Get the free Refi u rn of Clrga

Show details

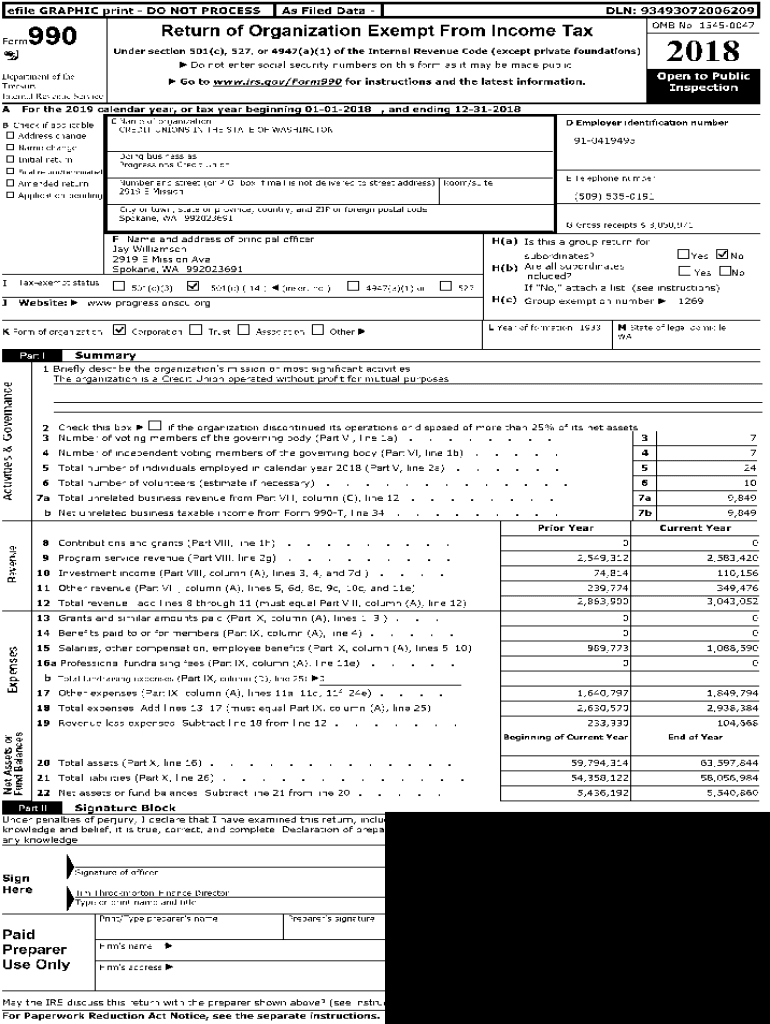

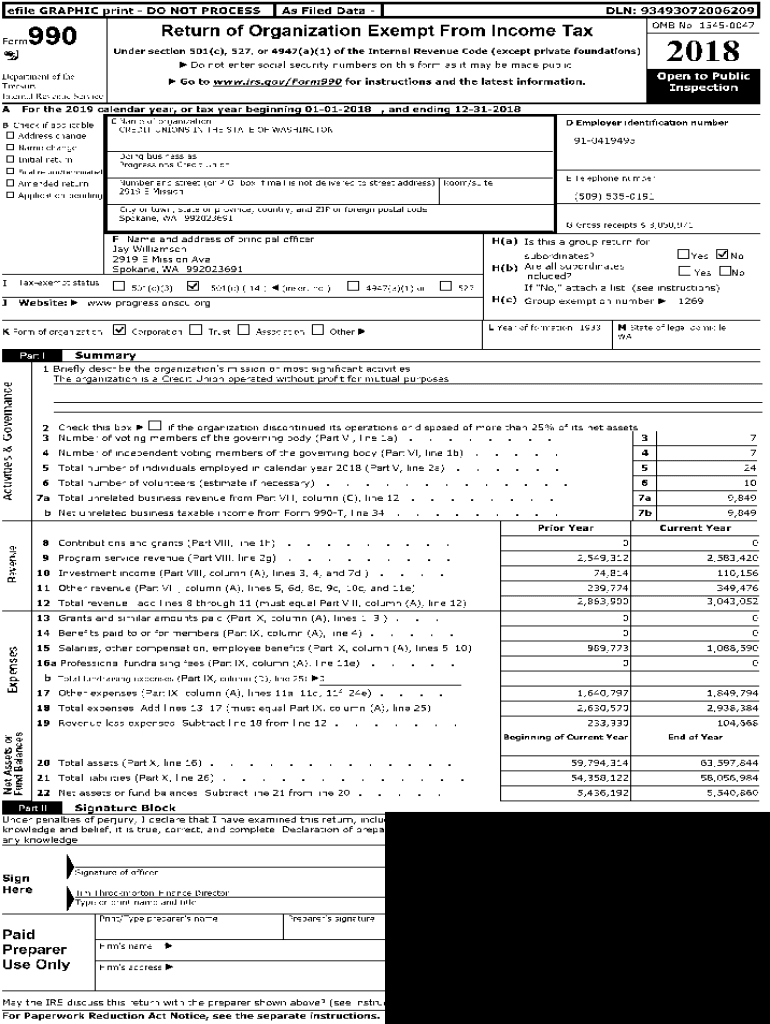

Defile GRAPHIC Forming DO NOT PROCESS As Filed Data IDLE: 93493072006209 OMB No 15450047Re phi urn of C LGA NI ZA tin n Exempt From INR n m e T ax990Under section 501(c), 527,2018r 4947 (a)(1) of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign refi u rn of

Edit your refi u rn of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your refi u rn of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit refi u rn of online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit refi u rn of. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out refi u rn of

How to fill out refi u rn of

01

Gather all the necessary financial documents, such as income statements, tax returns, and bank statements.

02

Research different refinance options and lenders to find the best fit for your needs.

03

Fill out the refinance application form accurately and completely, providing all required information.

04

Attach any supporting documents requested by the lender, ensuring they are legible and current.

05

Review the application thoroughly before submitting to avoid any errors or missing information.

06

Submit the completed application and supporting documents to the lender either online or in person.

07

Follow up with the lender to ensure the application is being processed and inquire about any additional information needed.

08

Wait for the lender's decision on your refinance application and proceed accordingly based on the outcome.

09

If approved, carefully review the terms and conditions of the new loan before accepting and signing the agreement.

10

Keep track of ongoing mortgage payments and communicate with the lender as needed during the refinance process.

Who needs refi u rn of?

01

Anyone who has an existing mortgage and wants to take advantage of lower interest rates.

02

Homeowners looking to reduce their monthly mortgage payments.

03

Individuals wanting to consolidate debt by refinancing their mortgage.

04

