Get the free A charitable organization registered to solicit contributions in Minnesota must file...

Show details

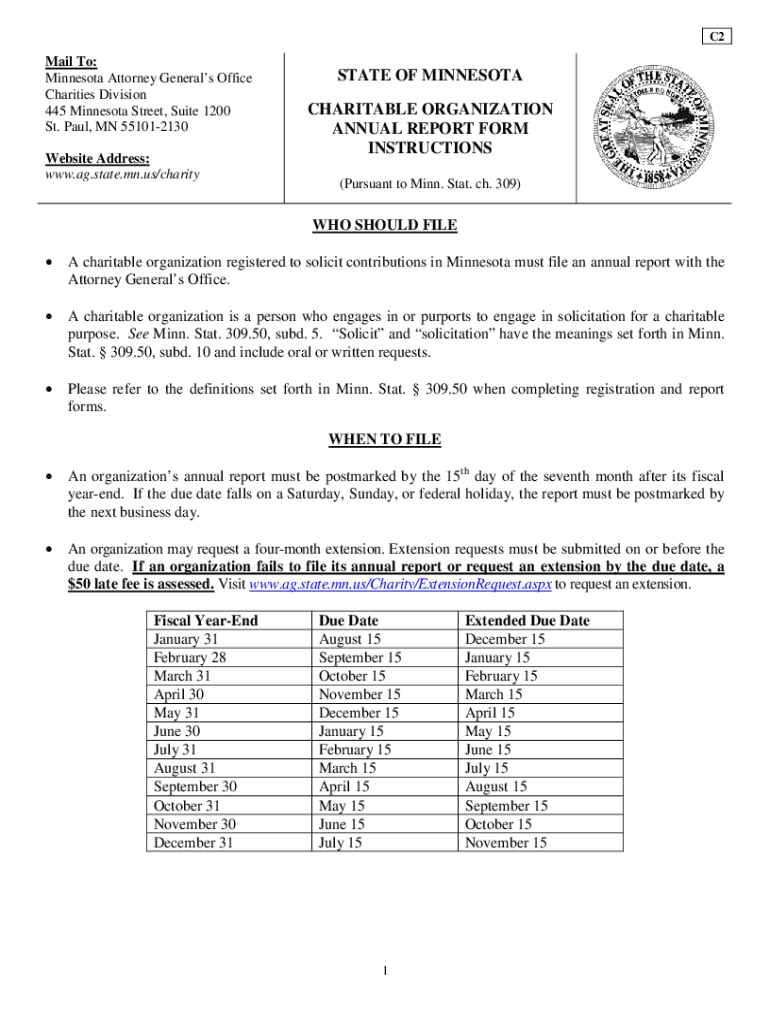

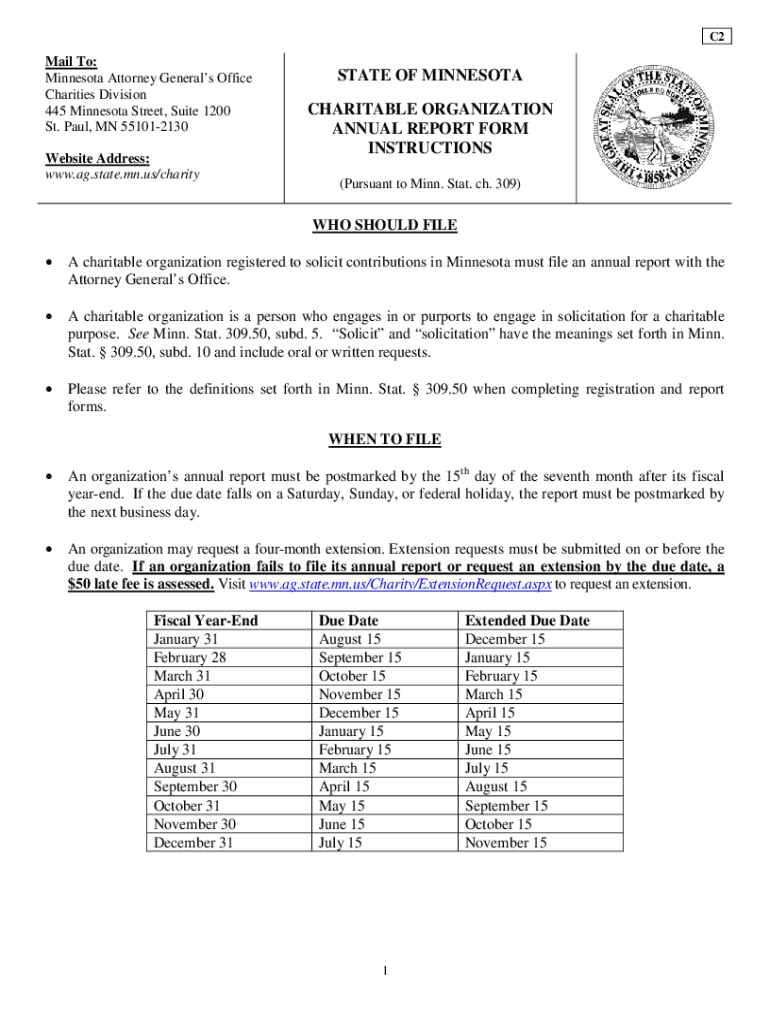

C2Mail To:

Minnesota Attorney Generals Office

Charities Division

445 Minnesota Street, Suite 1200

St. Paul, MN 551012130

Website Address:

www.ag.state.mn.us/charitySTATE OF MINNESOTA

CHARITABLE ORGANIZATION

ANNUAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a charitable organization registered

Edit your a charitable organization registered form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a charitable organization registered form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing a charitable organization registered online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit a charitable organization registered. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a charitable organization registered

How to fill out a charitable organization registered

01

Step 1: Gather all the required documents such as proof of non-profit status, articles of incorporation, bylaws, and financial statements.

02

Step 2: Prepare the application form provided by the relevant government agency or department responsible for charitable organization registration.

03

Step 3: Fill out the application form with accurate and complete information, including the organization's name, purpose, activities, and contact details.

04

Step 4: Attach the required documents to the application form as specified in the guidelines.

05

Step 5: Review the completed application form and attached documents for any errors or missing information.

06

Step 6: Submit the application form and supporting documents to the designated government agency or department either in person or through the specified submission method.

07

Step 7: Pay the required fees, if applicable, for the registration process.

08

Step 8: Wait for the processing of the application and follow up with the government agency or department, if necessary.

09

Step 9: Once approved, receive the charitable organization registration certificate and follow any additional instructions or requirements provided.

10

Step 10: Maintain proper record-keeping and comply with the regulations and reporting obligations imposed on registered charitable organizations.

Who needs a charitable organization registered?

01

Non-profit organizations that engage in activities aimed at benefiting the community or specific causes often need to be registered as charitable organizations.

02

Individuals or groups planning to raise funds for charitable purposes or events may also require a charitable organization registration to ensure transparency and legal compliance.

03

