CA FTB 8879 2020 free printable template

Show details

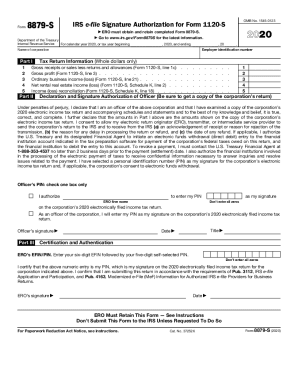

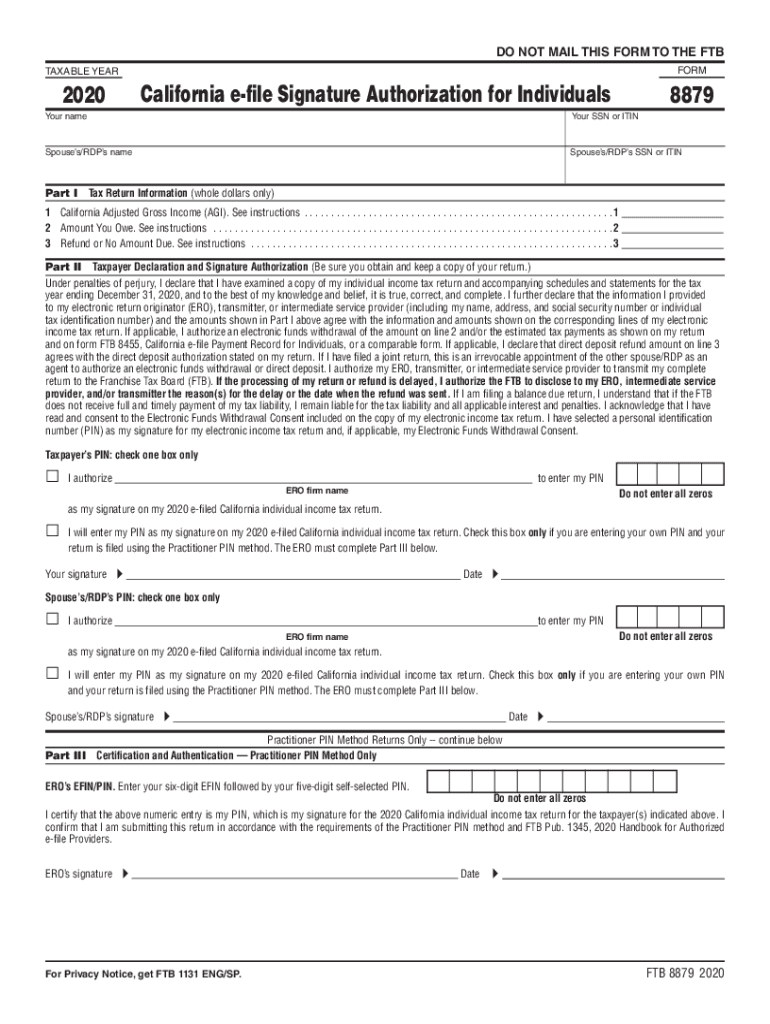

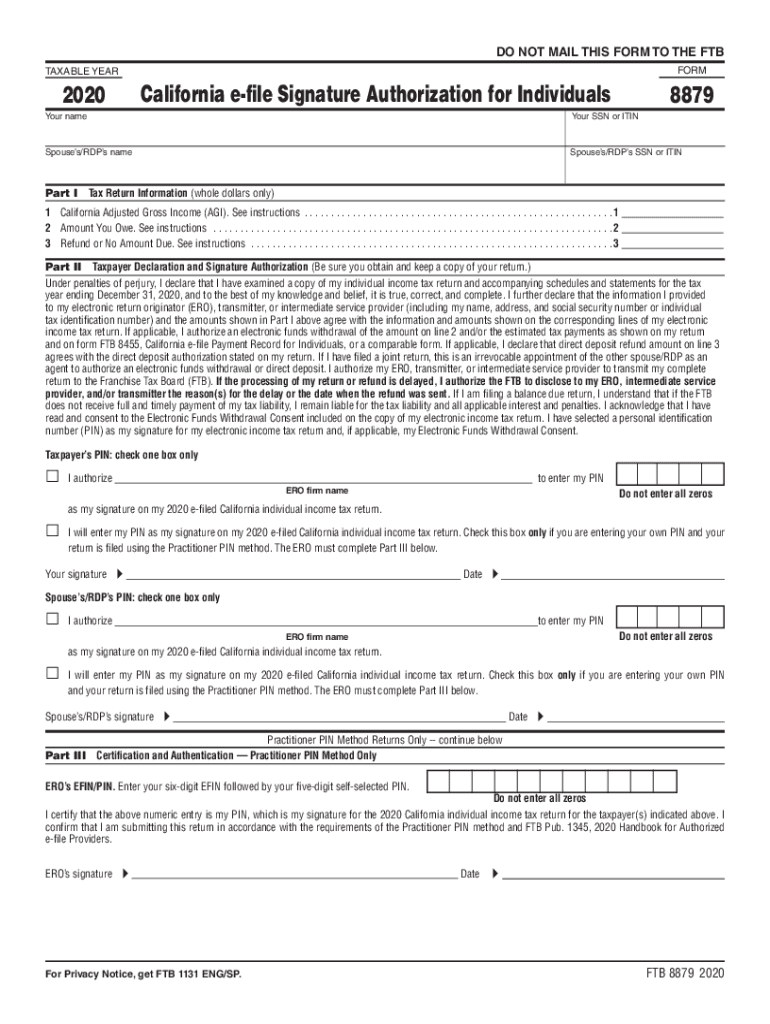

DO NOT MAIL THIS FORM TO THE FT FORMIDABLE YEAR2020California file Signature Authorization for Individuals8879Your numerous SSN or ITINSpouses/RDS espouses/RDS SSN or Impart Tax Return Information

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 8879

Edit your CA FTB 8879 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 8879 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA FTB 8879 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA FTB 8879. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 8879 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 8879

How to fill out CA FTB 8879

01

Gather your tax information, including your income documents and deduction details.

