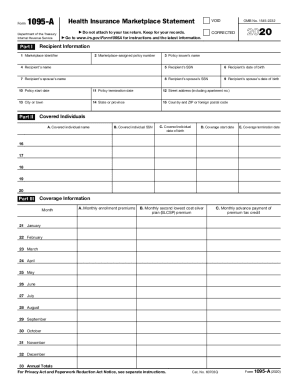

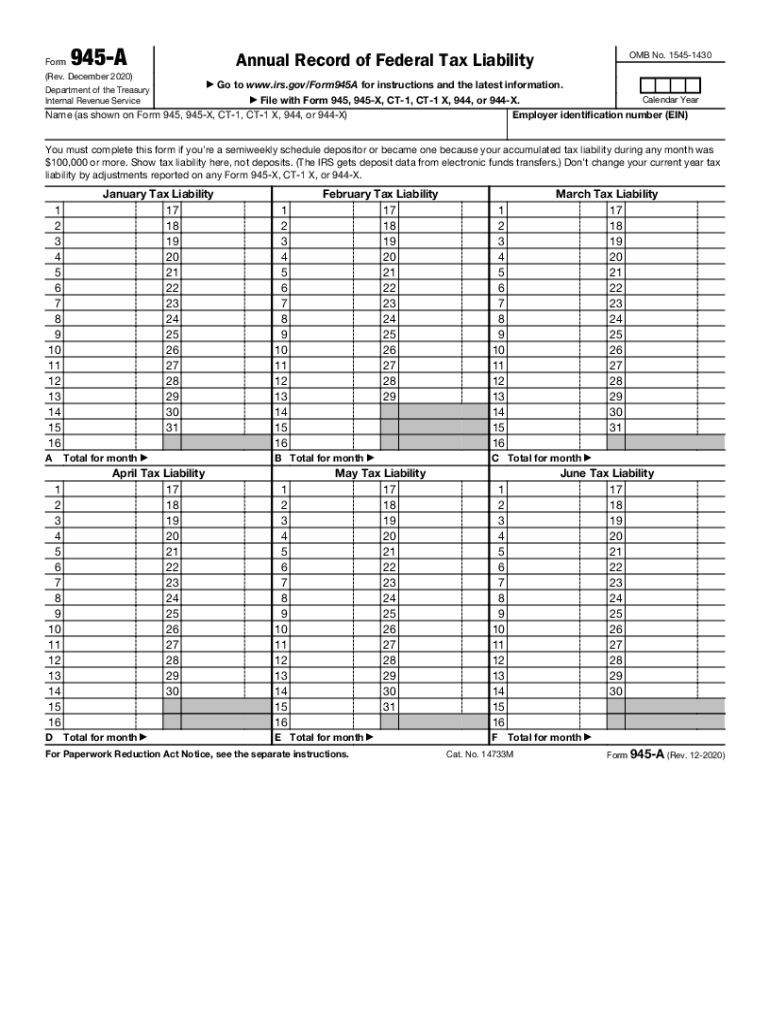

IRS 945-A 2020 free printable template

Instructions and Help about IRS 945-A

How to edit IRS 945-A

How to fill out IRS 945-A

About IRS 945-A 2020 previous version

What is IRS 945-A?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 945-A

What should I do if I realize I made a mistake on my IRS 945-A after submission?

If you spot an error after filing your IRS 945-A, you can correct it by submitting an amended form. This ensures that all reported information aligns correctly with IRS expectations. It's advisable to keep a copy of both the original and the amended submission for your records.

How can I verify the status of my filed IRS 945-A?

To check the status of your IRS 945-A, you can use the IRS's online tools or contact customer service for assistance. Be prepared with your details to help speed up the verification process. Tracking your filing will ensure it has been received and is being processed appropriately.

Are there specific privacy measures I should consider while submitting my IRS 945-A?

Yes, when filing your IRS 945-A, it's essential to consider data security protocols. Ensure you are using secure methods for submission, especially when providing sensitive information. Additionally, keep documentation stored in a secure location to protect against unauthorized access.

How can I address common errors I might encounter while filing the IRS 945-A?

To prevent common filing errors on your IRS 945-A, double-check all entries for accuracy and ensure you follow the guidelines provided by the IRS. Utilizing tax software can also help mitigate errors, as they often include prompts to correct common mistakes.

What should I do if I receive an audit notice regarding my IRS 945-A?

In the event you receive an audit notice for your IRS 945-A, it's crucial to respond promptly. Review the notice for specific issues raised, gather all relevant documentation, and possibly consult with a tax professional for guidance on how to effectively address the audit.

See what our users say