CA FTB 3586 2020 free printable template

Show details

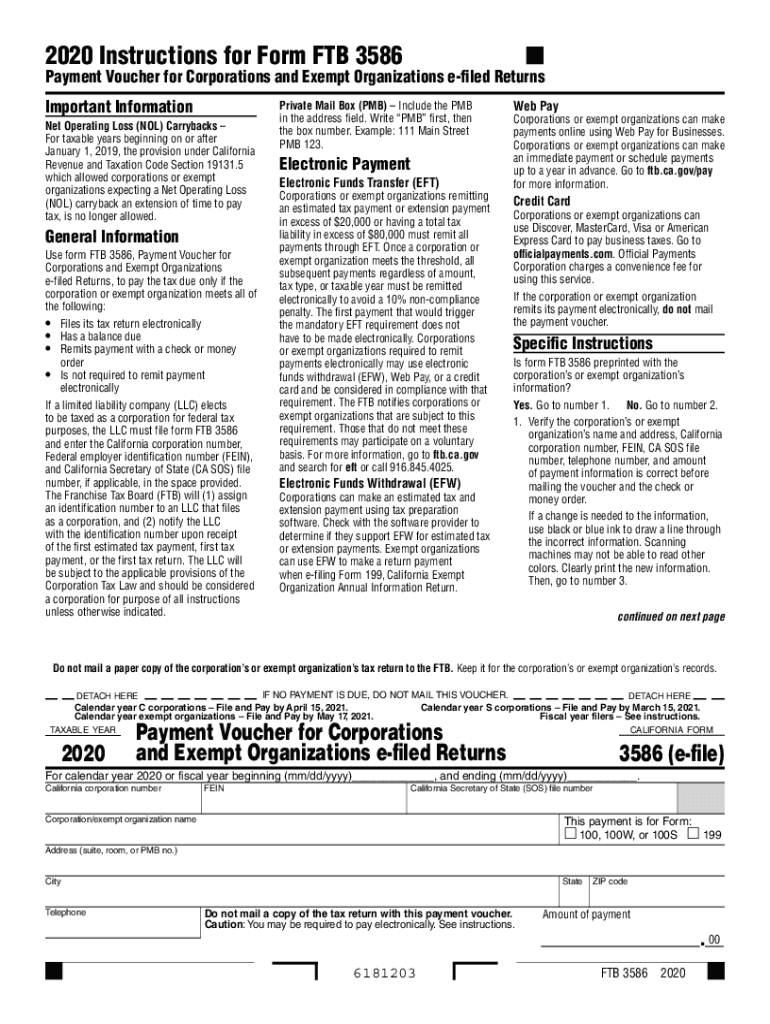

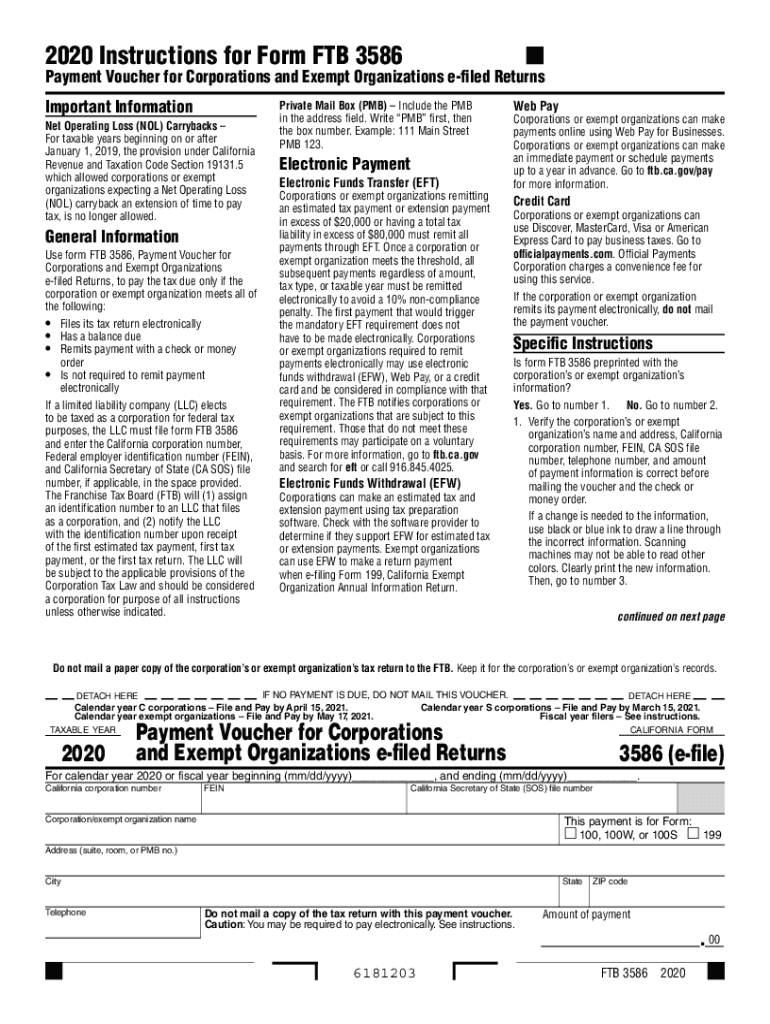

2020 Instructions for Form FT 3586Payment Voucher for Corporations and Exempt Organizations filed Returns

Important Information

Net Operating Loss (NOT) Carry backs

For taxable years beginning on

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 3586

Edit your CA FTB 3586 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 3586 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA FTB 3586 online

Follow the guidelines below to use a professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA FTB 3586. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 3586 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 3586

How to fill out CA FTB 3586

01

Obtain the CA FTB 3586 form from the California Franchise Tax Board website.

02

Enter your personal information such as your name, address, and Social Security Number in the designated sections.

03

Complete the income section by reporting your total income and any adjustments or deductions you are claiming.

04

Fill out the tax computation section, following the instructions carefully to calculate your tax owed or refund due.

05

Review the form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed form by mailing it to the address provided in the instructions.

Who needs CA FTB 3586?

01

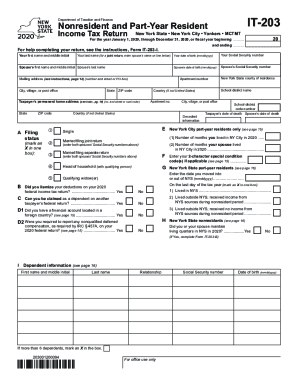

