Get the free Am That

Show details

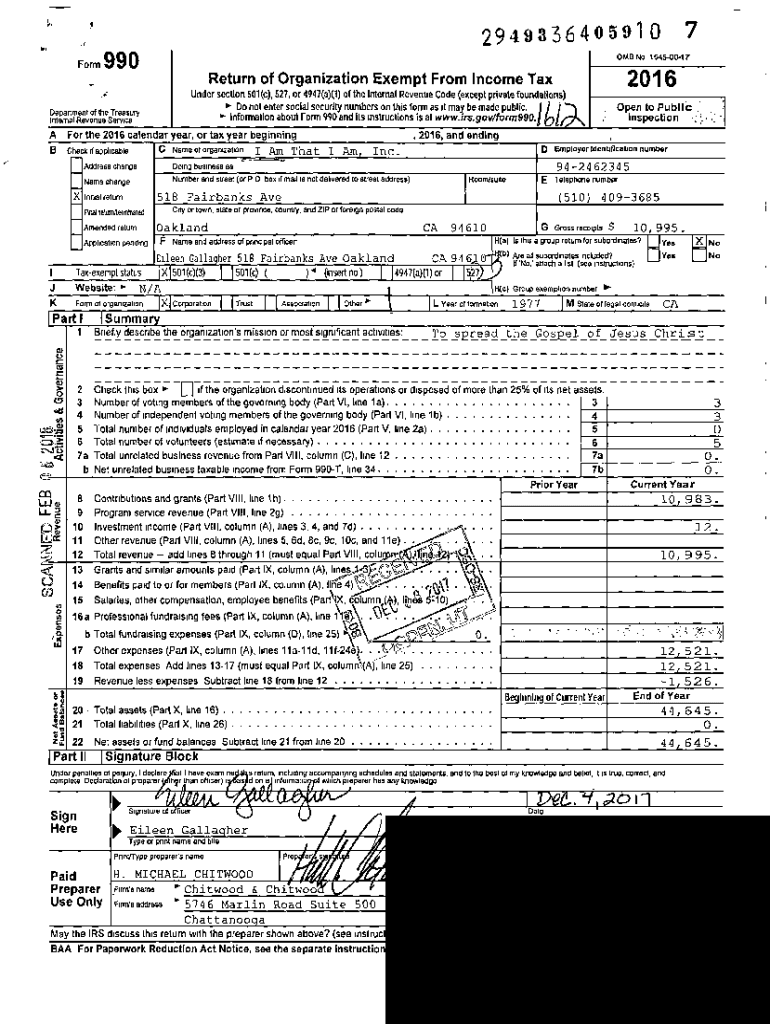

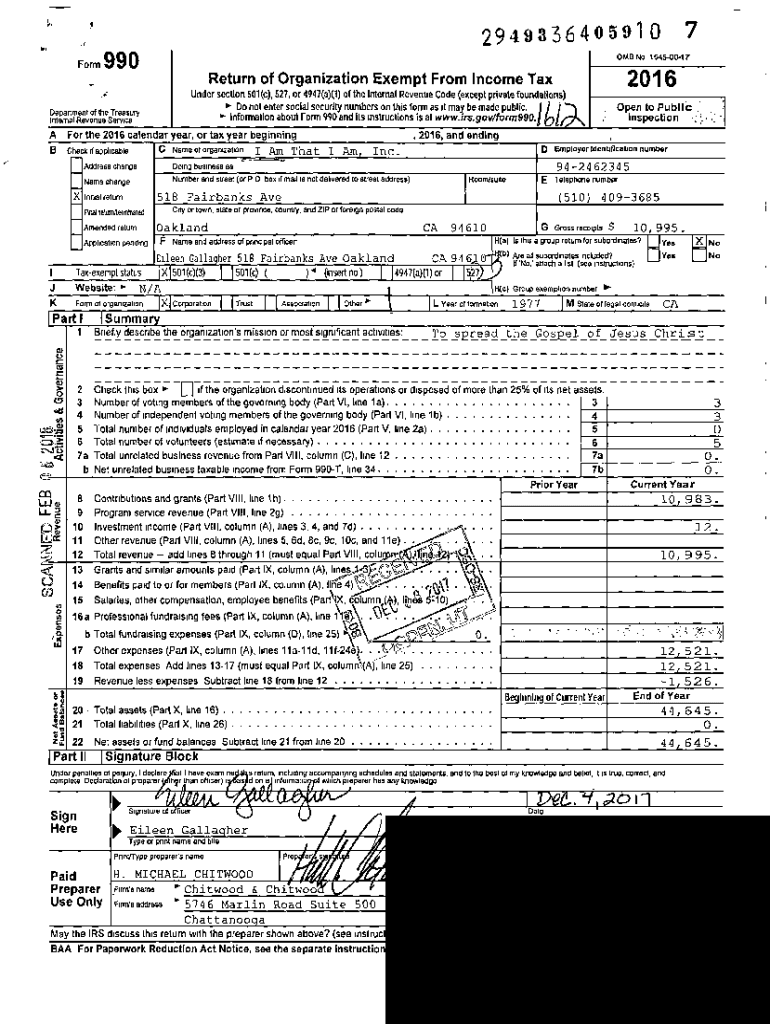

1 '72949336405910OMB No 15450047Form 990Department of the Treasury Internal Revenue ServiceReturn of Organization Exempt From Income Tax2016Under section 501(c), 527, or 4947 (a)(1) of the Internal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign am that

Edit your am that form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your am that form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit am that online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit am that. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out am that

How to fill out am that

01

To fill out an AM (Accomplishment Memorandum), follow these steps:

02

Start by providing your personal information at the top of the form, such as your name, position, and contact details.

03

Write down the date when the accomplishment occurred.

04

Begin by summarizing the accomplishment in a concise and clear manner. Be specific about what was achieved and how it contributed to the organization's goals.

05

Use bullet points or numbered lists to break down the key points of the accomplishment. Include relevant details, such as metrics, data, or specific tasks performed.

06

Explain any challenges or obstacles faced during the accomplishment and how they were overcome.

07

Discuss any collaboration or teamwork involved in achieving the accomplishment. Acknowledge the contributions of colleagues or team members.

08

Conclude the AM by highlighting the impact or benefits of the accomplishment on the organization, clients, or stakeholders.

09

Proofread the document for grammar and spelling errors before submitting it.

10

Submit the filled-out AM to the appropriate supervisor or department for review and approval.

Who needs am that?

01

AMs are typically needed by professionals and employees in organizations who want to document and highlight their achievements and contributions.

02

Some individuals who may need AMs include:

03

- Employees seeking recognition or promotion

04

- Managers evaluating their team members' performance

05

- Project managers reporting accomplishments to stakeholders

06

- Job applicants showcasing their accomplishments during interviews

07

- Professionals maintaining a record of their achievements for future reference

08

AMs serve as a valuable tool for self-reflection, performance evaluation, and career development.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the am that in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your am that in minutes.

Can I create an electronic signature for signing my am that in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your am that and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit am that on an iOS device?

Use the pdfFiller mobile app to create, edit, and share am that from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is am that?

AM that refers to a specific form or document required by the IRS for a particular tax purpose. The exact definition would depend on the context.

Who is required to file am that?

Typically individuals or entities that meet certain criteria set by the IRS, such as income thresholds or specific circumstances related to deductions or credits.

How to fill out am that?

To fill out AM that, follow the instructions provided by the IRS, which usually include entering personal information, income figures, and relevant financial data.

What is the purpose of am that?

The purpose of AM that is to report specific financial information to the IRS, ensuring compliance with tax regulations and accurate calculation of tax obligations.

What information must be reported on am that?

Information such as income amounts, deductions, credits, and other relevant financial details required for tax reporting.

Fill out your am that online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Am That is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.