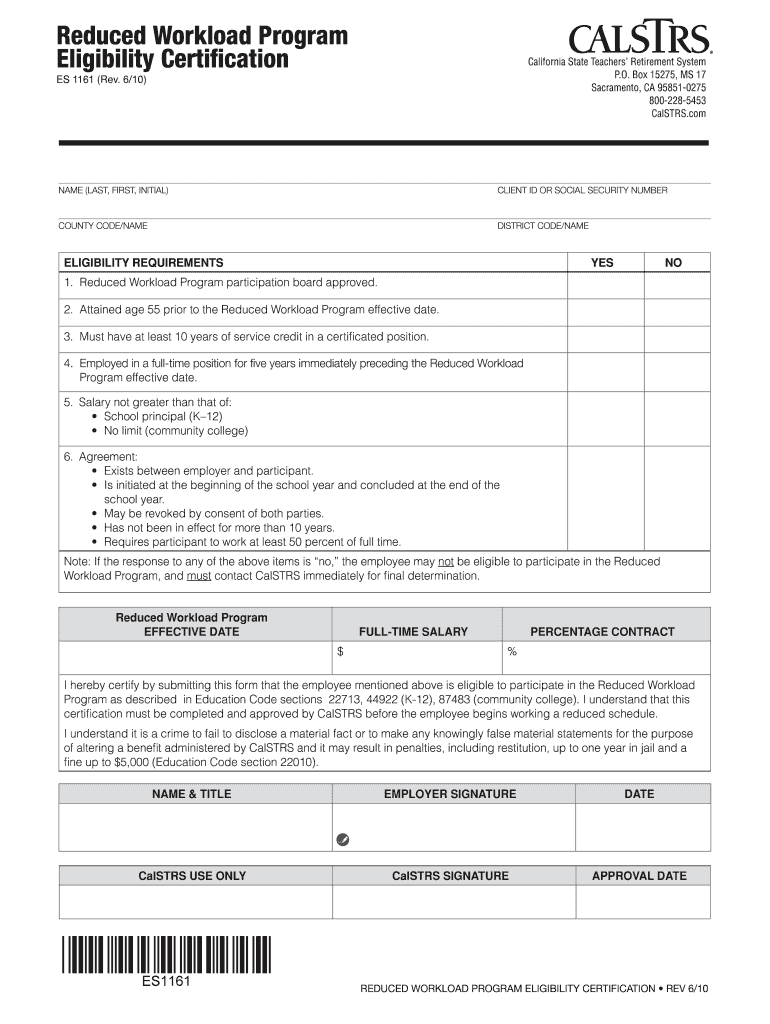

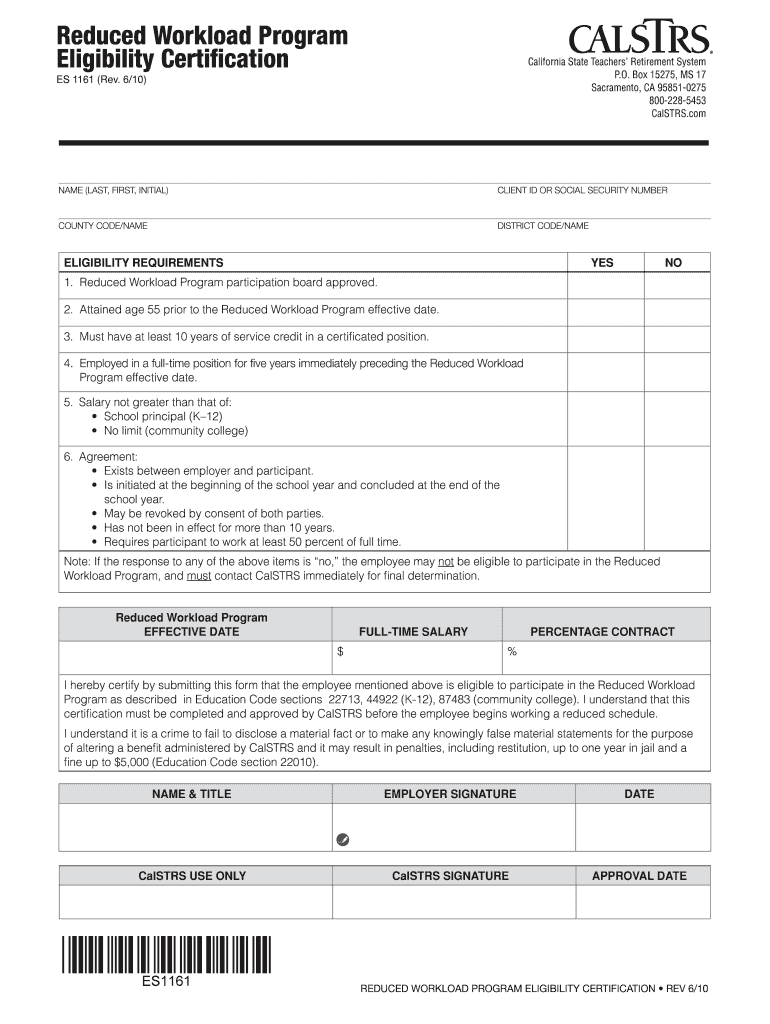

O. Box 15275 MS 17 Sacramento CA 95851-0275 800-228-5453 CalSTRS.com ES 1161 Rev. 6/10 white NAME last first initial client id or social security number county code/name district code/name ELIGIBILITY REQUIREMENTS YES NO 2. Member and Employer must make contributions to the system as if he or she were working full-time. CalSTRS Approval is Required Prior to Participation CalSTRS must receive and approve the Reduced Workload Program Eligibility Certification Application ES-1161 prior to the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CALSTRS ES 1161

Edit your CA CALSTRS ES 1161 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CALSTRS ES 1161 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA CALSTRS ES 1161 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CA CALSTRS ES 1161. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CALSTRS ES 1161 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CALSTRS ES 1161

How to fill out CA CALSTRS ES 1161

01

Visit the CALSTRS website to download the CA CALSTRS ES 1161 form.

02

Read the instructions provided on the form carefully.

03

Fill in your personal information in the designated fields, including name, address, and identification numbers.

04

Complete the employment details section with your job title and employer information.

05

Indicate the type of benefits or services you are applying for.

06

Review the form for accuracy and completeness before submission.

07

Sign and date the form at the bottom as required.

08

Submit the completed form via mail or electronically, based on the submission guidelines provided.

Who needs CA CALSTRS ES 1161?

01

Individuals who are applying for a retirement benefit with CALSTRS.

02

Former employees of California's public schools or state educational institutions seeking service retirement.

03

Beneficiaries of deceased members who need to claim benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is CalSTRS cash balance benefit program?

The Cash Balance Benefit Program is a hybrid retirement program that can be an alternative to the CalSTRS Defined Benefit Program, Social Security and other retirement plans. It accumulates funds based on dollars contributed by the employee and the employer plus interest, similar to a defined contribution program.

How long does it take to become vested in Texas teacher retirement?

You are vested after five years of service with a right to a retirement benefit. There are also disability and death and survivor benefits available to TRS members.

How many years does it take to be vested in CalSTRS?