Individuals who are residents of California and need to claim a refund for excess tax withheld.

02

Taxpayers who are eligible for credits and deductions that require filing the CA FTB 3586.

03

Anyone who has received a notice from the California Franchise Tax Board related to their tax situation.

Fill

form

: Try Risk Free

People Also Ask about

Does California accept amended returns electronically?

You can use e-file for these types of California tax returns: Original returns (this tax year and past two years) Amended returns (this tax year and past two years)

Can you file CA form 568 online?

Yes, California Form 568, Limited Liability Company Return of Income may be e-filed.

Do all amended returns have to be mailed?

Be advised – you can't e-file an amended return. A paper form must be mailed in. You should consider filing an amended tax return if there is a change in your filing status, income, deductions or credits.

When can I amend my California tax return?

You can generally amend a return up to three years from the date the original return was filed (or up to two years after the tax was paid, whichever is later).

Are amended returns processed electronically?

The IRS is—finally—making more amended returns available for taxpayers to file electronically. For years, all amended returns had to be filed by paper.

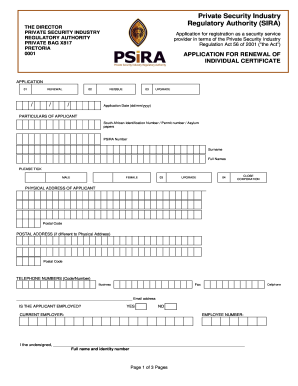

What is Franchise Tax Board 3586?

