Get the free Abate Nuisance Taxes

Show details

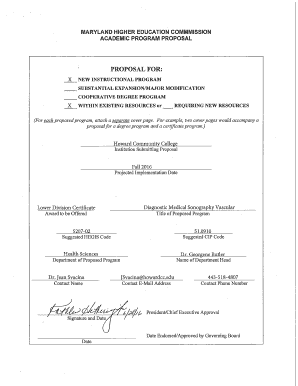

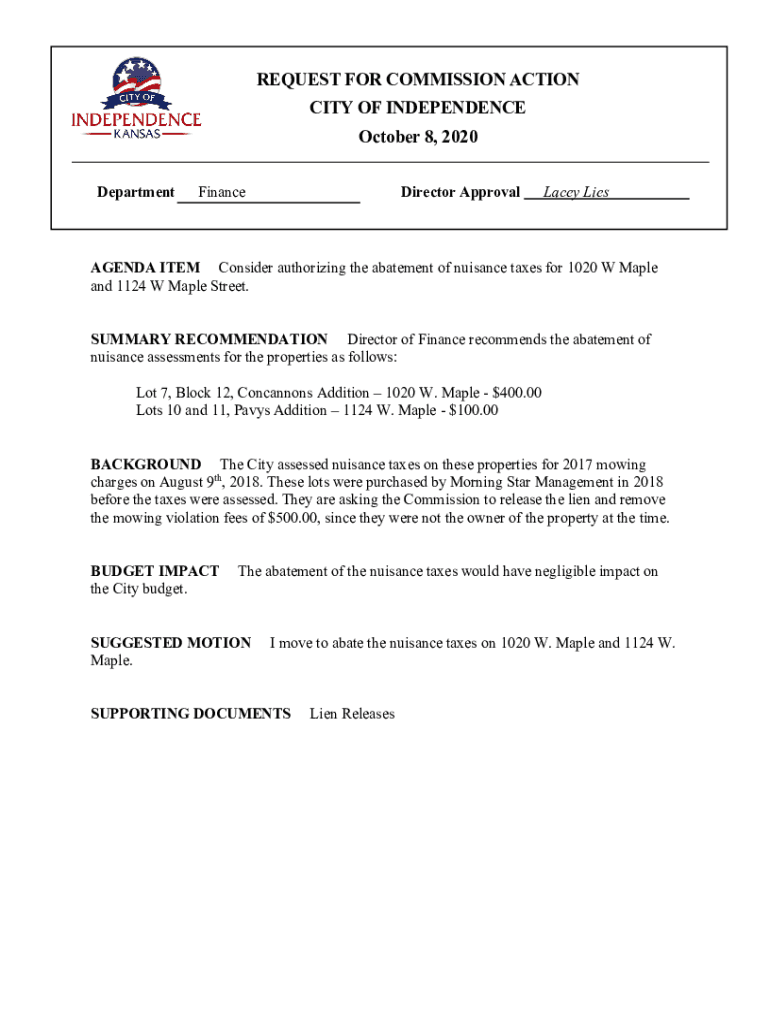

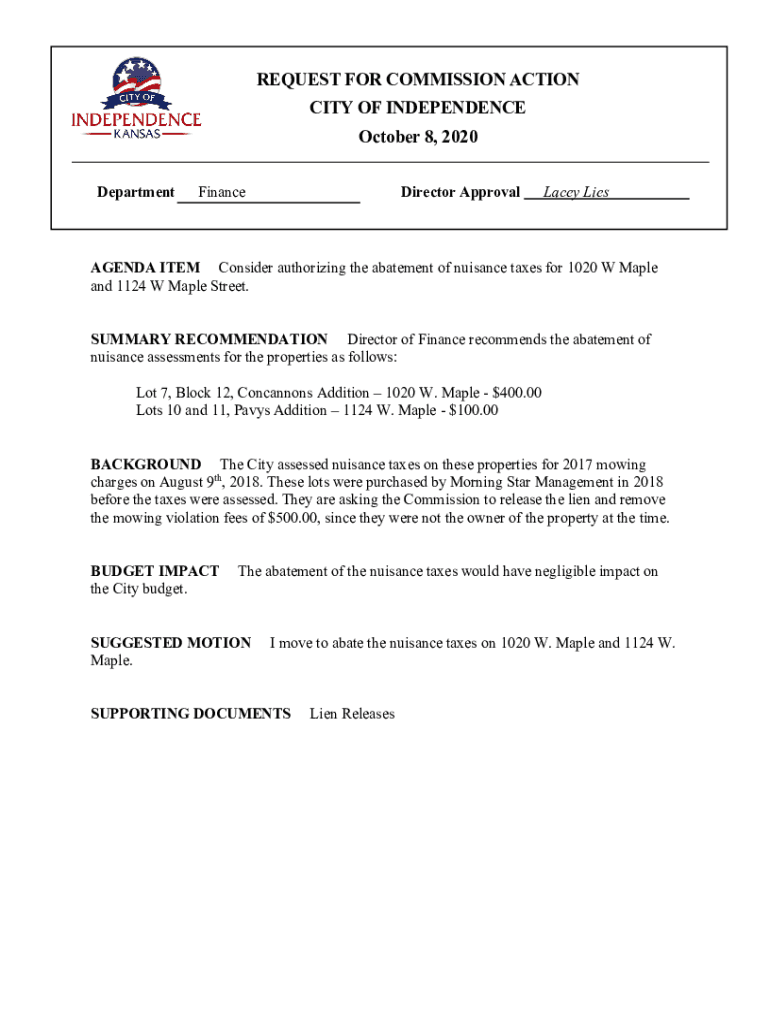

REQUEST FOR COMMISSION ACTION CITY OF INDEPENDENCE October 8, 2020, DepartmentDirector ApprovalFinanceLacey LiesAGENDA ITEM Consider authorizing the abatement of nuisance taxes for 1020 W Maple and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign abate nuisance taxes

Edit your abate nuisance taxes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your abate nuisance taxes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing abate nuisance taxes online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit abate nuisance taxes. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out abate nuisance taxes

How to fill out abate nuisance taxes

01

To fill out abate nuisance taxes, follow these steps:

02

Gather all necessary information and documents related to the taxes you want to abate.

03

Determine the eligibility criteria for abating nuisance taxes in your jurisdiction.

04

Fill out the abatement application form accurately and completely.

05

Attach all required supporting documents, such as proof of hardship or evidence of property improvements.

06

Double-check the accuracy of the information provided and make sure all necessary details are included.

07

Submit the completed abatement application along with the supporting documents to the appropriate tax authority.

08

Follow up with the tax authority to ensure your application is being processed and check for any additional steps or requirements.

09

If approved, pay attention to the abatement period and abide by any conditions or obligations imposed by the tax authority.

10

Keep records of the abatement process, including communication with the tax authority and any receipts or notices received.

11

Seek professional advice or consult with a tax attorney if you encounter any challenges or have specific questions related to your situation.

Who needs abate nuisance taxes?

01

Abate nuisance taxes can be beneficial for individuals or entities who are facing financial hardship or circumstances that make paying certain taxes burdensome.

02

Specifically, those who may need abate nuisance taxes include:

03

- Homeowners struggling with property tax payments due to financial difficulties or significant taxable property damage.

04

- Property owners facing excessive special assessment taxes that exceed the value of the benefits received.

05

