Get the free AICPA Comment Letter on Draft Form 1065, Schedule K-1, and Accompanying Instructions...

Show details

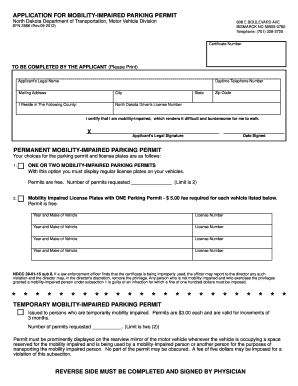

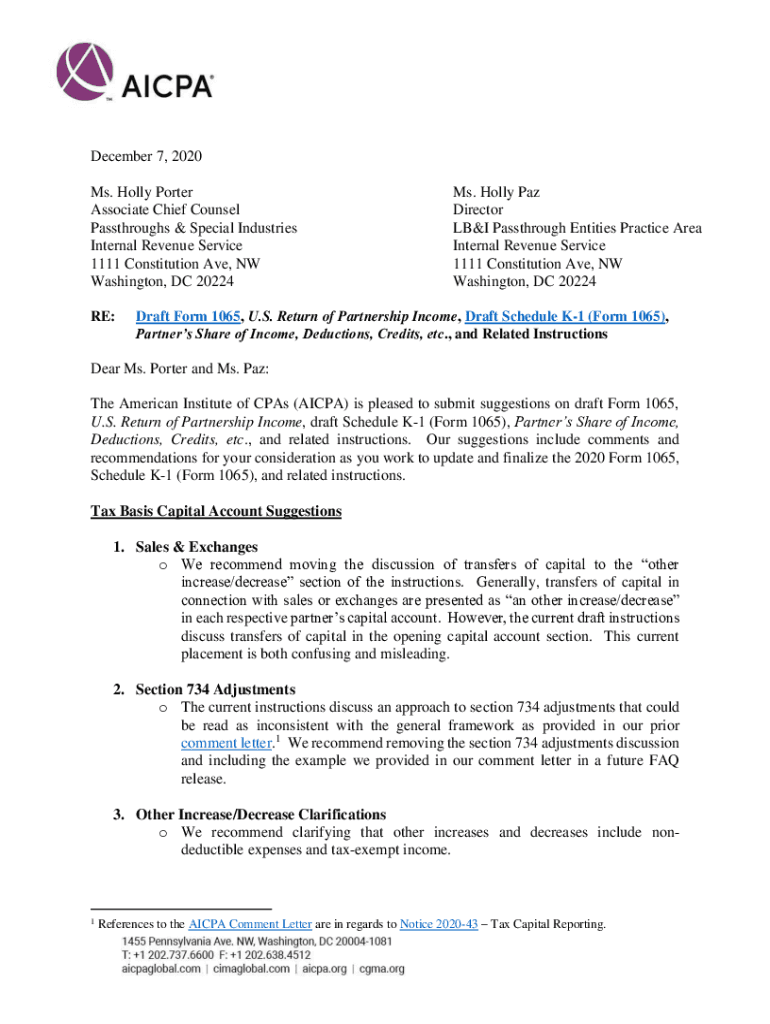

December 7, 2020, Ms. Holly Porter Associate Chief Counsel Walkthroughs & Special Industries Internal Revenue Service 1111 Constitution Ave, NW Washington, DC 20224 RE:Ms. Holly Pay Director LBI Pass

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aicpa comment letter on

Edit your aicpa comment letter on form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aicpa comment letter on form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing aicpa comment letter on online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit aicpa comment letter on. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aicpa comment letter on

How to fill out aicpa comment letter on

01

To fill out an AICPA comment letter, follow these steps:

02

Step 1: Start by reviewing the draft standard or regulation that is open for comment. Understand the key provisions and any potential impact on the accounting profession.

03

Step 2: Collect all relevant information and documentation that supports your position or concerns regarding the draft standard or regulation.

04

Step 3: Address the comment letter to the appropriate AICPA committee or board responsible for the standard-setting or regulatory process.

05

Step 4: Begin the letter with a clear and concise introduction expressing your interest in providing comments on the draft standard or regulation.

06

Step 5: Use specific reference points to cite the sections or provisions of the draft standard or regulation that you are commenting on. Provide a detailed explanation of your concerns or suggestions for improvement.

07

Step 6: Support your comments with appropriate evidence, such as research findings, industry data, or practical examples.

08

Step 7: Clearly articulate the potential impact of the draft standard or regulation on the accounting profession, businesses, and other stakeholders.

09

Step 8: Conclude the letter by summarizing your key points and reiterating your request for reconsideration or modification of the draft standard or regulation.

10

Step 9: Proofread the letter for clarity, precision, and professionalism. Make sure to include your contact information for further correspondence.

11

Step 10: Submit the comment letter within the specified deadline through the designated submission method, such as email or online portal.

12

Note: It is important to adhere to any specific instructions or guidelines provided by the AICPA regarding the format or content of the comment letter.

Who needs aicpa comment letter on?

01

The AICPA comment letter is needed by accounting professionals, practitioners, firms, and individuals who have a stake in the standard-setting or regulatory processes of the accounting profession.

02

This includes but is not limited to:

03

- Certified Public Accountants (CPAs)

04

- Accounting firms of all sizes

05

- Industry associations representing the accounting profession

06

- Corporate finance and accounting departments

07

- Accounting educators and researchers

08

- Financial statement users, such as investors, creditors, and analysts

09

- Regulators and government agencies overseeing the accounting profession

10

In essence, anyone who wants to provide feedback, express concerns, or suggest improvements to draft standards or regulations issued by the AICPA can submit an AICPA comment letter.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit aicpa comment letter on from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including aicpa comment letter on. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I get aicpa comment letter on?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the aicpa comment letter on in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make changes in aicpa comment letter on?

The editing procedure is simple with pdfFiller. Open your aicpa comment letter on in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

What is aicpa comment letter on?

The AICPA comment letter pertains to comments or feedback submitted regarding proposed accounting standards or regulatory changes by the American Institute of Certified Public Accountants (AICPA), aiming to represent the interests of its members and the accounting profession.

Who is required to file aicpa comment letter on?

Members of the AICPA, including CPAs and firms that are affected by the proposed changes in accounting standards or regulations, are encouraged to file AICPA comment letters.

How to fill out aicpa comment letter on?

To fill out an AICPA comment letter, individuals should first review the proposed standard or regulation, then articulate their feedback clearly and concisely, ensuring they address specific points of concern or support as outlined in the proposed document.

What is the purpose of aicpa comment letter on?

The purpose of the AICPA comment letter is to provide professional feedback on proposed standards, ensuring that the concerns and insights of accounting professionals are considered in the standard-setting process.

What information must be reported on aicpa comment letter on?

An AICPA comment letter must include the author's identification information, specific comments or feedback on the proposed standards, suggestions for changes, and any supporting reasons or evidence for the proposed suggestions.

Fill out your aicpa comment letter on online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aicpa Comment Letter On is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.