MD WH-AR 2021 free printable template

Show details

MARYLAND

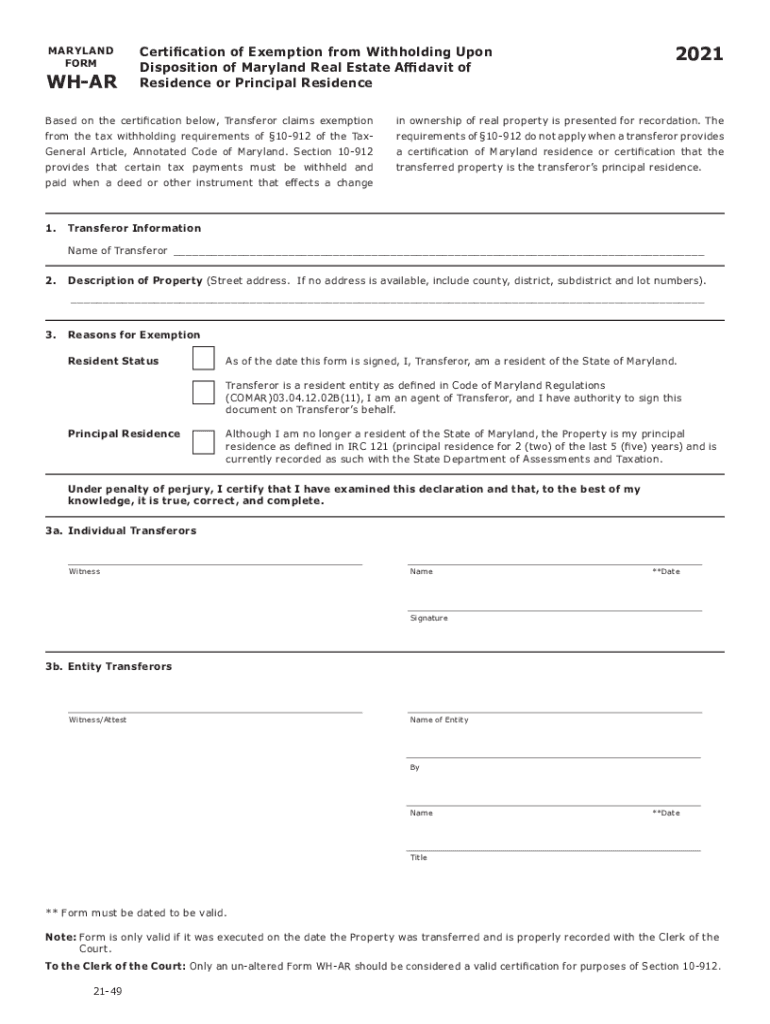

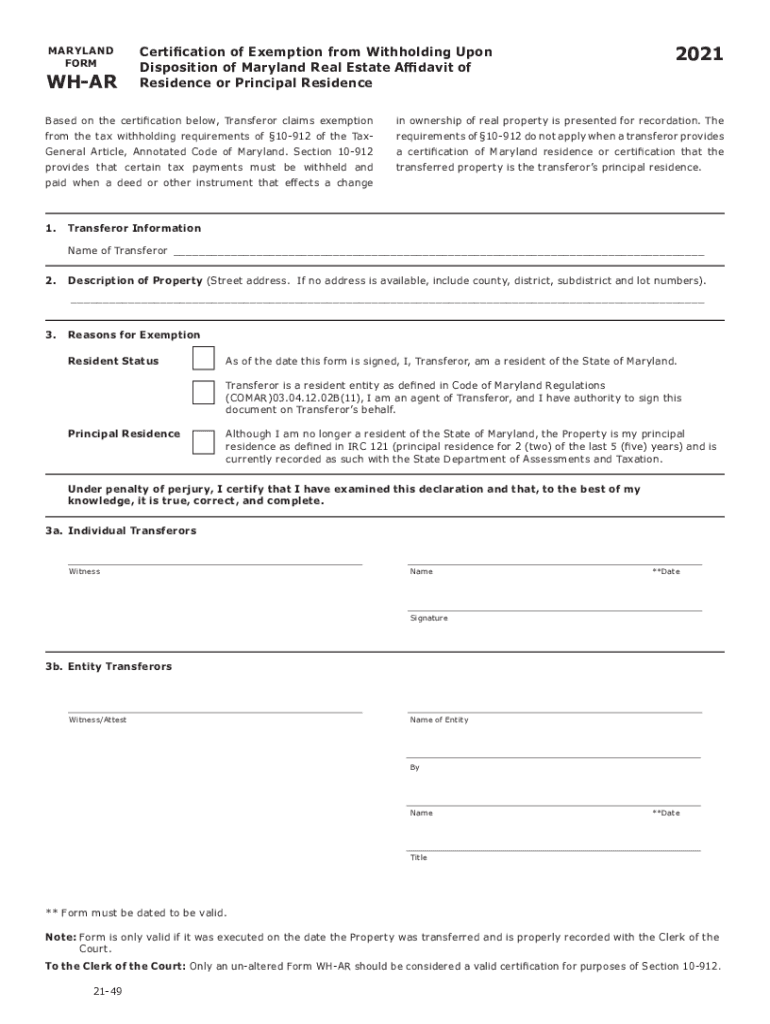

FORMWHARCertification of Exemption from Withholding Upon

Disposition of Maryland Real Estate Affidavit of

Residence or Principal ResidenceBased on the certification below, Transferor claims

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD WH-AR

Edit your MD WH-AR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD WH-AR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MD WH-AR online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MD WH-AR. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD WH-AR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD WH-AR

How to fill out MD WH-AR

01

Gather required information, including income details and personal identification.

02

Obtain the MD WH-AR form from the official Maryland state website or from your employer.

03

Fill out your personal information in the designated sections, including your name, social security number, and address.

04

Report your total wages earned during the reporting period.

05

Calculate the amount of state tax withheld from your wages.

06

Complete any additional sections required for specific deductions or credits.

07

Review the form for accuracy and completeness before submission.

08

Submit the completed MD WH-AR form to the Maryland Comptroller's Office by the deadline.

Who needs MD WH-AR?

01

Employees who work in Maryland and have state tax withheld from their wages.

02

Employers who need to report state withholding for their employees.

03

Individuals who are claiming a refund of overpaid state taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is the additional withholding in Maryland?

One additional withholding exemption is permitted for each $3,200 of estimated itemized deductions or adjustments to income that exceed the standard deduction allowance. NOTE: Standard deduction allowance is 15% of Maryland adjusted gross income with a minimum of $1,500 and a maximum of $2,000 for each taxpayer.

How many exemptions should I claim on Maryland withholding?

For those filing separately, you can only claim one exemption for yourself and may not claim an exemption for your spouse. Those filing jointly may claim one exemption for each person.

