Get the free PHILLIPS FAMILY FOUNDATION TRUST

Show details

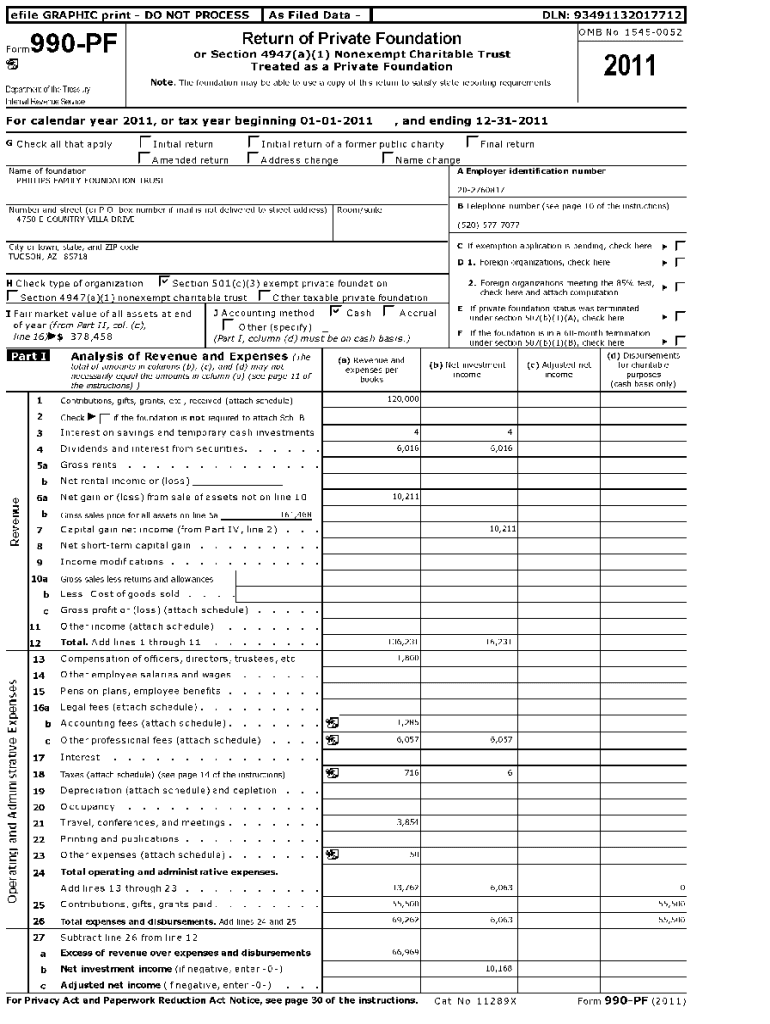

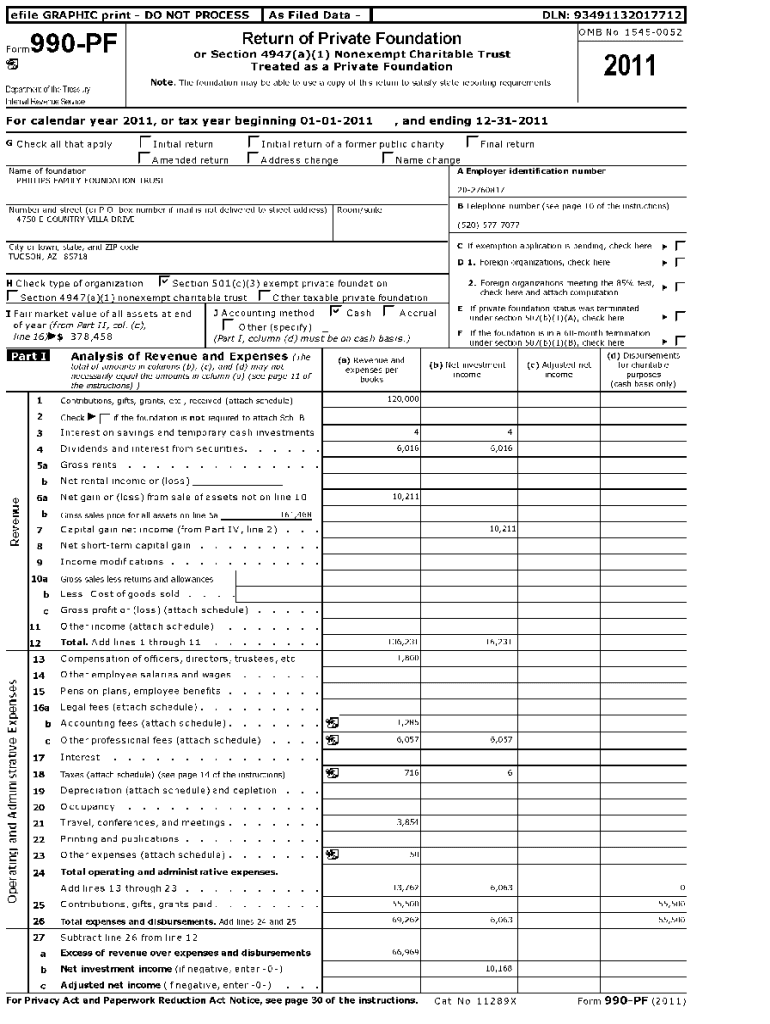

Le file GRAPHIC print DO NOT Processors Filed Data DAN: 93491132017712 OMB No 15450052Return of Private Foundation990 For Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign phillips family foundation trust

Edit your phillips family foundation trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your phillips family foundation trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing phillips family foundation trust online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit phillips family foundation trust. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out phillips family foundation trust

How to fill out phillips family foundation trust

01

Start by gathering all necessary documentation, such as identification documents, financial records, and legal paperwork relating to the assets that will be included in the trust.

02

Consult with an attorney specializing in trusts and estate planning to guide you through the process of filling out the Phillips Family Foundation Trust. They will be able to provide you with expert advice and ensure that all legal requirements are met.

03

Begin by completing the initial paperwork, which typically includes providing personal information about the grantor (the person creating the trust) and the beneficiaries (those who will benefit from the trust).

04

Specify the purpose and goals of the Phillips Family Foundation Trust. Clearly outline the intended use of the trust's funds and assets, such as supporting education, charity work, or other philanthropic endeavors.

05

Determine the terms and conditions of the trust, including any restrictions, rules, or criteria for distributing funds or making grants. It is important to carefully consider these details to ensure that the goals of the trust are effectively carried out.

06

Identify the assets that will be transferred to the trust, including real estate, investments, or other valuable items. Provide accurate and detailed descriptions of each asset, including their current value.

07

Designate a trustee or trustees who will be responsible for managing the trust and making decisions regarding its operation. It is crucial to select trustworthy individuals who have the necessary skills and knowledge to successfully fulfill their duties.

08

Review all completed documentation with your attorney to ensure accuracy and compliance with applicable laws and regulations.

09

Sign and notarize all required paperwork to make it legally binding.

10

Store copies of all trust documents in a safe and accessible location, and inform the relevant parties, such as beneficiaries and trustees, about the existence and details of the Phillips Family Foundation Trust.