You must earn one year of service credit since your last refund and have at least five years of service credit before being eligible for CalSTRS retirement benefits.

Does CalSTRS adjust for inflation?

Under California state law, you'll receive an automatic benefit increase equal to 2% of your initial benefit beginning September 1 after the first anniversary of your retirement. Your retirement date must be before September 1 to receive the annual benefit adjustment on September 1 of the next year.

What is the vesting period for CalSTRS?

Who Qualifies for a Teacher Pension in California? Like most states, teachers need to serve a number of years before qualifying for a pension. California has a 5 year vesting period. While educators qualify for a pension after 5 years of service, the pension may not be worth all that much.

What is the difference between CalSTRS and CalPERS?

What are CalSTRS and CalPERS? The California State Teachers' Retirement System (CalSTRS) and the California Public Employees' Retirement System (CalPERS) manage pensions for California public school educators and other public employees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA CALSTRS ES 1161 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign CA CALSTRS ES 1161 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete CA CALSTRS ES 1161 online?

Filling out and eSigning CA CALSTRS ES 1161 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my CA CALSTRS ES 1161 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your CA CALSTRS ES 1161 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is CA CALSTRS ES 1161?

CA CALSTRS ES 1161 is a form used by California educators to report compensation and contributions to the California State Teachers' Retirement System (CALSTRS).

Who is required to file CA CALSTRS ES 1161?

Employers of California educators who participate in CALSTRS are required to file CA CALSTRS ES 1161.

How to fill out CA CALSTRS ES 1161?

To fill out CA CALSTRS ES 1161, employers need to provide information such as employee details, reportable compensation amounts, and contributions made to CALSTRS.

What is the purpose of CA CALSTRS ES 1161?

The purpose of CA CALSTRS ES 1161 is to ensure accurate reporting of earnings and contributions for CALSTRS members to facilitate appropriate retirement benefits.

What information must be reported on CA CALSTRS ES 1161?

Information that must be reported on CA CALSTRS ES 1161 includes the employee's name, Social Security number, job classification, reportable compensation, and employer contributions.

Fill out your CA CALSTRS ES 1161 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CALSTRS ES 1161 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.