Borrowers who wish to change the terms of their current mortgage, such as switching from an adjustable-rate to a fixed-rate loan.

05

People in need of extra funds for major expenses, such as home renovations or education costs.

06

Those who want to shorten the loan term and pay off their mortgage faster.

07

Homeowners who want to switch from a government-insured mortgage to a conventional loan.

08

Individuals who want to remove a co-borrower from their mortgage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my refi u rn of in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your refi u rn of and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find refi u rn of?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the refi u rn of in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit refi u rn of on an iOS device?

You certainly can. You can quickly edit, distribute, and sign refi u rn of on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is refi u rn of?

Refi u rn of refers to a specific type of tax return form that must be filed by certain taxpayers to report their income, deductions, and credits to the tax authorities.

Who is required to file refi u rn of?

Individuals or entities that meet specific income thresholds or other criteria set by tax authorities are required to file refi u rn of.

How to fill out refi u rn of?

To fill out refi u rn of, taxpayers should gather necessary financial documents, follow the instructions provided with the form, enter their income and deductions accurately, and review for completeness before submission.

What is the purpose of refi u rn of?

The purpose of refi u rn of is to provide the tax authorities with a comprehensive overview of a taxpayer's financial status, allowing for proper assessment of taxes owed or refunds due.

What information must be reported on refi u rn of?

Information that must be reported on refi u rn of includes total income, adjustments to income, tax deductions, tax credits, and any payments made towards tax liabilities.

Fill out your refi u rn of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Refi U Rn Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.