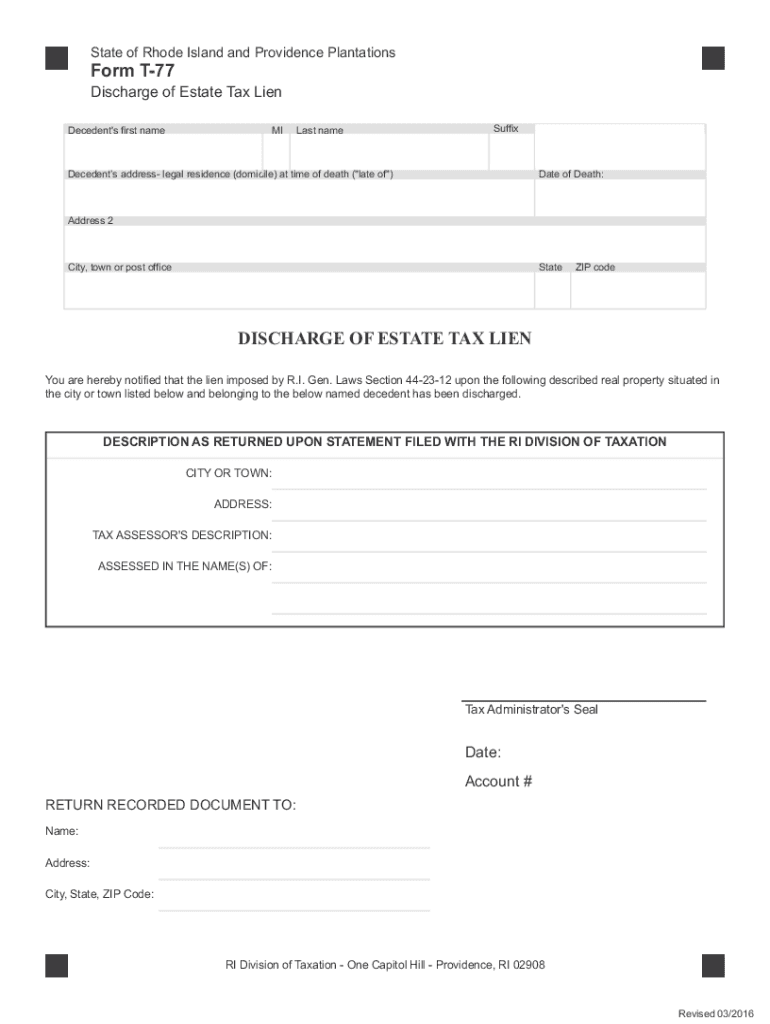

RI T-77 2016 free printable template

Get, Create, Make and Sign RI T-77

Editing RI T-77 online

Uncompromising security for your PDF editing and eSignature needs

RI T-77 Form Versions

How to fill out RI T-77

How to fill out RI T-77

Who needs RI T-77?