How many allowances should I claim Maryland?

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

What is the allowance for Maryland withholding?

NOTE: Standard deduction allowance is 15% of Maryland adjusted gross income with a minimum of $1,500 and a maximum of $2,000 for each taxpayer. spouse - An additional $1,000 may be claimed if the taxpayer and/or spouse is at least 65 years of age and/or blind on the last day of the tax year.

Is it better to claim 1 or 0?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

Does Maryland have a state withholding form?

The State of Maryland has a form that includes both the federal and state withholdings on the same form. Your current certificate remains in effect until you change it. The absence of a completed form results in being taxed at the highest rate and undeliverable paychecks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MD WH-AR in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your MD WH-AR and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send MD WH-AR for eSignature?

When your MD WH-AR is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the MD WH-AR electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your MD WH-AR.

What is MD WH-AR?

MD WH-AR is a tax form used in Maryland for reporting withholding tax information by employers.

Who is required to file MD WH-AR?

Employers in Maryland who withhold income taxes from employees' wages are required to file MD WH-AR.

How to fill out MD WH-AR?

To fill out MD WH-AR, employers need to provide their identification details, total wages subject to withholding, the amount of taxes withheld, and other relevant information as specified on the form.

What is the purpose of MD WH-AR?

The purpose of MD WH-AR is to report and reconcile the amount of Maryland state income tax withheld from employee wages during the reporting period.

What information must be reported on MD WH-AR?

MD WH-AR must report information including the employer's identification number, total wages paid, total tax withheld, and any adjustments or corrections if applicable.

Fill out your MD WH-AR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD WH-AR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.