Get the free BOE-571-L and BOE 571-D Business Property Statement - smcare

Show details

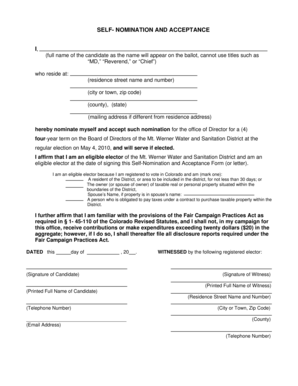

BOE-571-L (P1) REV. 17 (02-11) FORM 571-L BUSINESS PROPERTY STATEMENT MARK CHURCH COUNTY OF SAN MATEO ASSESSOR COUNTY CLEAR — RECORDER & CHIEF ELECTIONS OFFICER 555 COUNTY CENTER, REDWOOD CITY,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign boe-571-l and boe 571-d

Edit your boe-571-l and boe 571-d form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your boe-571-l and boe 571-d form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing boe-571-l and boe 571-d online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit boe-571-l and boe 571-d. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out boe-571-l and boe 571-d

How to fill out boe-571-l and boe 571-d:

01

Begin by gathering all the required information: To properly fill out boe-571-l and boe 571-d forms, you will need the following information: property details such as address, owner's name and contact information, lease information, and the current market value of the property.

02

Fill in the property details: Start by providing the address of the property and the owner's name and contact information in the respective fields on the form. Make sure to double-check the accuracy of the information before proceeding.

03

Enter lease information: If the property is being leased, provide the details of the lease agreement. This includes the start and end dates of the lease, the monthly rental amount, and any other pertinent lease terms. If the property is not leased, you can skip this section.

04

Determine current market value: This step requires determining the current market value of the property. The market value is usually assessed by a licensed appraiser or can be obtained from recent sales of comparable properties. Enter the market value accurately in the provided section of the form.

05

Complete any additional sections: Depending on your specific situation, there may be additional sections on the forms that need to be completed. These sections typically require additional information relating to exemptions, changes in ownership, or other property-related details. Take your time to carefully review the form and provide all the necessary information.

Who needs boe-571-l and boe 571-d:

01

Property owners: boe-571-l and boe 571-d are forms that property owners or their authorized representatives need to fill out. These forms are used in the assessment of property taxes and ensure that the property is valued correctly based on its market value.

02

Local taxing authorities: The boe-571-l and boe 571-d forms are required by local taxing authorities to assess property taxes accurately. These authorities rely on the information provided in the forms to determine the appropriate tax rates and calculate the taxes owed by the property owner.

03

Real estate professionals: Real estate professionals, such as appraisers or property managers, may also need to fill out boe-571-l and boe 571-d forms on behalf of property owners. This is especially true when assessing the market value of properties or managing lease agreements for multiple properties. These professionals play a crucial role in ensuring that accurate information is provided on the forms.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is boe-571-l and boe 571-d?

Boe-571-l and boe 571-d are forms used for reporting property information to the California State Board of Equalization (BOE).

Who is required to file boe-571-l and boe 571-d?

Property owners in California are generally required to file boe-571-l and boe-571-d forms if they own taxable personal property or possess real property that is subject to taxation.

How to fill out boe-571-l and boe 571-d?

Boe-571-l and boe-571-d forms can be filled out online through the BOE's website or manually by completing the paper forms. The forms require property owners to provide detailed information about their property, such as its location, description, value, and exemptions, if applicable.

What is the purpose of boe-571-l and boe 571-d?

The purpose of boe-571-l and boe-571-d forms is to ensure accurate reporting and assessment of property taxes in California. These forms help the BOE determine the value of taxable property and calculate the appropriate tax liabilities.

What information must be reported on boe-571-l and boe 571-d?

Boe-571-l and boe-571-d forms require property owners to report various information, including property location, description, acquisition date, cost, and other relevant details. Additionally, property owners must declare any exemptions or exclusions that apply to their property.

How can I send boe-571-l and boe 571-d to be eSigned by others?

When you're ready to share your boe-571-l and boe 571-d, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make changes in boe-571-l and boe 571-d?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your boe-571-l and boe 571-d to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I complete boe-571-l and boe 571-d on an Android device?

Use the pdfFiller app for Android to finish your boe-571-l and boe 571-d. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your boe-571-l and boe 571-d online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Boe-571-L And Boe 571-D is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.