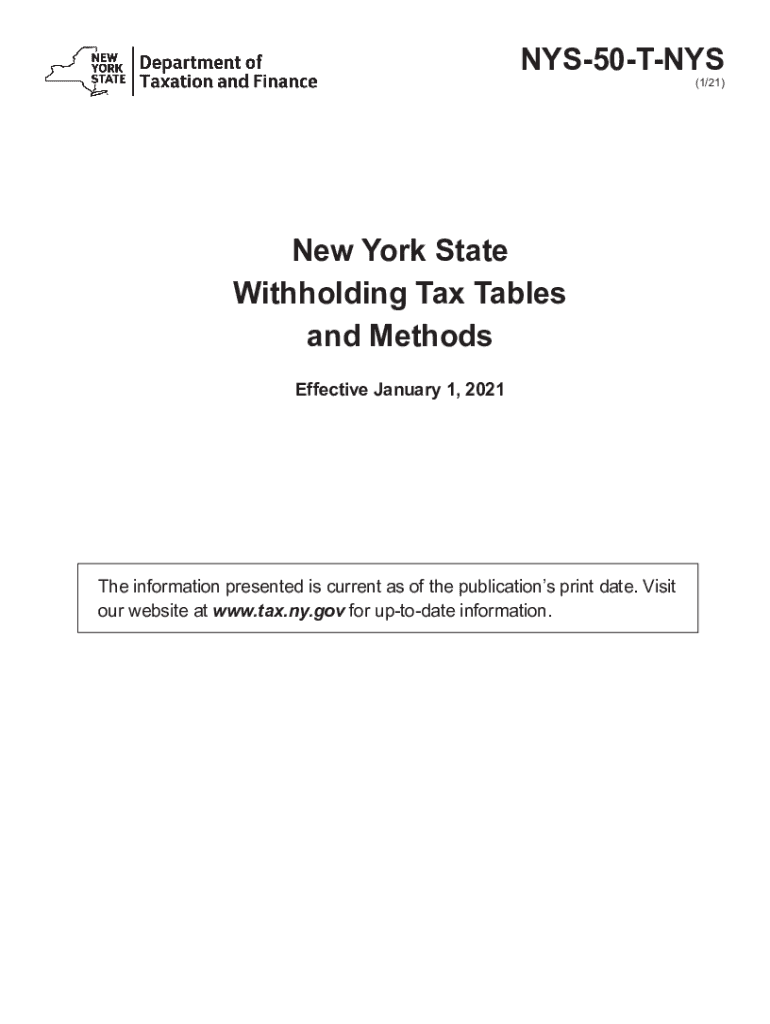

NY DTF NYS-50-T-NYS 2021 free printable template

Get, Create, Make and Sign NY DTF NYS-50-T-NYS

Editing NY DTF NYS-50-T-NYS online

Uncompromising security for your PDF editing and eSignature needs

NY DTF NYS-50-T-NYS Form Versions

How to fill out NY DTF NYS-50-T-NYS

How to fill out NY DTF NYS-50-T-NYS

Who needs NY DTF NYS-50-T-NYS?

Instructions and Help about NY DTF NYS-50-T-NYS

The New York state tax department is making it easier to follow your taxes by offering enhanced fill in forms available for download from our website filling forms are PDF files that let you enter your data using your computer instead of filling it in by hand enhanced filling forms have fields that populate automatically as you complete the form eliminating the need to look up information like school codes and some feature drop-down menus that make it easier to select entries enhanced filling forms even do most of the math for you reducing the chances of an error that could delay the processing of your return, but before you begin using these new forms here are some helpful tips to make your experience as smooth as possible first it×39’s importanfalloutut the pages in order beginning with your personal information at the top of page 1 hit the tab key to advance your cursor to the next field the fields highlighted in yellow will automatically populate as you complete the form buttons indicate drop-down menus can be clicked to list your choices for those fields you must select your country before you enter your address but otherwise it×39’s bescompletedhe fields in order since later calculations are based on data entered earlier ocean×39’ve completed the forPlayboybclickingng the green print button in the upper left-hand corner of the first pageant error message will warn you if you skip a required field to clear your form click the red reset button on the right the links button can direct you to additional forms you might need to complete your return when you print your forms the data is captured in a 2dbarcode this barcode will be scanned your automated systems to capture all your tax data if you need to make changes to your form you must make your changes within the PDF and then reprint to update these barcodes finally don'ttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttforget to sign your return in blue or black ink before mailing it to the tax department your signature is the only handwritten entry permitted on the Normand remember taxpayers who choose direct deposit as their refund method receive their refunds faster than those who Otto receives a check it×39’s thSafewayay Toto get you refund for more information visit our website at well.com you

People Also Ask about

How do I avoid taxes on my bonus check?

How to complete Employee's withholding allowance Certificate?

What is the NYS tax withholding form for pension?

What is New York State Publication NYS 50?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my NY DTF NYS-50-T-NYS in Gmail?

How can I edit NY DTF NYS-50-T-NYS on a smartphone?

How do I edit NY DTF NYS-50-T-NYS on an Android device?

What is NY DTF NYS-50-T-NYS?

Who is required to file NY DTF NYS-50-T-NYS?

How to fill out NY DTF NYS-50-T-NYS?

What is the purpose of NY DTF NYS-50-T-NYS?

What information must be reported on NY DTF NYS-50-T-NYS?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.