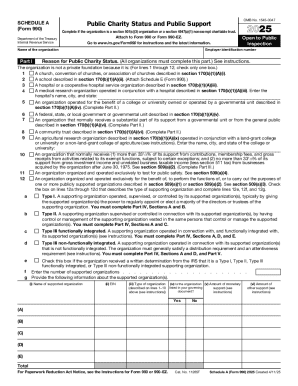

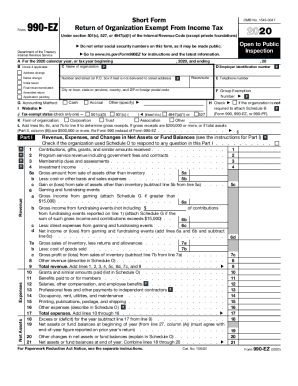

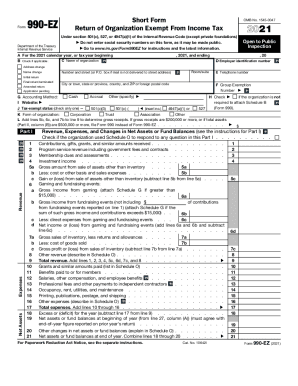

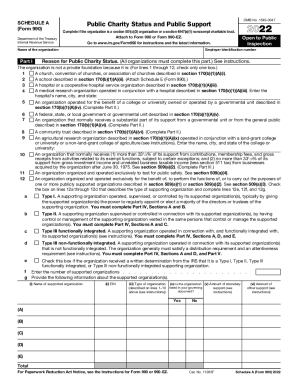

IRS 990 - Schedule A 2020 free printable template

Instructions and Help about IRS 990 - Schedule A

How to edit IRS 990 - Schedule A

How to fill out IRS 990 - Schedule A

About IRS 990 - Schedule A 2020 previous version

What is IRS 990 - Schedule A?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 990 - Schedule A

What should I do if I discover an error after submitting IRS 990 - Schedule A?

If you find a mistake after filing IRS 990 - Schedule A, you can submit an amended return to correct the error. To do this, complete a new version of the form, indicating that it is an amended return. Ensure you include any necessary explanations or documentation related to the corrections and send it to the appropriate address specified by the IRS.

How can I check the status of my IRS 990 - Schedule A submission?

To check the status of your IRS 990 - Schedule A, you can use the IRS online tools or contact them directly. If you e-filed, you might receive an acknowledgment email confirming receipt. Additionally, look out for common rejection codes if your submission was not accepted, as these will guide you in correcting any issues.

What are common errors that filers make with IRS 990 - Schedule A?

Common errors when filing IRS 990 - Schedule A include mismatched or incorrect information, such as discrepancies in EIN or incorrect financial data. To avoid these, double-check all entries for accuracy, ensure consistency across your financial documents, and follow the instructions closely to avoid pitfalls.

Are there any specifics on e-signature acceptability for IRS 990 - Schedule A?

When filing IRS 990 - Schedule A electronically, the use of e-signatures is generally accepted as long as the software used complies with IRS regulations. However, ensure that you appropriately authenticate your identity and that your submission adheres to all technical requirements set forth by the IRS to validate your e-signature.

What should I do if I receive an audit notice regarding IRS 990 - Schedule A?

If you receive an audit notice for your IRS 990 - Schedule A, it's crucial to respond promptly. Gather all relevant documentation and financial records that support your filing. Consult with a tax professional to understand the implications and prepare adequately for the audit to clarify any discrepancies or issues highlighted by the IRS.

See what our users say