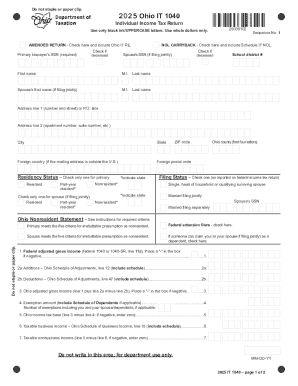

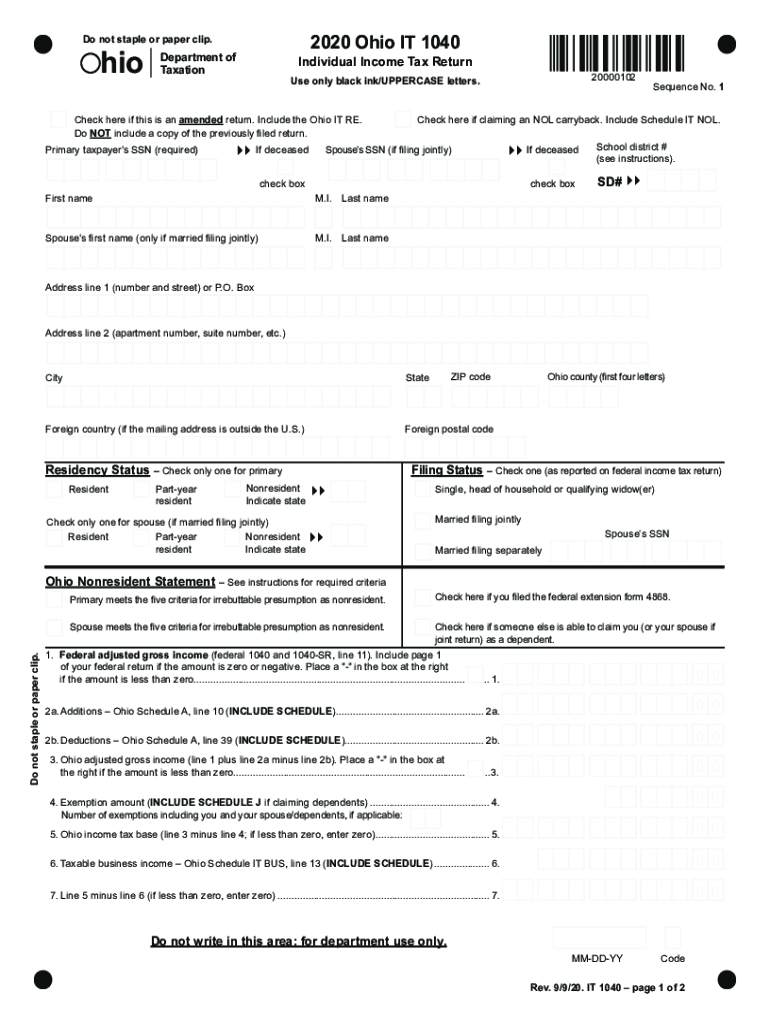

OH IT 1040 2020 free printable template

Instructions and Help about OH IT 1040

How to edit OH IT 1040

How to fill out OH IT 1040

About OH IT previous version

What is OH IT 1040?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about OH IT 1040

How can I correct mistakes on my ohio state tax forms after filing?

If you realize you've made an error on your ohio state tax forms after submission, you can file an amended return using the appropriate amendment form provided by the Ohio Department of Taxation. Make sure to carefully follow the instructions to ensure your corrections are processed correctly.

How can I track the status of my ohio state tax forms?

To verify the status of your filed ohio state tax forms, you can visit the Ohio Department of Taxation's website and use their online tracking tool. Enter the required information to check the receipt and processing status of your return and be aware of any potential issues that could arise during processing.

What should I do if I receive a notice regarding my ohio state tax forms?

If you receive a notice or letter concerning your ohio state tax forms, it's important to read it carefully and respond promptly. Depending on the notice, you may need to provide additional documentation, clarify information, or make corrections. Keep a record of all correspondence regarding this issue.

Are there specific fees associated with e-filing ohio state tax forms?

Yes, when e-filing your ohio state tax forms, there may be service fees depending on the e-filing service provider you choose. Be sure to review their fee structure in advance and understand any refund policies for rejected submissions.

See what our users say