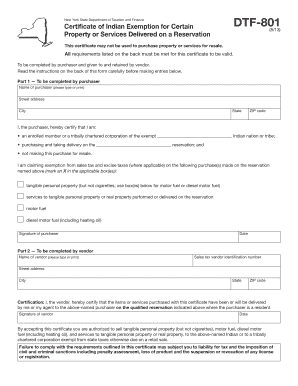

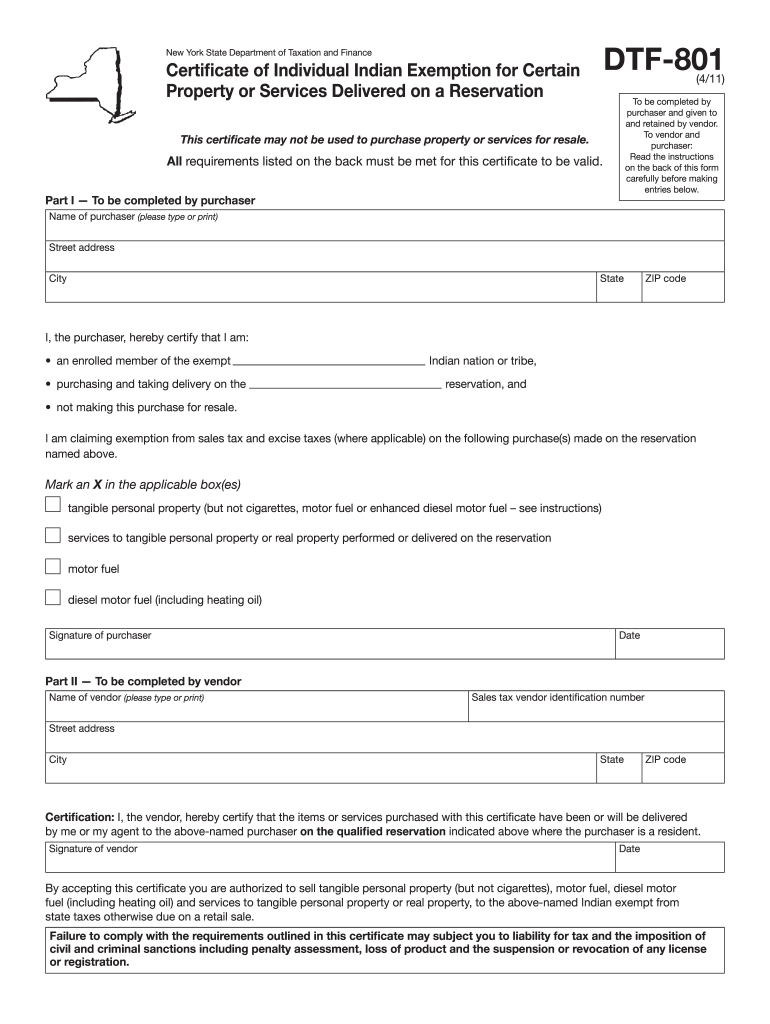

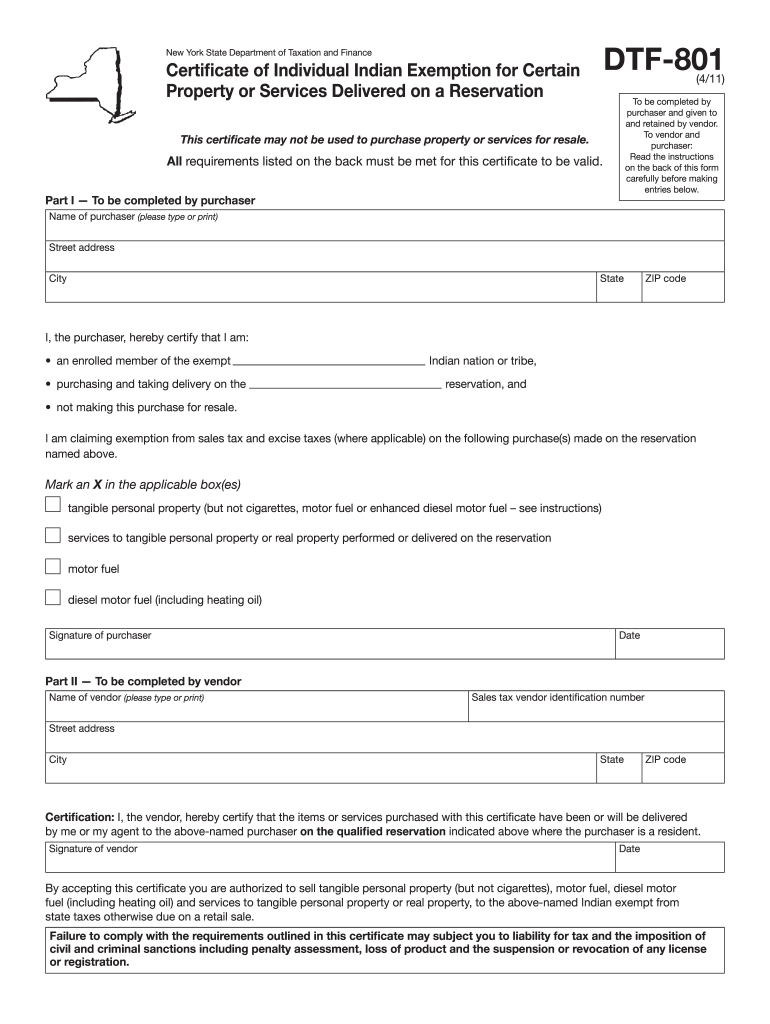

NY DTF-801 2011 free printable template

Show details

Vendors making sales to Indians who are purchasing for personal use may accept this certificate as proof of exemption from sales tax if the conditions listed in Instructions for purchasers are met and the purchaser gives them a properly completed Form DTF-801 and the vendor delivers the property or service with the exception of a motor vehicle on the reservation regardless of where purchased and attests to that delivery by completing Part II of ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF-801

Edit your NY DTF-801 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF-801 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF-801 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY DTF-801. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF-801 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF-801

How to fill out NY DTF-801

01

Download the NY DTF-801 form from the New York State Department of Taxation and Finance website.

02

Fill in your name and address in the appropriate fields at the top of the form.

03

Provide your New York State identification number or the last four digits of your Social Security number.

04

Indicate the tax year for which you are filing the form.

05

Complete the sections related to your income and any deductions you are claiming.

06

Calculate the total amount of tax owed or the refund amount, as applicable.

07

Review the completed form for accuracy and ensure all necessary fields are filled.

08

Sign and date the form at the designated area.

09

Submit the form either electronically or by mailing it to the appropriate address.

Who needs NY DTF-801?

01

Any individual or business that needs to report New York State income tax withholdings.

02

Employees who overpaid state income taxes and wish to claim a refund.

03

Businesses that are required to report non-resident employee withholdings.

Fill

form

: Try Risk Free

People Also Ask about

Are you exempt from New York State income tax withholding?

Exemption from New York State and New York City withholding You must be under age 18, or over age 65, or a full-time student under age 25 and. You did not have a New York income tax liability for the previous year; and. You do not expect to have a New York income tax liability for this year.

What does it mean to be exempt from withholding?

Exemption From Withholding If an employee qualifies, he or she can also use Form W-4 to tell you not to deduct any federal income tax from his or her wages. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.

What form do I use for sales tax exempt in NYC?

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

What is tax liability exemption?

