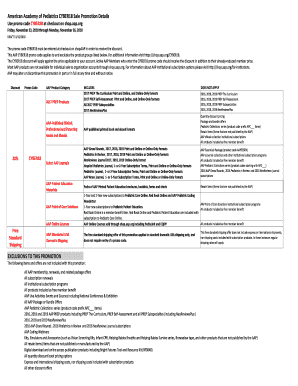

Get the free Financial and Accounting Forms - northwestern

Show details

Este documento proporciona información sobre cómo ingresar transacciones financieras y contables en el entorno de NUFinancials a través de formularios en línea. Incluye una lista de formularios

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial and accounting forms

Edit your financial and accounting forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial and accounting forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial and accounting forms online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit financial and accounting forms. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial and accounting forms

How to fill out Financial and Accounting Forms

01

Gather all necessary financial documents related to your business or personal finances.

02

Identify the specific financial and accounting forms you need to complete (e.g., income statements, balance sheets, tax forms).

03

Carefully read the instructions provided with each form to understand the requirements.

04

Fill in the form starting with basic information such as your name, address, and identification number.

05

Input financial figures accurately, ensuring all calculations are correct.

06

Attach any required supporting documents as outlined in the form instructions.

07

Review the completed form for any errors or omissions.

08

Sign and date the form where necessary.

09

Submit the form to the appropriate organization, ensuring to keep copies for your records.

Who needs Financial and Accounting Forms?

01

Business owners who need to track their finances for operational and regulatory purposes.

02

Individuals filing personal taxes or seeking financial assistance.

03

Accountants and financial analysts who prepare financial statements for various stakeholders.

04

Government agencies requiring financial declarations from businesses.

05

Non-profit organizations needing to maintain transparency in their financial reporting.

Fill

form

: Try Risk Free

People Also Ask about

What are the 10 types of financial records?

Balance Sheet. This report summarizes the following: Income Statement (Profit and Loss Statement) Cash Flow Statement. Bank Reconciliation Report. Aged Debtors Report. Aged Creditors Report. Report on Financial Ratios. Collection Report.

What forms are used in financial accounting?

The 10 essential accounting forms for small businesses in 2023 Profit and loss. The success of your business relies heavily on money going in vs money going out of your accounts. Balance sheet. Accounts receivable report. Cash fow statement. Business plan. Purchase approval form. Daily inventory form. Credit card payment form.

What are the main financial records?

There are four primary types of financial statements: Balance sheets. Income statements. Cash flow statements. Statements of shareholders' equity.

What is financial accounting in English?

Financial Accounting is the process of recording, summarizing and reporting transactions and revenue-expense generations in a time period. For example, investors or sponsors need to verify an account statement before showing interest in associating with the business.

What are the list of financial records?

Financial records general account books – including general journal and general and subsidiary ledgers. cash book records – including receipts and payments. banking records – including bank and credit card statements, deposit books, cheque butts and bank reconciliations.

What are 5 examples of financial documents?

The usual order of financial statements is as follows: Income statement. Cash flow statement. Statement of changes in equity. Balance sheet. Note to financial statements.

What are the different types of financial records?

The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. These three statements together show the assets and liabilities of a business, revenues, and costs, as well as its cash flows from operating, investing, and financing activities.

What are the 5 basic financial statements?

The usual order of financial statements is as follows: Income statement. Cash flow statement. Statement of changes in equity. Balance sheet. Note to financial statements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial and Accounting Forms?

Financial and Accounting Forms are standardized documents used to report financial information and accounting data of an individual or entity. These forms are essential for organizing, summarizing, and reporting financial transactions.

Who is required to file Financial and Accounting Forms?

Typically, businesses, corporations, and individuals who are required to report their financial status, income, expenses, and comply with regulatory requirements must file Financial and Accounting Forms. This includes tax filings for individuals, corporations, and nonprofits.

How to fill out Financial and Accounting Forms?

To fill out Financial and Accounting Forms, one should gather all necessary financial documents, carefully read the instructions provided with the forms, accurately input the requested financial data, and ensure all calculations are correct before submitting them by the specified deadline.

What is the purpose of Financial and Accounting Forms?

The purpose of Financial and Accounting Forms is to provide a standardized method for reporting financial information to tax authorities, investors, and regulatory agencies. They help ensure transparency, compliance, and proper record-keeping.

What information must be reported on Financial and Accounting Forms?

The information that must be reported on Financial and Accounting Forms typically includes income earned, expenses incurred, assets owned, liabilities owed, and any other relevant financial data necessary to present a complete picture of the financial position of the filer.

Fill out your financial and accounting forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial And Accounting Forms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.