IRS 4562 2020 free printable template

Show details

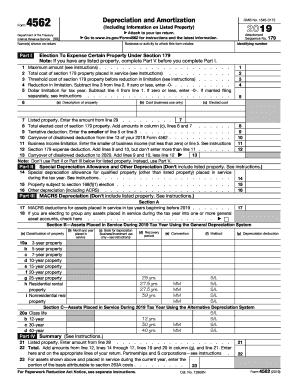

Form4562Depreciation and Amortization Attach Got your tax return. To www.irs.gov/Form4562 for instructions and the latest information. Name(s) shown on return1 2 3 4 5Attachment Sequence No. 179 Identifying

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 4562

How to edit IRS 4562

How to fill out IRS 4562

Instructions and Help about IRS 4562

How to edit IRS 4562

Editing IRS 4562 can be performed using pdfFiller, which provides tools to modify the text fields as necessary. Users can input their information directly on the form template and make adjustments based on their specific tax situations. Ensure that all changes are completed prior to submission to maintain accuracy.

How to fill out IRS 4562

Filling out IRS 4562 requires attention to detail. Follow these steps:

01

Identify the purpose of the form, typically related to depreciation and amortization.

02

Gather necessary information including asset details, depreciation methods, and the placed-in-service date.

03

Complete each section methodically, ensuring all relevant expenses are accurately reported.

Utilizing pdfFiller's editing features can streamline this process, making it easier to input and review your information. Keep careful records for each asset to facilitate accurate filing.

About IRS 4 previous version

What is IRS 4562?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 4 previous version

What is IRS 4562?

IRS 4562 is a tax form used by U.S. taxpayers to report depreciation and amortization claims on eligible assets. This form assists individuals and businesses in calculating the correct amount for tax deductions related to property expenses over time.

What is the purpose of this form?

The purpose of IRS 4562 is to allow taxpayers to claim deductions for depreciation on property used in business or held for income production. These deductions help in reducing taxable income, thereby lowering the overall tax liability. By understanding how to properly apply these deductions, taxpayers can optimize their financial outcomes.

Who needs the form?

Taxpayers who have purchased, improved, or disposed of depreciable assets in a tax year must file IRS 4562. This includes business owners, investors in rental property, and individuals who utilize personal assets for business purposes. If you are referencing new vehicles, machinery, or equipment, this form is critical for compliance.

When am I exempt from filling out this form?

You may be exempt from filing IRS 4562 if you do not claim depreciation for any property or if your total depreciation for the tax year is under the minimum threshold as specified by IRS guidelines. Additionally, certain small businesses may qualify to use simplified methods that bypass this form.

Components of the form

IRS 4562 includes various sections covering different types of property and methods of depreciation. Key components include:

01

Part I: Election to Expense Certain Properties, allowing immediate deduction of expenses.

02

Part II: Special Depreciation Allowance for property placed in service during the year.

03

Part III: MACRS Depreciation for most assets.

Each part correlates to specific calculation methods and types of assets, so understanding each component is essential for accurate reporting.

What are the penalties for not issuing the form?

Failing to issue IRS 4562 when required can lead to additional tax liabilities, penalties, and interest charges. The IRS may assess penalties based on underpayment or improperly claiming depreciation, potentially leading to an audit or further scrutiny of filed taxes. It is imperative to file accurately to avoid these consequences.

What information do you need when you file the form?

When filing IRS 4562, you will need detailed information about each depreciable asset, including:

01

Description of the property.

02

Date the property was placed in service.

03

Cost or other basis of the property, including improvements.

Having this information readily available will facilitate the completion of the form and ensure that all deductions are maximized.

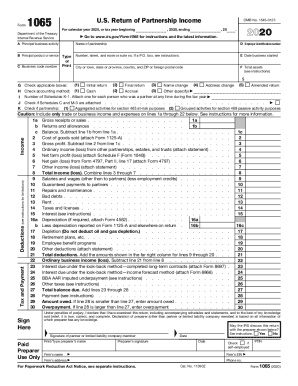

Is the form accompanied by other forms?

IRS 4562 may need to accompany other forms depending on your tax situation. Commonly, taxpayers may need to file this form together with their main income tax return (such as 1040 or 1120) or additional worksheets that specify calculations related to the assets. Always check to ensure all required forms are included in your submission.

Where do I send the form?

Where to send IRS 4562 depends on your filing status and the type of tax return being submitted. Generally, this form should be included with your income tax return, either mailed to the address specified in the return instructions or electronically filed if applicable. Verify current IRS guidelines for exact mailing addresses or electronic submission procedures.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It was just fine - a few learning curve quirks, but relatively easy.

It has been just what I have needed. Love it!

See what our users say