We last updated California Form 3586 e-File in January 2022 from the California Franchise Tax Board. This form is for income earned in tax year 2021, with tax returns due in April 2022. We will update this page with a new version of the form for 2023 as soon as it is made available by the California government.

What is CA Form 3586?

electronically If a limited liability company (LLC) elects to be taxed as a corporation for federal tax purposes, the LLC must file form FTB 3586 and enter the California corporation number, Federal employer identification number (FEIN), and California Secretary of State (CA SOS) file number, if applicable, in the

What happens if you don't pay California LLC tax?

The California Franchise Tax Board imposes a penalty if you do not pay the total amount due shown on your tax return by the original due date. The penalty is 5 percent of the unpaid tax (underpayment), plus 0.5 percent of the unpaid tax for each month or part of a month it remains unpaid (monthly).

Does a single member LLC need to file form 568 in California?

If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC. We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes.

Is CA entity number same as EIN?

In California, however, corporations receive seven-digit corporation numbers from the California Secretary of State or Franchise Tax Board, and LLCs receive a 12-digit corporate number. The company can then use this number to apply for an EIN. In most states, though, a corporate number is the equivalent of an EIN.

What is the entity ID number?

An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity. Generally, businesses need an EIN. You may apply for an EIN in various ways, and now you may apply online.

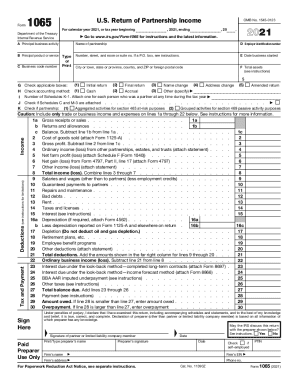

How to fill out California form 568?

If you have an LLC, here's how to fill in the California Form 568: Line 1—Total income from Schedule IW. Enter the total income. Line 2—Limited liability company fee. Enter the amount of the LLC fee. The LLC must pay a fee if the total California income is equal to or greater than $250,000.

What is California identification number?

SEIN stands for State Identification Number and in California it is known as the California Identification Number. If you cannot find the number, it is usually located on correspondence related to the business. Ask the EDD if no correspondence is found. EDD stands for the Employment Development Department.

How do I get an entity number in California?

California Secretary of State File Numbers are assigned to all entities in the state of California by the Secretary of State. This can be found in the LLC form that was submitted when applying for a limited liability corporation. The business will either have a seven-digit corporation number or a 12 digit file number.

Does a single member LLC need to file form 568?

SMLLCs, owned by an individual, are required to file Form 568 on or before April 15. You and your clients should be aware that a disregarded SMLLC is required to: File a tax return (Form 568) Pay the LLC annual tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CA FTB 3586 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like CA FTB 3586, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Where do I find CA FTB 3586?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the CA FTB 3586. Open it immediately and start altering it with sophisticated capabilities.

Can I edit CA FTB 3586 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as CA FTB 3586. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is CA FTB 3586?

CA FTB 3586 is a form used by taxpayers in California to report and claim certain credits related to the California income tax.

Who is required to file CA FTB 3586?

Taxpayers who are claiming certain tax credits for personal income tax may be required to file CA FTB 3586.

How to fill out CA FTB 3586?

To fill out CA FTB 3586, taxpayers should provide the necessary personal information, details of the claimed credits, and any supporting documentation as required by the form instructions.

What is the purpose of CA FTB 3586?

The purpose of CA FTB 3586 is to allow taxpayers to claim specific tax credits and benefits as part of their California income tax return.

What information must be reported on CA FTB 3586?

Information that must be reported on CA FTB 3586 includes the taxpayer's name, Social Security number, the credits being claimed, and any other required financial details.

Fill out your CA FTB 3586 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 3586 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.