Donors or contributors who seek to support legitimate charitable causes may prefer to donate to registered charitable organizations for accountability and tax-deductibility purposes.

04

Government agencies, grantors, or other funding bodies may require charitable organizations to be registered to qualify for funding or grants.

05

In many jurisdictions, operating as a registered charitable organization may provide certain legal protections and benefits that are not available to informal or unregistered entities.

06

Overall, anyone involved in charitable activities or fundraising endeavors should consider registering as a charitable organization to establish credibility, transparency, and eligibility for various benefits and opportunities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send a charitable organization registered to be eSigned by others?

When you're ready to share your a charitable organization registered, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I execute a charitable organization registered online?

pdfFiller has made it easy to fill out and sign a charitable organization registered. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit a charitable organization registered straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing a charitable organization registered.

What is a charitable organization registered?

A charitable organization registered is a nonprofit entity that has been formally registered with the appropriate governmental authority to operate for charitable purposes and is typically granted tax-exempt status.

Who is required to file a charitable organization registered?

Organizations that solicit donations from the public or that are established for charitable purposes are generally required to file as a charitable organization registered.

How to fill out a charitable organization registered?

To fill out a charitable organization registration, organizations must complete the required application forms, provide necessary supporting documents, and submit them to the relevant state or federal agency, ensuring all information is accurate and complete.

What is the purpose of a charitable organization registered?

The purpose of a charitable organization registered is to promote charitable activities, provide community benefits, and advance social welfare, education, and other causes for the public good.

What information must be reported on a charitable organization registered?

Information that must be reported includes the organization's name, mission statement, board of directors, financial statements, details of fundraising activities, and how donations are utilized.

Fill out your a charitable organization registered online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A Charitable Organization Registered is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.