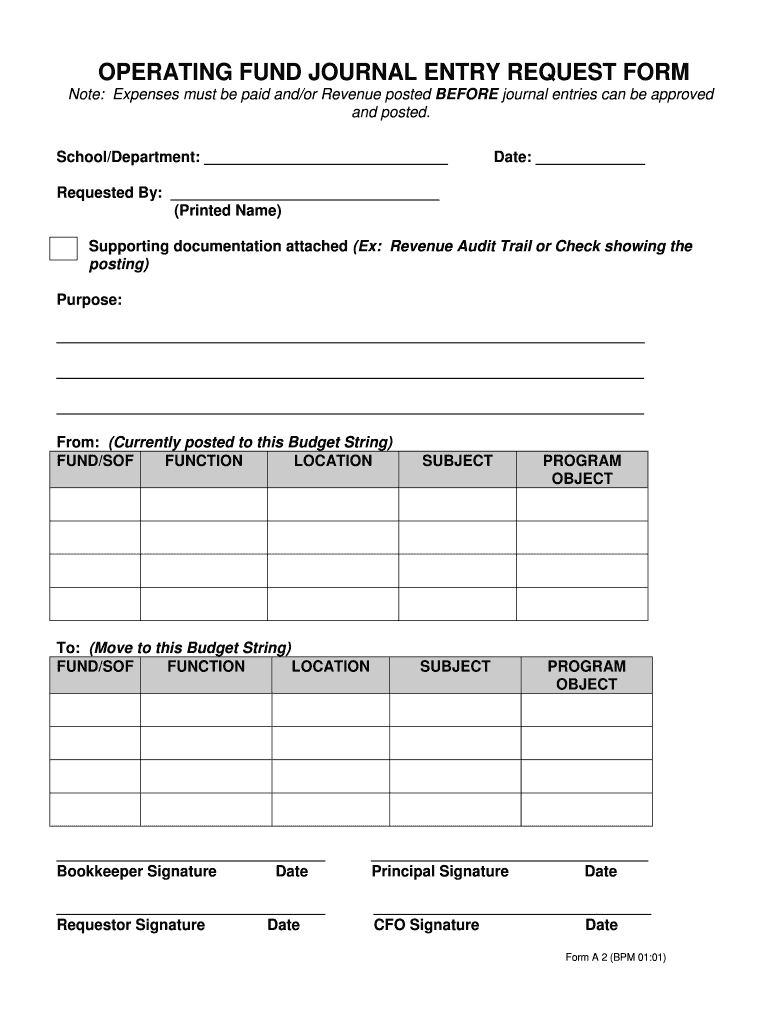

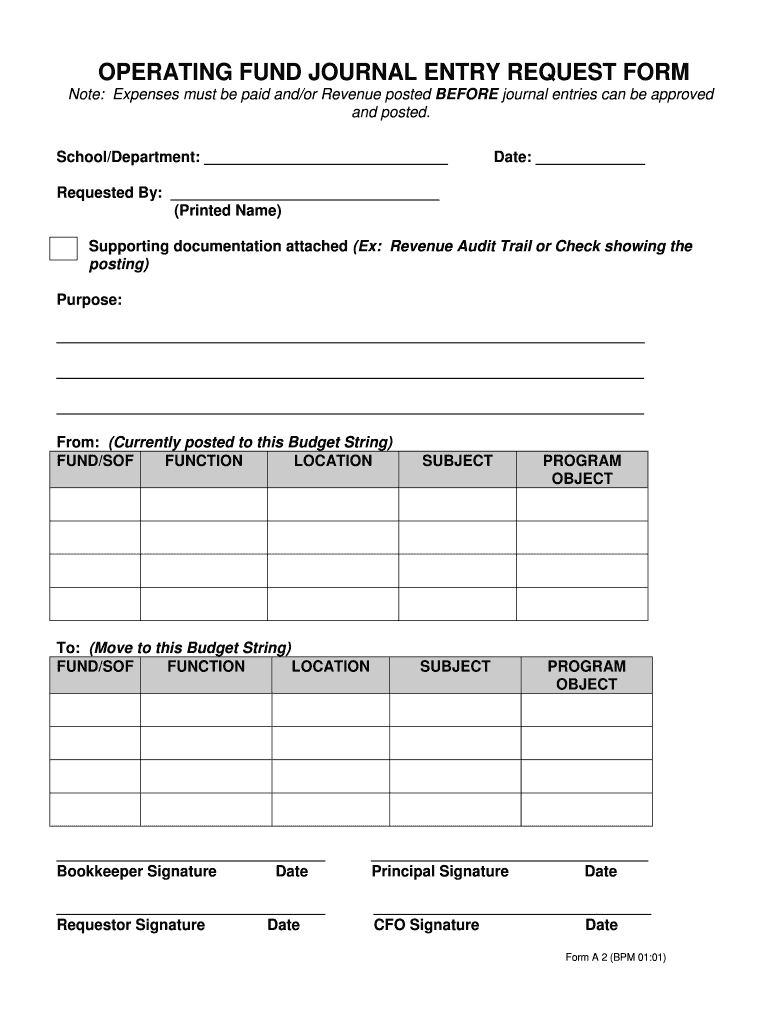

Get the free OPERATING FUND JOURNAL ENTRY REQUEST FORM - pcssd

Show details

15 Aug 2014 ... District Activity Funds is that it be for a school PRPO e”. ... The Bookkeeper and the Principal are considered to be the Fiscal Managers of all financial activity ..... Bookkeepers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign operating fund journal entry

Edit your operating fund journal entry form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your operating fund journal entry form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing operating fund journal entry online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit operating fund journal entry. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out operating fund journal entry

01

To correctly fill out an operating fund journal entry, start by identifying the date of the transaction. This is essential for accurate record keeping.

02

Next, indicate the account title that you are recording the transaction for. This could be an expense account, revenue account, or any other relevant category.

03

Write a brief description of the transaction being recorded. This should include details such as the nature of the expense or revenue, the amount involved, and any additional relevant information.

04

Determine the appropriate debit and credit entries for the transaction. Debits represent increases in expenses or decreases in revenue, while credits represent decreases in expenses or increases in revenue.

05

Record the debit entry in the left column of the journal entry and the credit entry in the right column. Be sure to clearly indicate the account name and the respective amount.

06

Repeat this process for any additional transactions that need to be recorded in the operating fund journal. Each transaction should have its own separate entry.

07

After completing the journal entries, calculate the total debits and credits for the period. These totals should balance each other out, ensuring that the accounting equation stays in equilibrium.

08

Finally, review and verify the accuracy of the journal entries before they are posted to the ledger. This step is crucial for maintaining accurate financial records.

Who needs operating fund journal entry?

01

Businesses of all sizes and industries require operating fund journal entries to accurately track their financial transactions.

