Get the free Income & Asset Information Clarification (F2FABC) - mu

Show details

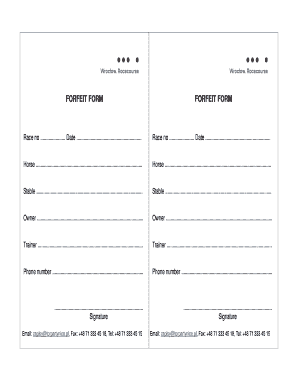

This worksheet is designed to clarify and verify the income and asset information reported on the 2011-12 FAFSA for students and parents. It includes various sections for reporting income sources

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income asset information clarification

Edit your income asset information clarification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income asset information clarification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit income asset information clarification online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit income asset information clarification. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income asset information clarification

How to fill out Income & Asset Information Clarification (F2FABC)

01

Gather all necessary financial documents related to your income and assets.

02

Begin the form by entering your personal information as requested at the top.

03

Fill out your income section by providing details about your earnings, including salary, wages, and any additional income sources.

04

Complete the asset section by listing all your assets, such as bank accounts, real estate, investments, and other valuable items.

05

Double-check the accuracy of all information entered to ensure it is correct.

06

Review any instructions provided on the form to ensure compliance.

07

Sign and date the form as required before submission.

08

Submit the completed form to the appropriate authority by the specified deadline.

Who needs Income & Asset Information Clarification (F2FABC)?

01

Individuals applying for financial assistance or benefits that require income verification.

02

Those seeking loans or financial services that assess income and asset stability.

03

People undergoing financial assessments for government programs or subsidies.

04

Families applying for housing assistance or other social welfare programs that evaluate financial status.

Fill

form

: Try Risk Free

People Also Ask about

What is a credible proof of income?

For example, business owners can provide pay stubs (if they pay themselves the salary), employed individuals can use employment verification letters (which they should request from their employer), and retirees can verify their proof of income through documents like annual pension statements, trust fund income or

How are assets verified?

This proof can include financial statements, bank statements, property deeds, investment records, or other documents that prove the existence and value of their assets. For secured loans, borrowers might need to offer assets as collateral.

What does income and assets mean?

The best way to think about assets and income is that: Your assets are the things you own, while your income is what you've earned from those assets.

What is an example of proof of assets?

Examples are checking, saving, money market accounts, and certificates of deposit.

What is the question on the FAFSA parent assets?

What assets is the FAFSA looking for? Savings and checking account balances. Net worth of non-retirement investments (FYI: Retirement funds and pensions are generally not considered assets) Investment property separate from the family's primary residence.

Can I skip asset questions on FAFSA?

Based on your answers to certain questions on the Free Application for Federal Student Aid (FAFSA®) form, you may be given the option to skip additional questions about your income and assets. If you're given the option to skip questions, keep in mind that doing so won't affect your eligibility for federal student aid.

How do you verify income and assets?

This involves gathering and checking documents like pay stubs, tax returns, and bank statements to make sure the income is real and reliable. It's important when applying for loans, renting property, or getting government help.

How do you verify proof of income?

Paystubs. W2s or other wage statements. IRS Form 1099s. Tax filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Income & Asset Information Clarification (F2FABC)?

Income & Asset Information Clarification (F2FABC) is a form used to verify and clarify the financial data related to income and assets for individuals or households applying for financial assistance or benefits.

Who is required to file Income & Asset Information Clarification (F2FABC)?

Individuals or households applying for financial assistance programs, loans, or other benefits that require financial verification are typically required to file the Income & Asset Information Clarification (F2FABC).

How to fill out Income & Asset Information Clarification (F2FABC)?

To fill out the F2FABC, applicants must provide detailed information about their income sources, amounts, and asset holdings. This may include completing specific sections for employment income, other income types, and listing assets such as bank accounts and properties.

What is the purpose of Income & Asset Information Clarification (F2FABC)?

The purpose of the Income & Asset Information Clarification (F2FABC) is to ensure that the financial information provided by applicants is accurate and up-to-date, which is essential for determining eligibility for various financial assistance programs.

What information must be reported on Income & Asset Information Clarification (F2FABC)?

Applicants must report information related to their total monthly income, sources of income (e.g., wages, benefits), and a comprehensive list of assets including bank accounts, investments, real estate, and other valuable items.

Fill out your income asset information clarification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Asset Information Clarification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.