Get the free Allocation of Mortgage Insurance Premiums - gpo

Show details

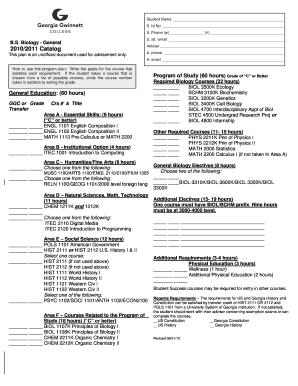

This document contains final regulations that explain how to allocate prepaid qualified mortgage insurance premiums to determine the amount of the prepaid premium that is treated as qualified residence

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign allocation of mortgage insurance

Edit your allocation of mortgage insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your allocation of mortgage insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit allocation of mortgage insurance online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit allocation of mortgage insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out allocation of mortgage insurance

How to fill out Allocation of Mortgage Insurance Premiums

01

Begin by gathering your mortgage documents and relevant financial information.

02

Locate the section of the form specifically designated for Allocation of Mortgage Insurance Premiums.

03

Enter the total premium amount you paid for mortgage insurance during the applicable period.

04

Specify the allocation period for the mortgage insurance premiums (e.g., year or financial quarter).

05

Distribute the premium amount according to the proportion of the loan that is covered by the insurance.

06

Include any additional required information, such as your mortgage account number and your lender's details.

07

Review the completed form for accuracy and ensure all entries correspond to your financial records.

08

Submit the form to the appropriate entity, such as your lender or the IRS, as needed.

Who needs Allocation of Mortgage Insurance Premiums?

01

Homebuyers who are required to pay mortgage insurance as part of their loan agreement.

02

Borrowers seeking tax deductions related to their mortgage insurance premiums.

03

Individuals who have refinanced their mortgage and need to allocate premiums for insurance previously obtained.

04

Homeowners who have taken out a loan with a loan-to-value ratio greater than 80% and are required to obtain private mortgage insurance (PMI).

Fill

form

: Try Risk Free

People Also Ask about

What are considered mortgage insurance premiums?

Filers were able to use the deduction on line 8d of Schedule A (Form 1040) for amounts paid or accrued. The deduction expired at the end of 2021, however, so this insurance isn't tax deductible for tax year 2022 and beyond.

Where do I find PMI on my mortgage statement?

Mortgage insurance, no matter what kind, protects the lender – not you – in the event that you fall behind on your payments. If you fall behind, your credit score could suffer and you can lose your home through foreclosure.

Where do I find my mortgage insurance premiums?

MIP is mortgage insurance required for Federal Housing Administration (FHA) insured loans. When closing on a home using an FHA loan, all debtors are subjected to an upfront charge of the MIP in a percentage amount of the sales price of the home.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Allocation of Mortgage Insurance Premiums?

Allocation of Mortgage Insurance Premiums refers to the process of distributing and reporting the premiums paid for mortgage insurance on a taxpayer's tax return to determine the allowable deduction.

Who is required to file Allocation of Mortgage Insurance Premiums?

Taxpayers who have paid mortgage insurance premiums should file Allocation of Mortgage Insurance Premiums to claim a deduction for those premiums on their tax returns.

How to fill out Allocation of Mortgage Insurance Premiums?

To fill out Allocation of Mortgage Insurance Premiums, taxpayers must complete the specific IRS form by providing information such as the amount of premiums paid, the mortgage amount, and filing status, and then attaching it to their tax return.

What is the purpose of Allocation of Mortgage Insurance Premiums?

The purpose of Allocation of Mortgage Insurance Premiums is to allow taxpayers to deduct eligible mortgage insurance premiums paid during the tax year, thus reducing their taxable income.

What information must be reported on Allocation of Mortgage Insurance Premiums?

Information that must be reported includes the total amount of mortgage insurance premiums paid, the loan origination date, the taxpayer's adjusted gross income, and any other relevant financial details that affect the deduction amount.

Fill out your allocation of mortgage insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Allocation Of Mortgage Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.