- Businesses or individuals facing unexpected or extraordinary tax liabilities that they cannot manage without severe financial consequences.

06

- Low-income individuals or families who may qualify for property tax relief programs in certain jurisdictions.

07

- In some cases, non-profit organizations or entities dedicated to public service missions may be eligible for tax abatement to support their operations.

08

It is important to note that eligibility requirements and types of taxes that can be abated vary by jurisdiction. Therefore, it is advisable to consult local tax authorities or seek professional advice to determine if abate nuisance taxes are applicable and beneficial in a specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send abate nuisance taxes for eSignature?

When your abate nuisance taxes is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for the abate nuisance taxes in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your abate nuisance taxes and you'll be done in minutes.

How do I edit abate nuisance taxes on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute abate nuisance taxes from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is abate nuisance taxes?

Abate nuisance taxes are taxes implemented by local governments aimed at addressing properties that contribute to community nuisances, such as abandoned houses, overgrown yards, or other properties that detract from the neighborhood's quality.

Who is required to file abate nuisance taxes?

Property owners of real estate deemed a nuisance by local authorities are typically required to file for abate nuisance taxes.

How to fill out abate nuisance taxes?

To fill out abate nuisance taxes, property owners usually need to complete a specific form provided by their local tax authority, detailing the property in question, the nature of the nuisance, and any corrective measures taken.

What is the purpose of abate nuisance taxes?

The purpose of abate nuisance taxes is to incentivize property owners to maintain their properties, reduce community nuisances, and ensure a higher standard of living within the community.

What information must be reported on abate nuisance taxes?

Information typically required includes the property owner's name, property address, the specific nuisances present, and any actions taken to mitigate these nuisances.

Fill out your abate nuisance taxes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Abate Nuisance Taxes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.