Get the free ORB Relief Trust

Show details

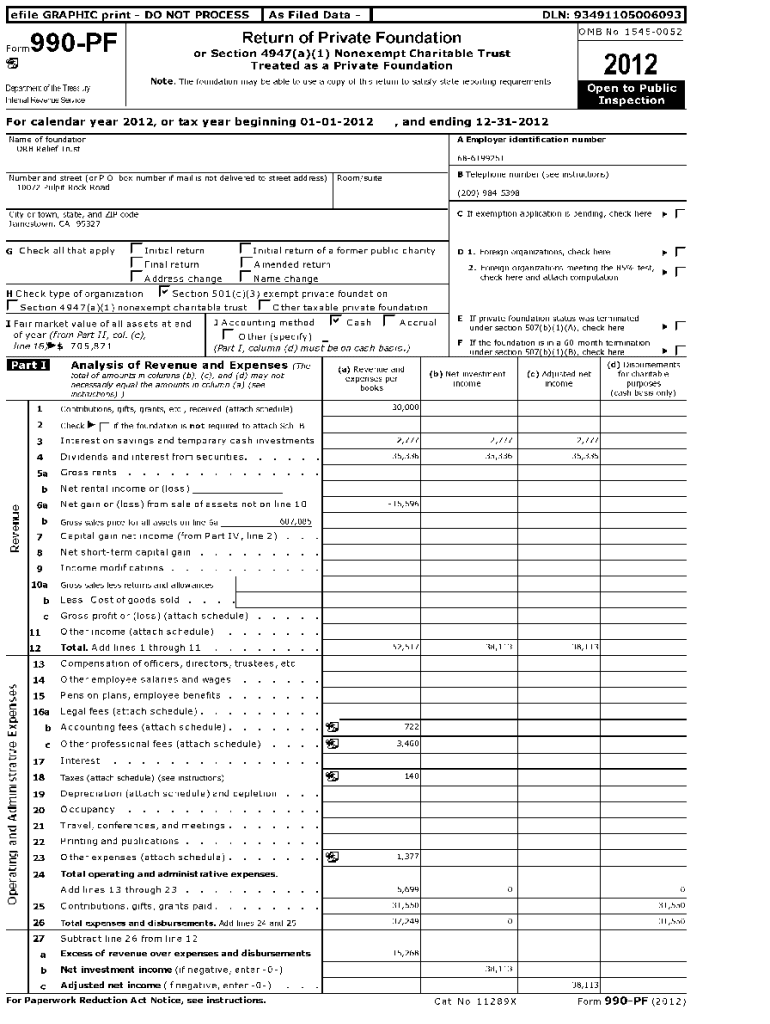

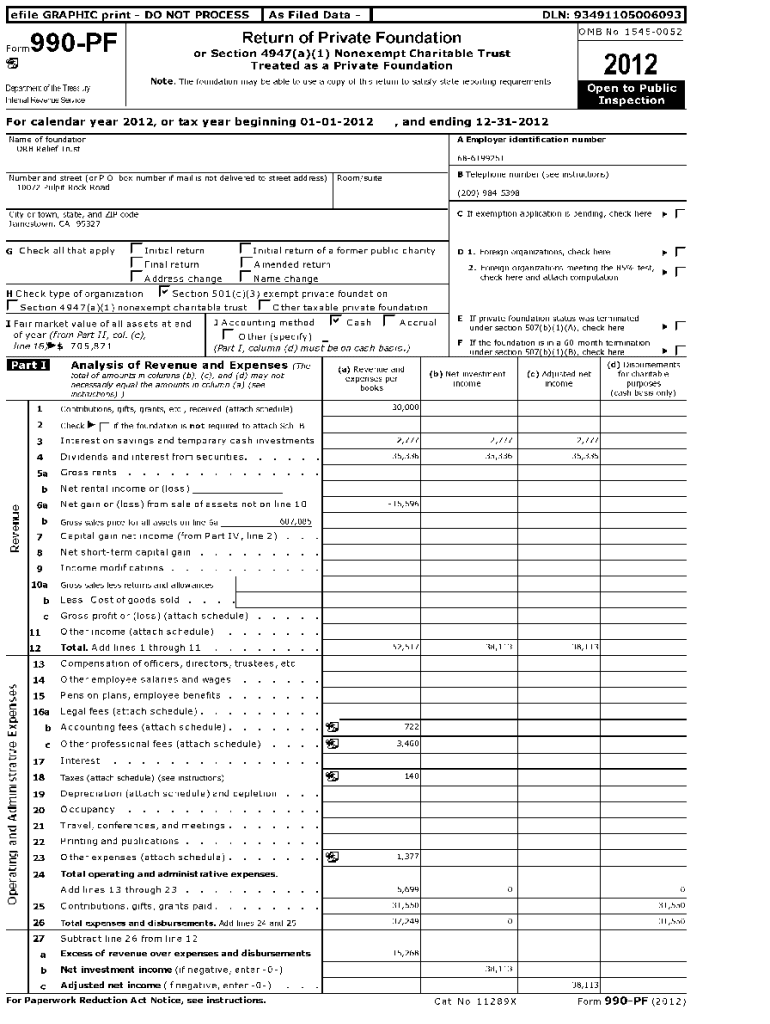

Le file GRAPHIC print DO NOT Processors Filed Data DAN: 93491105006093 OMB No 15450052Return of Private Foundation990 For Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation2012Note.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign orb relief trust

Edit your orb relief trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your orb relief trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit orb relief trust online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit orb relief trust. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out orb relief trust

How to fill out orb relief trust

01

To fill out the Orb Relief Trust, follow these steps:

02

Begin by obtaining the necessary documents and forms for the trust. These can usually be found online or obtained from a lawyer specializing in trust creation.

03

Gather all relevant information and documentation, such as the full names and contact details of the beneficiaries, trustees, and settlors involved in the trust.

04

Carefully read and understand the instructions provided with the trust document or form. Pay attention to any specific requirements or provisions that need to be included in the trust.

05

Start filling out the trust document or form, ensuring that all fields and sections are completed accurately and comprehensively. Provide all necessary information, such as addresses, dates of birth, and social security numbers, where applicable.

06

Review the completed trust document or form for any errors or omissions. Make any necessary corrections before finalizing the document.

07

If required, have the trust document notarized or witnessed by the appropriate authorities. This step may vary depending on local laws and regulations.

08

Retain a copy of the filled-out and finalized trust document for your records. It is advisable to keep multiple copies in secure locations.

09

Follow any additional steps or instructions provided with the trust document, such as filing it with the relevant government agency or recording it with the appropriate office.

10

Consult with a legal professional or financial advisor to ensure the trust has been filled out correctly and meets your intended goals and objectives.

11

Note: The process of filling out the Orb Relief Trust may vary depending on your jurisdiction and individual circumstances. It is always advisable to seek professional advice when dealing with legal matters.

Who needs orb relief trust?

01

The Orb Relief Trust is typically beneficial for individuals or families who wish to protect and manage their assets for future generations or specific beneficiaries. It can be especially valuable in the following situations:

02

- High net worth individuals who want to ensure smooth and efficient transfer of wealth to their heirs or beneficiaries

03

- Individuals with complex financial assets or business interests who want to plan for the long-term preservation and distribution of those assets

04

- Parents or grandparents who want to provide for the financial security and well-being of their children or grandchildren

05

- Individuals who want to minimize or avoid estate taxes, probate proceedings, or public disclosure of their assets and distributions

06

- People with charitable intentions who wish to establish a philanthropic legacy

07

Ultimately, anyone who wants to have control over the distribution and management of their assets, while reducing potential legal complexities and maximizing benefits for their chosen beneficiaries, may find the Orb Relief Trust to be a suitable option.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send orb relief trust to be eSigned by others?

When your orb relief trust is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete orb relief trust on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your orb relief trust by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I complete orb relief trust on an Android device?

Complete your orb relief trust and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is orb relief trust?

An Orb Relief Trust is a financial mechanism designed to provide benefits to beneficiaries during the administration of an estate or trust, often used to manage the distribution of assets in a tax-efficient manner.

Who is required to file orb relief trust?

Individuals or entities that manage a trust or estate that falls under specific regulatory requirements are typically required to file an Orb Relief Trust.

How to fill out orb relief trust?

To fill out an Orb Relief Trust, obtain the necessary forms from your local tax authority, complete them with accurate financial information, detail the assets and beneficiaries, and ensure all required signatures are included.

What is the purpose of orb relief trust?

The purpose of the Orb Relief Trust is to provide financial support and relief to beneficiaries while complying with estate and tax regulations, ultimately aiding in the smooth distribution of assets.

What information must be reported on orb relief trust?

Information that must be reported includes details about the trust's assets, income, beneficiaries, and any distributions made during the reporting period.

Fill out your orb relief trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Orb Relief Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.