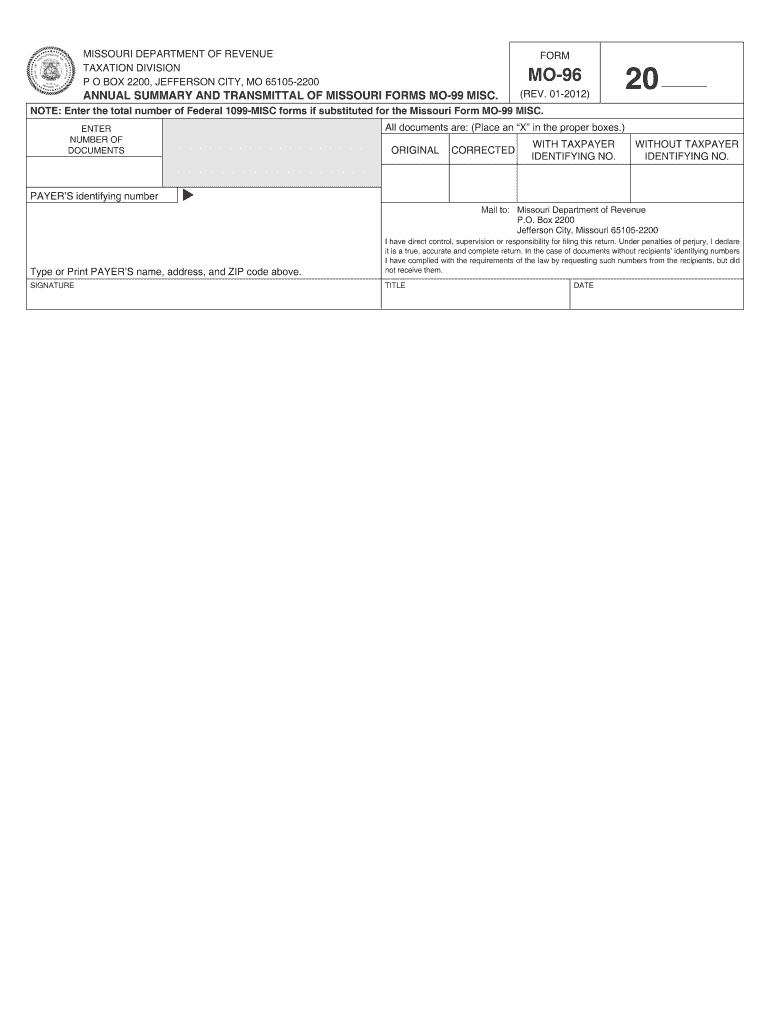

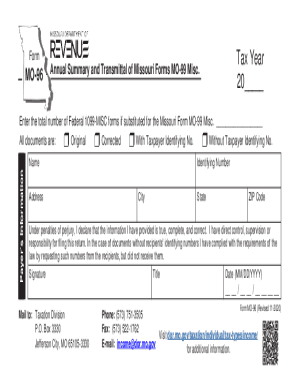

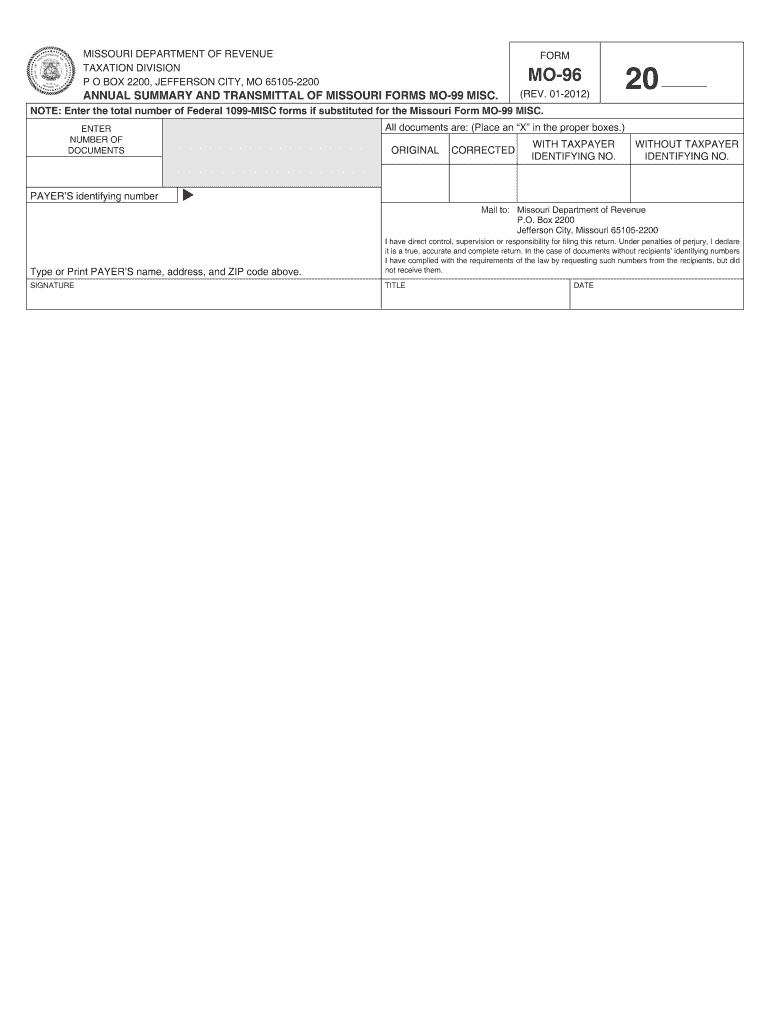

MO DoR MO-96 2012 free printable template

Get, Create, Make and Sign MO DoR MO-96

How to edit MO DoR MO-96 online

Uncompromising security for your PDF editing and eSignature needs

MO DoR MO-96 Form Versions

How to fill out MO DoR MO-96

How to fill out MO DoR MO-96

Who needs MO DoR MO-96?

Instructions and Help about MO DoR MO-96

Filing your taxes can be a stressful task, but the Missouri Department of Revenue has some online tools to help you even if you choose not to e-file you can still save time and reduce errors by using the department's electronic forms visit DE Or gov and click forms and manuals at the top of the page simply select the tax year and click search click on the form you need enter the correct information in the fields and select prints at the top of the page when the form is complete printed forms can then be mailed to the proper filing agency did you know that you can also check the status of your state tax refund just visit the FOR Viacom homepage and select check my income tax return or refund under popular online services fill out the requested information and click Submit to view the status of your return if you need a 1099-g inquiry that shows your tax information from the previous year click the video player on the screen to learn how to obtain your 1099-g information online you

People Also Ask about

What is the threshold for 1099k in Missouri?

Does Missouri require 1099 filing?

Do I need to file 1099s with Missouri?

Do I need to file 1099-NEC with state of Missouri?

Which states have 1099 filing requirements?

Are you required to file 1099s?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MO DoR MO-96 in Gmail?

How can I send MO DoR MO-96 for eSignature?

How do I execute MO DoR MO-96 online?

What is MO DoR MO-96?

Who is required to file MO DoR MO-96?

How to fill out MO DoR MO-96?

What is the purpose of MO DoR MO-96?

What information must be reported on MO DoR MO-96?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.