Instructions and Help about RI T-77

In this week we×39’re talking about Rhodesian historic tax credits for real estate and I want to touch on this real quick because you know not a lot of people are talking about this and I feellike it×39’s pretty important all right so throughout the country you know that historic real estate tax credits they've helped shape and rebuild cities and towns with a heavy inventory of mill buildings you know all those old buildings we have around that used to be bustling with workers and stimulating the economy well now that×39’re empty they're nothing, but you know sites for vandalism you know just places that are just collecting dust and it×39’s just you know unfortunately that real estate which I believe we have over a million square feet of it here in Rhode Islandthat'’s not being used don't quote Mon that at it could be off but uh what do begot to do with it how are we going house that to stimulate our economy unfortunately it's not going to be manufacturing okay with that overseas umbut what we found is that when these tax credits were in place back in the early to mid 2000s that every dollar that testate of Rhode Island invested in these tax credits they got five dollars andthirty-five cents returned on so get then get this I love this fact right testate of Rhode Island issued 460 million dollars in tax credits okay, and they generated on every dollar again five dollars and thirty-five cents that whence put that into retrospect that×39’s 2.5million dollars in economic outputthat'’s huge that's big money surpriseded that it took so long for you know the tax credits to come back in place but what you×39’re going to see is you're going to see a lot of rentals actually they're going to turn these mills into a lot of rental units another×39’re going to have them at market rent price, and you can put hundreds of units in one mill what you×39’re seeing it already there's a lot of mills Thatcher×39’ve done not in west Warwick they did the Royal Mail Royal Mills yes remover point park there's another Oman I believe that×39’s Coventry its west for Coventry borderland×39’t remember the name of that one, but they redid that project their×39’s a lot of mills out there and this ISN×39’an uncommon on practice they're doing this throughout the country in fact one of my friends who live out in Wisconsin heroes commercial renovations like this ASA living they buy these giant Mills tease these emerging tax credits that they get, and they literally pick up these buildings for pennies on the dollar×39;all get a more renovated get them all rented, and then they sell them to investors, and they do very well doing that hopefully we can get some people in here doing it my only fear when we offer tax credits are that what we talked about a couple segments ago people come in they get taxed deferrals for ten years and then after that time when it×39’s finally time for them to start paying their taxes these buildings become vacant again then I can see that definitely...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify RI T-77 without leaving Google Drive?

How can I get RI T-77?

How do I make edits in RI T-77 without leaving Chrome?

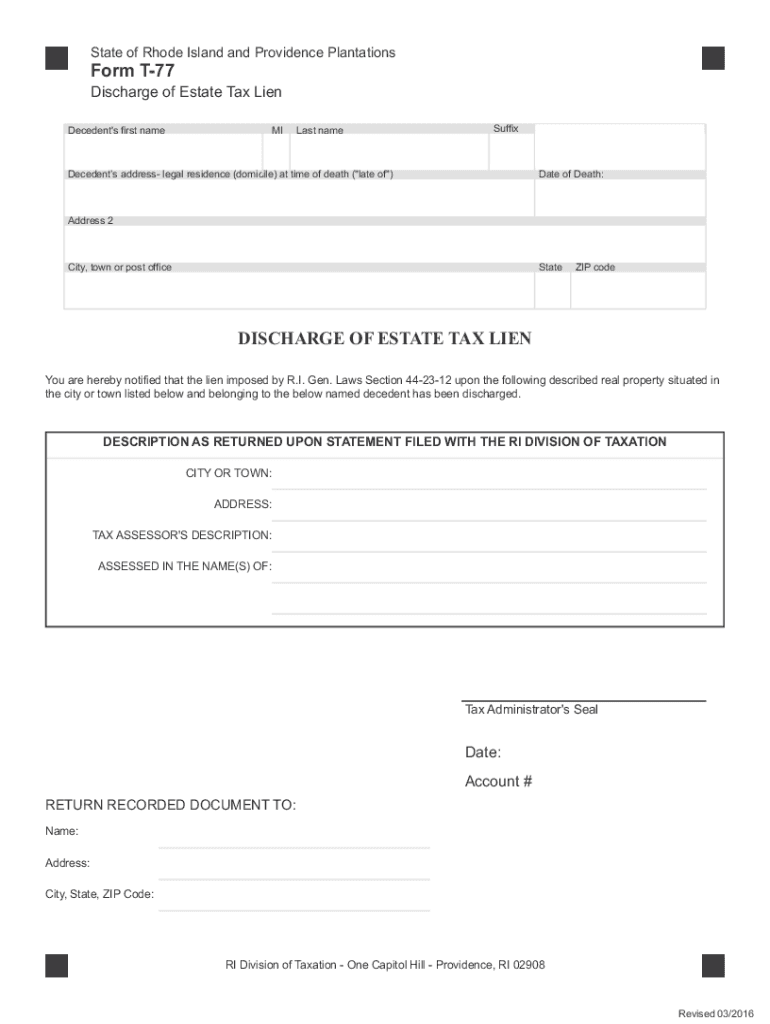

What is RI T-77?

Who is required to file RI T-77?

How to fill out RI T-77?

What is the purpose of RI T-77?

What information must be reported on RI T-77?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.