02

Fill in your personal information such as name, address, and Social Security number on the form.

03

Enter the tax year for which you are filing.

04

Complete the income and tax calculations section, ensuring all figures match your tax return.

05

Sign and date the form to authorize the e-filing of your tax return.

06

Provide any additional information or signatures as required.

Who needs CA FTB 8879?

01

Taxpayers who are e-filing their California state income tax returns.

02

Individuals who have used a tax professional to prepare their taxes.

03

Anyone whose tax return includes electronic filing consent from a paid preparer.

Fill

form

: Try Risk Free

People Also Ask about

Does CA have an e-file authorization form?

California e-file Signature Authorization for Individuals form (FTB 8879) California Electronic Funds Withdrawal Payment Signature Authorization for Individuals and Fiduciaries form (FTB 8879 PMT)

What does 8879 mean?

More In Forms and Instructions Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO).

Does CA accept electronic signatures on tax returns?

We accept electronic signatures for Individual e-filed returns and stand-alone electronic funds withdrawal (EFW) payment requests.

Does California FTB accept electronic signatures 2022?

Temporary allowance of electronic signature option for statute of limitations waivers. For statute of limitations (SOL) waivers, FTB will continue to temporarily allow taxpayers and/or their representatives to utilize a third party service for their electronic signature solution through June 30, 2022.

What does E-File stand for?

Electronic filing is the process of submitting tax returns via the internet. It's available from professional tax preparers, through guided preparation software that has been preapproved by the Internal Revenue Service (IRS) or free fillable forms on the IRS site.

What is a ERO signature?

Taxpayers, who currently use Forms 8878 or 8879 to sign electronic Forms 1040 federal tax returns or filing extensions, can use an e-signature to sign and electronically submit these forms to their Electronic Return Originator (ERO).

Why do I have to e-file?

You're required to electronically file your return if you meet all three of the following conditions: you use software to prepare your own personal income tax return; and. your software supports the electronic filing of your return; and. you have broadband Internet access.

What is 8879 form used for?

What's New. Form 8879 is used to authorize the electronic filing (e-file) of original and amended returns. Use this Form 8879 (Rev. January 2021) to authorize e-file of your Form 1040, 1040-SR, 1040-NR, 1040-SS, or 1040- X, for tax years beginning with 2019.

What is a 9325 form?

Form 9325 is a confirmation form from the IRS that the individual tax return or extension has been received through the electronic filing process and accepted by the IRS. Form 9325 is not required, but some taxpayers may request this form to prove their returns have been e-filed and accepted by the IRS.

What is the difference between 1040 form and 8879?

No, 8879 is the e-signature authorization form, and 1040 is the actual tax form.

What does form 8879 mean?

Form 8879 is used to authorize the electronic filing (e-file) of original and amended returns. Use this Form 8879 (Rev. January 2021) to authorize e-file of your Form 1040, 1040-SR, 1040-NR, 1040-SS, or 1040- X, for tax years beginning with 2019. Purpose of Form.

Who must file form 8879?

Complete Form 8879 when the Practitioner PIN method is used or when the taxpayer authorizes the ERO to enter or generate the taxpayer's personal identification number (PIN) on his or her e-filed individual income tax return.

Why would the IRS reject an e-file?

Possible reasons for the rejection include reporting the wrong amount on your tax return, inputting the wrong W-2 amounts when transferring the information electronically or just math errors.

What is e-file authorization?

The taxpayer authorizes the ERO to enter or generate the taxpayer's personal identification number (PIN) on his or her e-filed individual income tax return.

What does ERO stand for?

The Electronic Return Originator (ERO) is the Authorized IRS e-file Provider who originates the electronic submission of a return to the IRS. The ERO is usually the first point of contact for most taxpayers filing a return using IRS e-file.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CA FTB 8879 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like CA FTB 8879, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make edits in CA FTB 8879 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your CA FTB 8879, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the CA FTB 8879 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your CA FTB 8879 in minutes.

What is CA FTB 8879?

CA FTB 8879 is a California e-file signature authorization form that allows taxpayers to electronically sign their California tax returns.

Who is required to file CA FTB 8879?

Taxpayers who electronically file their California state tax returns are required to submit CA FTB 8879.

How to fill out CA FTB 8879?

To fill out CA FTB 8879, provide your identifying information such as name, address, and Social Security number, review the form for accuracy, and sign it to authorize e-filing.

What is the purpose of CA FTB 8879?

The purpose of CA FTB 8879 is to provide a method for taxpayers to authorize the electronic filing of their California tax returns.

What information must be reported on CA FTB 8879?

CA FTB 8879 must include the taxpayer's name, Social Security number, spouse's name (if applicable), address, and the details of the electronic tax return being filed.

Fill out your CA FTB 8879 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 8879 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.