02

Non-profit organizations also need operating fund journal entries to monitor their revenue and expenses, ensuring that funds are allocated appropriately for their intended purposes.

03

Individuals who manage personal finances, such as landlords or self-employed individuals, can benefit from keeping an operating fund journal to track their income and expenses.

In summary, anyone involved in financial transactions, whether it's a business, non-profit organization, or individual, can benefit from understanding how to fill out operating fund journal entries. It is a vital tool for accurate record keeping and helps in financial analysis and decision making.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in operating fund journal entry?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your operating fund journal entry to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for the operating fund journal entry in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your operating fund journal entry in minutes.

Can I edit operating fund journal entry on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute operating fund journal entry from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is operating fund journal entry?

Operating fund journal entry is a record of financial transactions related to the operational expenses of an organization.

Who is required to file operating fund journal entry?

Any organization or business that has operational expenses needs to file an operating fund journal entry.

How to fill out operating fund journal entry?

To fill out an operating fund journal entry, you need to record all financial transactions related to operational expenses, including income and expenses.

What is the purpose of operating fund journal entry?

The purpose of an operating fund journal entry is to track and monitor the financial transactions related to the day-to-day operations of an organization.

What information must be reported on operating fund journal entry?

The operating fund journal entry must include details of all income and expenses related to operational activities, as well as any transfers or adjustments.

Fill out your operating fund journal entry online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Operating Fund Journal Entry is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.