Being tax-exempt means you are free from tax liability. You do not need to pay the same tax that other people are paying. You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold.

How do I apply for tax exemption withholding?

Go to .ura.go.ug and log in to your account with your TIN and password. Under e-services,click on e-registration and then under “others” select. Under Application Details,Select Application type from the drop down. Enter your Tax payer Identification Number (TIN) Select period of exemption from the drop down menu.

Who is exempt from NY state tax?

Military spouses are exempt from New York State income tax under the service members Civil Relief Act and Veterans Benefits and Transition Act, and full-time students under the age of 25 who had no New York income tax liability in the previous taxable year and expect none in the current year.

How do I know if I am exempt from withholding?

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

Are you exempt from New York State income tax withholding meaning?

Exemption from New York State and New York City withholding You must be under age 18, or over age 65, or a full-time student under age 25 and. You did not have a New York income tax liability for the previous year; and. You do not expect to have a New York income tax liability for this year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NY DTF-801 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your NY DTF-801 into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an electronic signature for signing my NY DTF-801 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your NY DTF-801 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I complete NY DTF-801 on an Android device?

Use the pdfFiller app for Android to finish your NY DTF-801. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is NY DTF-801?

NY DTF-801 is a tax form used in New York State for reporting and claiming a credit for taxes paid to another jurisdiction.

Who is required to file NY DTF-801?

Individuals or businesses who have paid income tax to another jurisdiction and are seeking a credit against their New York State tax liability are required to file NY DTF-801.

How to fill out NY DTF-801?

To fill out NY DTF-801, you must provide your personal information, details of the taxes paid to other jurisdictions, and calculate the credit against your New York State taxes.

What is the purpose of NY DTF-801?

The purpose of NY DTF-801 is to allow taxpayers to claim a credit for taxes paid to other states or local jurisdictions, reducing their New York State tax liability.

What information must be reported on NY DTF-801?

Information that must be reported on NY DTF-801 includes taxpayer identification details, the amount of tax paid to other jurisdictions, and any relevant calculations for the credit being claimed.

Fill out your NY DTF-801 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF-801 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.