Who needs phillips family foundation trust?

01

The Phillips Family Foundation Trust is ideal for individuals or families who wish to establish a long-term philanthropic legacy. It is suitable for those who have significant assets that they want to dedicate to charitable causes and create a structured system for managing and distributing funds. The trust can be used to support various philanthropic endeavors, such as education, healthcare, arts and culture, environmental conservation, social welfare, and more. Additionally, the trust provides certain tax benefits and allows individuals to have control and influence over how their assets are used for charitable purposes, even after they are no longer alive.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my phillips family foundation trust directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your phillips family foundation trust and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I execute phillips family foundation trust online?

pdfFiller makes it easy to finish and sign phillips family foundation trust online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I edit phillips family foundation trust on an Android device?

The pdfFiller app for Android allows you to edit PDF files like phillips family foundation trust. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is phillips family foundation trust?

The Phillips Family Foundation Trust is a type of trust established to manage and distribute the family's financial resources and assets, typically for philanthropic purposes or to support the family's needs and interests.

Who is required to file phillips family foundation trust?

Typically, the trustees or the responsible individuals managing the Phillips Family Foundation Trust are required to file the necessary paperwork and tax returns as mandated by law.

How to fill out phillips family foundation trust?

Filling out the Phillips Family Foundation Trust involves providing detailed information about the trust's assets, beneficiaries, and intended use. Specific forms and requirements may vary based on jurisdiction and purpose.

What is the purpose of phillips family foundation trust?

The purpose of the Phillips Family Foundation Trust generally includes philanthropic efforts, supporting charitable initiatives, managing family wealth, and ensuring proper distribution of assets according to the family's wishes.

What information must be reported on phillips family foundation trust?

Information that must be reported typically includes details about the trust's assets, income, distributions made, expenses incurred, and information about trustees or beneficiaries.

Fill out your phillips family foundation trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Phillips Family Foundation Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.