NY DTF ST-124 2006 free printable template

Show details

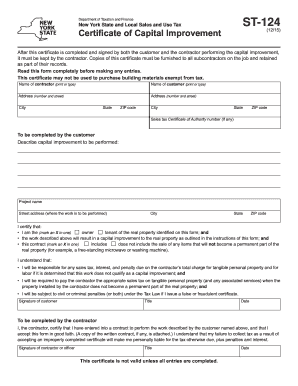

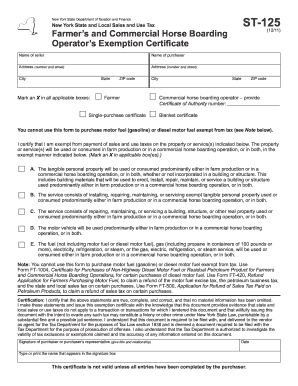

ST-124 5/06 back Guidelines If a contractor gets a properly completed that is no required entries on the form are left blank Form ST-124 Certificate of Capital Improvement from the customer within 90 days after rendering services the customer bears the burden of proving the job or transaction was a capital improvement that is was not taxable to the customer. ST-124 New York State and Local Sales and Use Tax 5/06 Certificate of Capital Improvement After this certificate is completed and signed...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF ST-124

Edit your NY DTF ST-124 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF ST-124 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF ST-124 online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY DTF ST-124. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF ST-124 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF ST-124

How to fill out NY DTF ST-124

01

Obtain a blank copy of the NY DTF ST-124 form from the New York State Department of Taxation and Finance website.

02

Fill in your name, address, and identification number in the designated fields at the top of the form.

03

Indicate the type of exemption you are claiming by checking the appropriate box.

04

Provide the required details of the purchase or lease, including date, vendor, and description of the items.

05

Sign and date the form at the bottom after review for accuracy.

06

Submit the completed form to the vendor from whom you are purchasing or leasing the items.

Who needs NY DTF ST-124?

01

Individuals or businesses that are purchasing goods or services in New York and wish to claim a sales tax exemption.

02

Non-profit organizations or government entities that qualify for sales tax exemptions under New York State law.

03

Resellers who need to provide proof of exempt status for taxable purchases.

Fill

form

: Try Risk Free

People Also Ask about

What improvements can be deducted from capital gains?

These are called capital improvements. Some capital improvements include a new room, appliances, floor, garage, deck, windows, roof, insulation, AC, water heater, ductwork, security system, landscaping, driveway, or swimming pool. All may qualify as improvements as they are meant to increase the home's value.

What are IRS guidelines for capital improvements?

The IRS indicates what constitutes a real property capital improvement as follows: Fixing a defect or design flaw. Creating an addition, physical enlargement or expansion. Creating an increase in capacity, productivity or efficiency.

What is capital improvement tax exemption NY?

Services that result in a capital improvement to real property are exempt from sales tax. A capital improvement to real property is an addition or alteration to real property that: substantially adds to the value of the real property or appreciably prolongs the useful life of the real property; and.

Are capital improvements tax deductible?

If you are beginning to consider remodeling your home to increase its value, you might be wondering about the financial implications that could have. Capital home improvements are renovations you can make that not only bring up your home value but are tax-deductible.

What is a NYS certificate of capital improvement?

A capital improvement is any addition or alteration to real property that meets all three of the following conditions: It substantially adds to the value of the real property, or appreciably prolongs the useful life of the real property.

What qualifies as capital improvements?

A capital improvement is an addition or change that increases a property's value, increases its useful life, or adapts it (or a component of the property) to new uses.

What is NY ST 124?

If you are the customer and the work being performed will result in a capital improvement, fill out Form ST-124, Certificate of Capital Improvement, and give it to the contractor. You must give the contractor a properly completed form within 90 days after the service is rendered.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my NY DTF ST-124 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your NY DTF ST-124 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out the NY DTF ST-124 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign NY DTF ST-124 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit NY DTF ST-124 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like NY DTF ST-124. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is NY DTF ST-124?

NY DTF ST-124 is a form used in New York State to claim a sales tax exemption on purchases by certain organizations or for specific purposes.

Who is required to file NY DTF ST-124?

Organizations such as exempt entities, government agencies, and certain non-profit groups that make tax-exempt purchases are required to file NY DTF ST-124.

How to fill out NY DTF ST-124?

To fill out NY DTF ST-124, applicants must provide their organization's information, indicate the reason for the exemption, and list the items being purchased decisively.

What is the purpose of NY DTF ST-124?

The purpose of NY DTF ST-124 is to allow qualifying entities to claim exemption from sales tax on eligible purchases, thereby reducing their tax burden.

What information must be reported on NY DTF ST-124?

NY DTF ST-124 requires the reporting of the purchaser's name and address, the reason for exemption, details of the items purchased, and the seller's information.

Fill out your NY DTF ST-124 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF ST-124 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.