MO 1746R 2008 free printable template

Show details

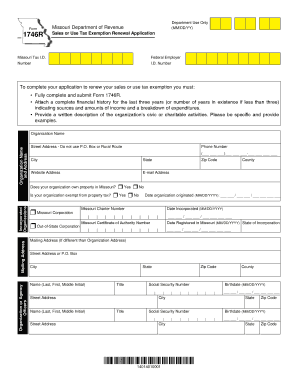

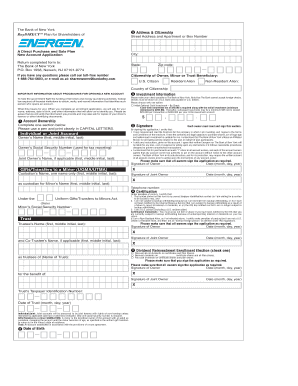

Mo. gov FORM 1746R REV. 09-2012 MISSOURI SALES OR USE TAX EXEMPTION RENEWAL APPLICATION 1. MISSOURI TAX ID NUMBER 2. Reset Form Print Form MISSOURI DEPARTMENT OF REVENUE TAXATION DIVISION P. O. BOX 358 JEFFERSON CITY MISSOURI 65105 0358 573 751-2836 FAX 573 751-9409 E-mail salestaxexemptions dor. FEDERAL ID NUMBER ORGANIZATION NAME AND LOCATION STREET ADDRESS DO NOT USE P. O. BOX OR RURAL ROUTE PHONE CITY COUNTY - STATE DOES YOUR ORGANIZATION OWN PROPERTY IN MISSOURI ZIP CODE WEB SITE...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO 1746R

Edit your MO 1746R form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO 1746R form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO 1746R online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MO 1746R. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO 1746R Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO 1746R

How to fill out MO 1746R

01

Obtain Form MO 1746R from the official website or appropriate office.

02

Read the instructions carefully before starting to fill out the form.

03

Provide personal identification information in the designated fields.

04

List any relevant financial information required on the form.

05

Ensure all information is accurate and complete.

06

Review the form for any errors or omissions before submission.

07

Submit the completed form as per the instructions, either by mail or electronically.

Who needs MO 1746R?

01

Individuals or entities who need to report specific financial information.

02

Taxpayers required to provide additional details for tax compliance.

03

Businesses filing for particular assessments or adjustments.

Fill

form

: Try Risk Free

People Also Ask about

What is tax exempt form 5060 in Missouri?

This form is to be completed and given to your contractor. The Missouri exempt entity named above hereby authorizes the purchase, without sales tax, of tangible personal property to be incorporated or consumed in the construction project identified herein and no other, pursuant to Section 144.062, RSMo.

How do I qualify for farm tax exemption in Missouri?

How to Claim the Missouri Sales Tax Exemption for Agriculture. In order to claim the Missouri sales tax exemption for agriculture, qualifying agricultural producers must fully complete a Missouri Form 149 Sales and Use Tax Exemption Certificate and furnish this completed form to their sellers.

What is Missouri form 126?

Form 126 - Registration or Exemption Change Request. Page 1. This form can be used to make changes to your sales and use, employer withholding, corporate income or franchise tax, or exemption registration records.

How do I renew my tax exemption in Missouri?

To complete your application to renew your sales or use tax exemption you must: • Fully complete and submit Form 1746R. Attach a complete financial history for the last three years (or number of years in existence if less than three) indicating sources and amounts of income and a breakdown of expenditures.

Do tax exempt forms expire in Missouri?

If the seller does not have an exemption certificate for a sale it claims was exempt, the seller may be held liable for the tax. Exemption certificates retained by the seller must be updated every five (5) years or when the certificate expires by its terms, whichever is earlier.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute MO 1746R online?

Filling out and eSigning MO 1746R is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an eSignature for the MO 1746R in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your MO 1746R and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out MO 1746R on an Android device?

Complete your MO 1746R and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is MO 1746R?

MO 1746R is a tax form used in the state of Missouri for reporting income and withholding information for tax purposes.

Who is required to file MO 1746R?

Employers who withhold Missouri income tax from their employees' wages are required to file MO 1746R.

How to fill out MO 1746R?

To fill out MO 1746R, you must provide information such as the employer's name, address, and federal employer identification number (FEIN), along with the total wages paid and the total Missouri income tax withheld.

What is the purpose of MO 1746R?

The purpose of MO 1746R is to report the amount of Missouri income tax withheld from employees' wages and to reconcile those amounts with the employer's tax liability.

What information must be reported on MO 1746R?

MO 1746R must report the employer's identification information, total wages paid to employees, and total Missouri income tax withheld during the reporting period.

Fill out your MO 1746R online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO 1746r is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.